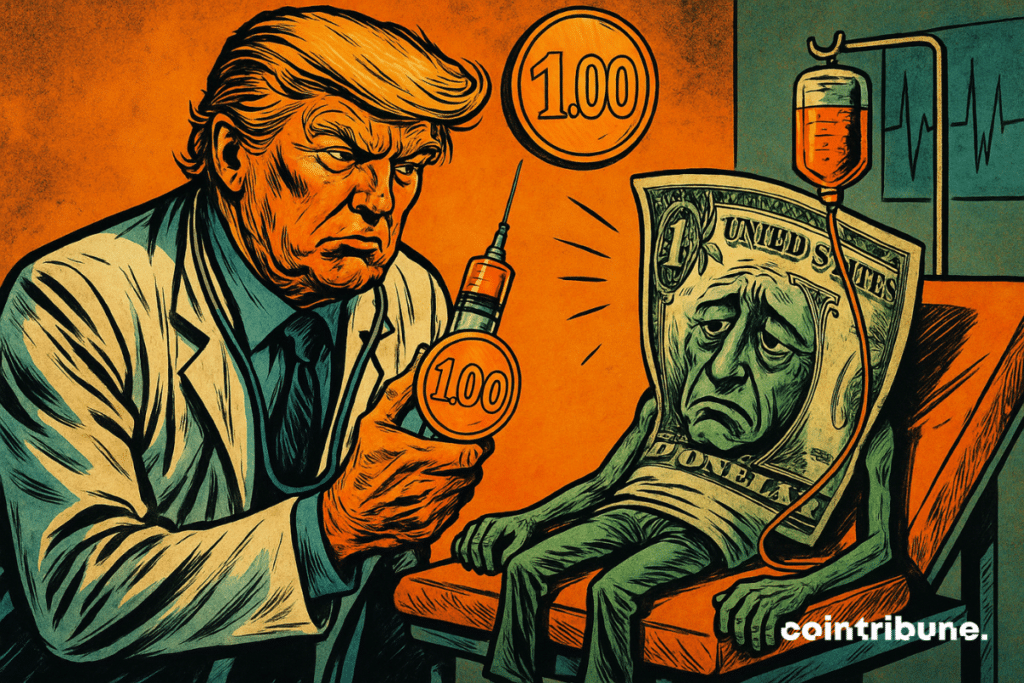

Dollar Dominance in Jeopardy: How US Stablecoins Are Becoming the Last Line of Defense

The greenback's reign faces its greatest threat yet—and Washington's answer is printed on blockchain ledgers, not paper.

Stablecoins: America's Hail Mary Pass

As BRICS nations ditch USD reserves and CBDCs gain traction, the US Treasury isn't fighting the future—it's trying to co-opt it. Enter Tether and USD Coin, the unlikely foot soldiers in a financial cold war.

The 800-Pound Algorithm in the Room

Circle's monthly attestations now show more offshore dollar-pegged tokens than physical Benjamins circulating abroad. When did 'trust us, we're backed 1:1' become the new full faith and credit?

DeFi or Die Trying

From Caracas to Khartoum, dollar-denominated stablecoins bypass sanctions faster than a SWIFT workaround. The irony? Regulators hate them—until they need them.

Closing Thought: Nothing says 'confidence in your currency' like needing a crypto band-aid. But hey, at least the arbitrage bots are having a banner year.

In brief

- The dollar falls despite high rates, marking its worst semester since the 1970s.

- Trump pushes the GENIUS Act to regulate dollar-pegged stablecoins.

- Stablecoins target emerging countries hit by inflation and lack of strong currencies.

- The BRICS prepare an alternative system, challenging the dollar via a multipolar monetary model.

Dollar weakening, ambitions on hold

Long the undisputed king,. Beyond having fallen to its lowest level in three years since January, it is experiencing one of its worst starts in fifty years. According to ABC News, the greenback could record, with a drop of over 10%. Even high bond yields are no longer enough to reassure.

A viral tweet from the Global Markets Investor account puts it bluntly:

The dollar continues to fall despite high yields on Treasury bonds. There may no longer be enough demand for American assets. This calls into question its role as the world reserve currency.

The problem is deeper than a simple market correction. Since 2000,, according to Sygnum. The Fed is also losing its grandeur. Its successive U-turns, silences, and public criticisms – including those from Trump – weaken it.

The paradox is cruel: to defend its currency,… but weakens global confidence. More worryingly, even giants like Buffett openly talk about a dollar “going to hell” (a currency going to hell). And alternatives are gaining ground, slowly but surely.

Stablecoins: Washington plays its crypto card

In the face of the confidence drain, the United States brandishes. The goal?in the blockchain economy. The project has a name:. This text, adopted by the Senate and supported by Trump, David Sacks, and Scott Bessent, aims to regulate and legitimize stablecoins backed by the dollar.

These stable cryptos are becoming. The idea: capture USD demand in emerging countries where inflation is eroding local economies. And it works. The Sygnum report emphasizes this:

Global demand for dollar stablecoins is a geopolitical opportunity to maintain US monetary dominance.

Fireblocks, Sygnum, and other institutional players are already setting upusing stablecoins. Meanwhile, Abu Dhabi Global Market is preparing a stablecoin pegged to the dirham, proof that the momentum is global.

But criticism is mounting. Italy, through its finance minister, warned in April that the US policy on cryptocurrencies, particularly regarding dollar-backed stablecoins, is even more dangerous. A striking argument but revealing of European unease.

For Trump, this digital bet is also electoral: to show that. But the BRICS want to surpass it, not follow it.

What if stablecoins accelerate the decline of the dollar?

The problem is that none of this solves the Core issue. The dollar is losing its grandeur, andon a deeper wound.

The Sygnum report reminds us that:

If the decentralized economy expands, dollar dominance can be reinforced by stablecoins. However, their impact will remain limited without massive adoption in Southern countries.

Theare not mistaken. Their strategy is not to replace the dollar but to. The yuan, euro, ruble, and even some local cryptocurrencies are gaining ground.

The facts, figures, and stakes:

- The dollar still represents 55% of global reserves but was at 70% in 2000;

- The GENIUS Act, passed in the Senate, aims to regulate all dollar-issued stablecoins;

- The BRICS are developing multi-currency systems to avoid dependence on the greenback;

- Fireblocks and Sygnum launch an instant settlement network using stablecoins;

- Italy warns of dependence on these stable cryptos: “a greater danger than tariffs“.

If the digital dollar becomes ubiquitous in the crypto universe, that will be a victory. But it will have to convince beyond the blockchain. Because in the long term, stable cryptos risk making visible the decline they seek to mask.

Even Elon Musk warns against a sudden dollar collapse if budget fundamentals are not restored. Robert Kiyosaki, Arthur Hayes, Donald Trump himself… all now mention a possible monetary cataclysm. It is no longer a BRICS fantasy. It is an American reality.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.