Bitcoin Smashes $113,804: Why This Bull Run Is Just Warming Up

Bitcoin's relentless surge past $113,804 isn't just a rally—it's a financial revolution leaving traditional assets in the dust.

Here's why the party's just getting started.

The Halving Effect: Scarcity on Steroids

With each block reward slashed in half, Bitcoin's code-enforced scarcity keeps supply tighter than a Wall Street banker's grip on their bonus. This isn't speculation—it's mathematics.

Institutional Tsunami

BlackRock's ETF was just the first wave. Pension funds and sovereign wealth managers are now FOMO-buying like day traders during a meme stock frenzy.

The Retail Stampede Hasn't Even Begun

Mainstream media still calls it a 'bubble' while quietly accumulating positions. Sound familiar? *cough* 2017 *cough*.

Wake up—the real FOMO begins when your dentist starts quoting Satoshi.

Macro Meltdown Fuel

With central banks printing money like Monopoly tickets and bonds yielding less than a savings account, Bitcoin's hard cap looks smarter every day.

Remember: $113k isn't a price target—it's a waypoint. The only thing more volatile than Bitcoin's charts? A traditional banker's excuses when their fiat system implodes.

En bref

- Bitcoin hits a historic record of $113,804, climbing steadily through several key price levels.

- ETFs, especially IBIT, absorb massive inflows that strongly support the bullish momentum.

- A technical “bull flag” pattern suggests a 30% upside potential toward $140,000.

- Polymarket sees a 76% chance of Bitcoin hitting $115,000 by the end of July.

Another Peak for Bitcoin: What Does This Number Tell Us?

The story of this rise is written in stages. First,, the first warning. Then, a continuous push, without real pause. This morning, $113,313 were exceeded. And finally,, just before a slight pullback below $113,300.

This sequence is not accidental. It reflects, mainly channeled through spot Bitcoin ETFs, which have attracted massive flows. IBIT, in particular, catalyzes these volumes. And what the charts whisper, CoinDesk analysts confirm:suggests a potential 30% increase, which would push BTC’s price toward $140,000.

Meanwhile, prediction markets are excited. On Polymarket,as early as this July. A figure that sets the tone in an already optimism-charged climate.

BTCUSD chart by TradingViewInstitutions, Geopolitics, and the Trump Effect: Behind the Rally

But this rise is not just about technical analysis. Behind the scenes, the crypto machine is running at full speed, driven by external factors.

First dynamic: the. According to analysts, institutions no longer just observe. They buy. And they buy in mass, in a market where supply remains limited. This rush has drawn strong volumes in spot markets, notably through ETFs.

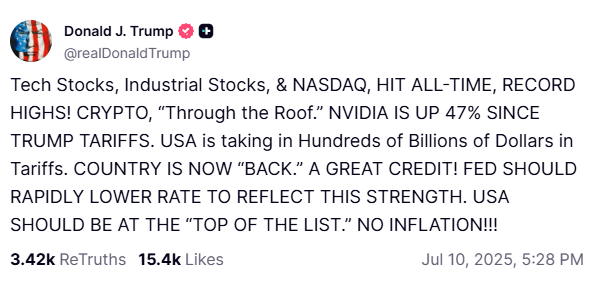

Second factor: geopolitics. Donald Trump, in a tense campaign atmosphere, has promised, targeting key sectors like semiconductors. Result? The dollar rises against the yen, as Reuters explains, and investors turn to alternative assets, including Bitcoin.

Finally,. According to Digital Watch, about $35 billion in shorts have been liquidated, amplifying a fierce short squeeze that catapulted prices.

The Leading Crypto Racing Towards $140,000: Credible Scenario or Euphoria?

In the prevailing euphoria, some are already dreaming of. And rightly so, several data points converge toward an ambitious target.

- $113,804, new all-time high reached before a moderate pullback;

- +4% increase on July 10, following a +3.5% the day before;

- 30% bullish potential according to the “bull flag” model;

- 76% chance Bitcoin will reach $115,000 in July (Polymarket);

- $35B in short positions liquidated, triggering a massive short squeeze.

These figures are not vague projections but observed facts: the price of bitcoin has risen. Many investors see in this momentum a replay of the euphoric period at the end of 2020, but with a much more mature player, supported by a stronger infrastructure.

Moreover, inflation is receding in the United States, offering a calmer environment for markets. Bitcoin, a good barometer of uncertain times, benefits from this relaxed climate. This dynamic could well continue.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.