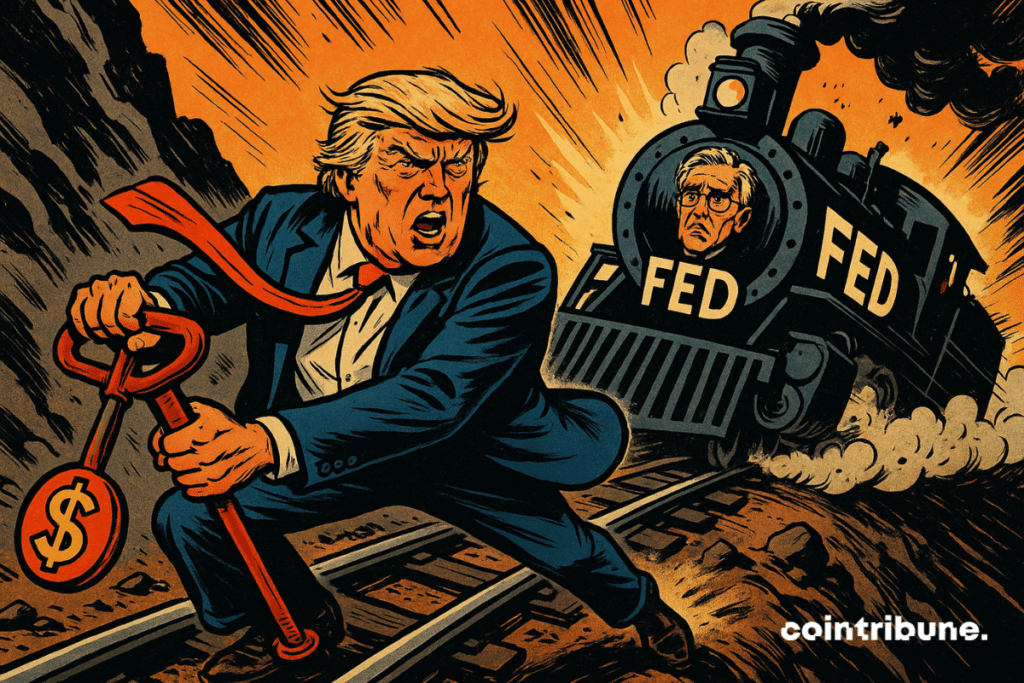

Fed Chair Powell Points Finger at Trump Tariffs for Stalling Rate Cuts—What It Means for Markets

Jerome Powell just dropped a political grenade in the monetary policy arena. The Fed chair explicitly linked stalled rate cuts to Trump-era tariffs—throwing gasoline on the inflation debate.

The Tariff Timebomb

Those 2018 trade wars? They're still haunting the Fed's playbook. Powell's admission reveals how past protectionism keeps forcing today's hawkish stance—even as crypto markets scream for liquidity.

Market Whiplash Ahead?

Traders are recalculating odds of September cuts. Bitcoin's recent slump suggests some already priced in prolonged higher rates. Classic finance—where yesterday's bad decisions become tomorrow's 'unforeseen consequences.'

One thing's clear: When politics and monetary policy collide, hodlers win by playing the long game. The Fed's hands may be tied, but blockchain never asks for permission.

In brief

- Powell accuses Trump: his tariff policies are slowing the drop in interest rates.

- The Fed remains cautious in the face of the White House’s unpredictable attacks and decisions.

- Bitcoin retreats slightly amid a tense monetary climate.

The Return of Economic Trumpism: Costly Tariff Uncertainty

Though inflation is slowing, the economy shows signs of fatigue, yet the Fed keeps a firm foot on the brake. Why? Powell doesn’t beat around the bush: the tariffs imposed by TRUMP on the United States’ major trading partners create a climate of instability pushing the central bank to hold back.

“I think that’s true,” Powell replies, almost laconic, when asked if the Fed WOULD have already cut rates without Trump’s interventions. It’s no small statement. Behind the apparent calm, the message is clear: as long as the Trump administration makes abrupt decisions, the Fed will remain still.

In reality, this confrontation is more than just an economic tug-of-war. It fits into a tense history between the two men. Trump, who appointed Powell to the head of the Fed in 2019, has never forgiven the strictness of his former protégé.

Just last Friday, the American president called Powell a “stubborn mule” and a “stupid person.” A slapstick diplomacy that doesn’t seem to bother Powell, but certainly affects the monetary landscape.

Frozen Rates, Unstable Crypto: When Trump Also Rattles Bitcoin

The Fed’s standstill does not only concern traditional markets. Cryptocurrencies, now sensitive to monetary policies like any other financial asset, also live under the yoke of Trumpian rhetoric.

Since tensions rose between Trump and Powell, Bitcoin has experienced increased volatility. Although it lost only 1.3% on Tuesday, the trend remains fragile.

BTCUSDT chart by TradingViewInvestors know this: as long as rates remain high, liquidity becomes scarcer, and cryptos suffer. This partial decoupling from the early “anti-system” spirit is now a reality: bitcoin lives at Washington’s pace.

But not everything is frozen. Powell has also supported legislation on stablecoins, a sign that the Fed, despite its caution, does not turn its back on monetary innovations. He acknowledges “a significant change in tone” on Wall Street towards cryptos, even anticipating a rise of the sector. Double talk? No, a pragmatic adaptation to a world where even monetary policy can no longer ignore digital tokens.

Between Political Posture and Economic Strategy, an Unstable Balance

Through his direct attacks and decisive trade decisions, Trump is reshaping the contours of American economic policy. In doing so, he forces the Fed to adapt in an uncomfortable position: maintaining credibility without yielding to political pressure.

Powell, stoic, plays for time, convinced that the economy must first regain some predictability before easing. Trump, meanwhile, seems determined to make every tariff an electoral lever. In this tug-of-war, it’s not just the key rate at stake, but the Fed’s ability to remain independent in a rapidly changing America.

The next step? It will depend on a single variable: Trump. Because behind the charts, rates, and hushed speeches, one name stands out everywhere—from trading floors to crypto forums. For Trump, bitcoin does not compete with the dollar; it becomes the safety valve, a strategic lever in his monetary vision.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.