BIS Rings Alarm Bells: Global Economy at Risk as Central Banks Brace for Impact

The Bank for International Settlements just threw gasoline on the smoldering fears of global financial instability—and crypto traders are taking notes.

Central banks in panic mode

As traditional finance titans scramble to contain contagion risks, Bitcoin's decentralized architecture stands untouched by their institutional tremors. The BIS-Fed alliance reveals more about their fragility than our resilience.

DeFi doesn't do bailouts

While legacy systems beg for coordinated interventions, blockchain networks hum along at 24/7 settlement speeds—no emergency meetings required. The irony? Their 'risk warnings' sound like marketing copy for crypto adoption.

Another day, another warning shot across the bow of traditional finance. How many red flags before capital migrates permanently on-chain?

In Brief

- The BIS warns about political risks threatening the independence of global central banks.

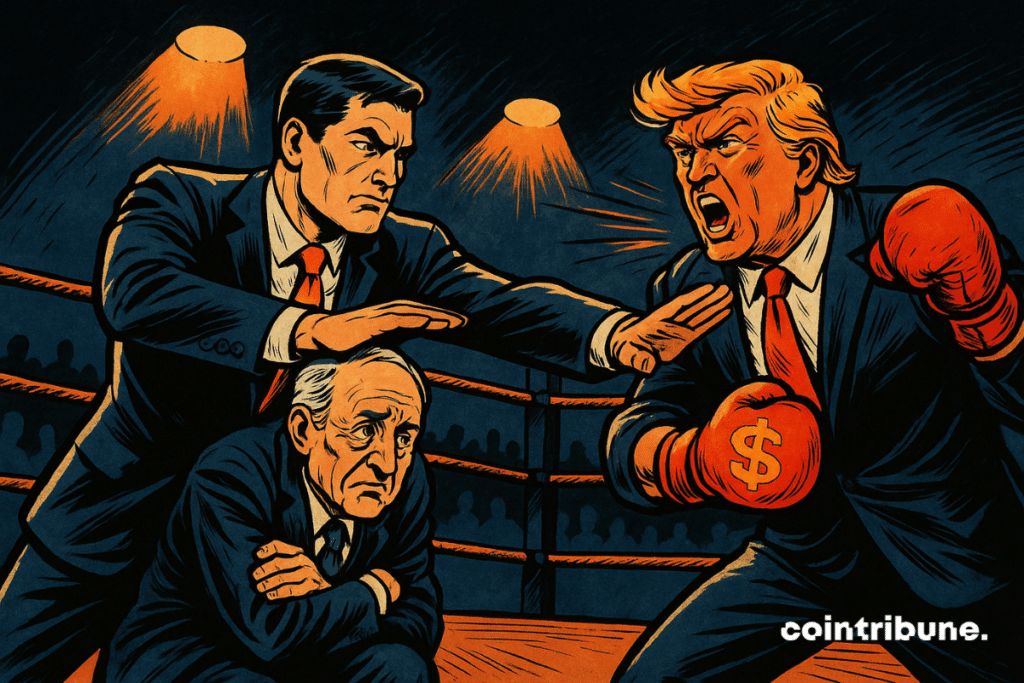

- Trump’s attacks on Powell weaken financial stability and the global economy.

BIS: Last Barrier Against Political Risk on the Global Economy

In its annual report published Sunday, the BIS warns aboutin the management of interest rates. Without directly naming Donald Trump, the Basel-based institution emphasizes the vital role of an independent monetary policy. According to it, a central bank must be able to do what it deems necessary, even if it does not align with the government’s wishes.

More explicitly, recent tensions stem from Trump’s verbal attacks on Powell. The latter called the current Fed Chairman a “beast” and “stubborn” on the Truth Social network. The American president indeed wants a rapid rate cut, despite persistent inflation and the uncertain impact of tariffs. These pressures undermine financial stability and generate worrying volatility for investors.

In this regard, the BIS highlights in its report that central banks face a “delicate trade-off.” The dilemma? Support economic growth through low rates or preserve monetary value in the face of growing public debt.

What Impact on Cryptocurrencies and the Real Economy?

Thedoes not only concern the United States. It could also disrupt the global economy, including crypto markets.

A Fed subjected to political power would actually create a dangerous precedent, threatening the credibility of economic measures. For holders of Bitcoin or digital assets, this uncertainty could reinforce the thesis of a safe-haven asset outside of the classic monetary system.

Conversely,by a loss of confidence in the Fed could also cause a general decline in risky assets. It will thus depend on the ability of central banks to resist political pressures and to navigate through this phase of economic uncertainty.

The BIS therefore plays the caution card to protect the global economy. Faced with Trump’s ambitions, monetary independence could well become one of the major geopolitical issues of 2025.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.