🚀 Ethereum ETFs Smash $4B Barrier – A Watershed Moment for Crypto

Wall Street's stamp of approval just got louder. Ethereum exchange-traded funds (ETFs) have rocketed past $4 billion in assets under management—flipping the script on traditional finance's crypto skepticism.

The big picture: Institutional money is voting with its wallet. Again.

This isn't just another bull market stat. It's proof that ETH—once dismissed as 'Bitcoin's erratic kid brother'—now commands real gravitational pull in global markets. Even the SEC's foot-dragging couldn't stop the avalanche.

Between the lines: That $4B milestone? It arrived 37% faster than Bitcoin ETFs hit the same mark last cycle. Traders are clearly betting this isn't just a 'store of value' play—it's a full-stack bet on Web3's infrastructure.

Cynic's corner: Funny how fast Wall Street warms to crypto when there's 2% management fees to harvest. The same banks that called it a scam in 2018 are now racing to custody your ETH.

One thing's clear: The 'crypto is dead' narrative just took another bullet. And this time, it came from the suits.

In Brief

- Ethereum ETFs have surpassed $4 billion after a rapid surge in fifteen sessions.

- BlackRock captures most of the flows thanks to its low fees and allocator network.

- ETH price falls but flows remain positive, signifying a long-term institutional bet.

- Grayscale declines, Fidelity settles in, and multi-asset arbitrages support the movement of Ethereum funds.

BlackRock, clever fees and billions at stake

In the Ethereum ETF match,decided not to play small. Its fundin gross inflows. Opposite,and its two products () are struggling withsince ETF conversion.

The strategy? Simple, but deadly., when Grayscale remains stuck at 2.5%. A gap that hurts, especially in a period of aggressive institutional flows. “Wealth managers don’t want to pay for the old guard anymore,” notes a CoinShares analyst.

And then there’s the: flows accelerated starting May 30, marking a real turning point. Over $160 million absorbed on June 11 alone, and five days with more than $100 million in 15 sessions. It’s not a euphoric surge, but a steady, almost surgical rise.

Ethereum is still searching for its compass, but moves forward

The paradox is that. Its price has dropped 25% since January, and the failure of the post-ETF approval “momentum” remains a thorn in the side. The CEO of DYOR sums it up:

After the initial approval of the ETH ETF without a price spike, institutional investors began to build positions quietly.

Translation? No hype, but strategic positioning.

Circle’s successful IPO, the resurgence around stablecoins, and the restructuring of the Ethereum Foundation give. But solana looms. And Ethereum ecosystem revenues have been down since its last technical update. Proof that the perceived value of the infrastructure remains fragile, even though some see beyond the short term.

“The market looks like an electrocardiogram, but buyers are betting on the infrastructure,” adds Ben Kurland.

A phrase that sums up this stage well:.

Crypto: the silent battle between Ethereum and Bitcoin

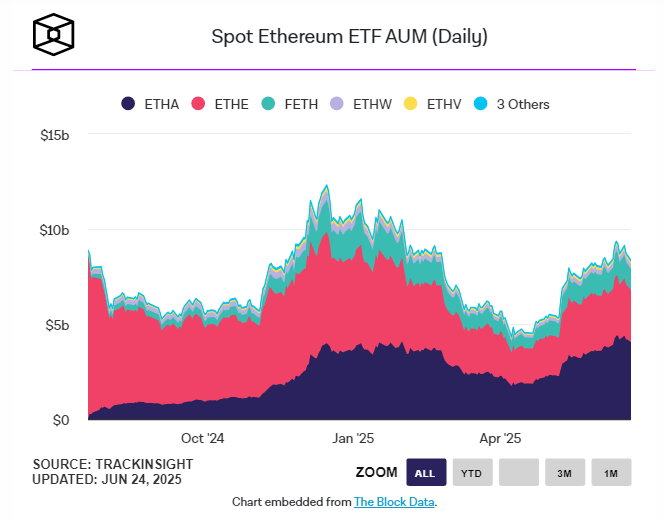

While Ethereum is strengthening, Bitcoin is soaring., compared to barely $4 billion for ETH. The gap is wide, but beware: the dynamic could shift. For nine consecutive days, Bitcoin ETFs have still recorded positive flows. But the gap is closing.

The latest alert? On June 21, Ethereum faced a $19.7 million withdrawal on ETHA, but paradoxically, overall inflows this month remain positive: $840 million net since early June. And this despite ETH falling below $2,400.

ETHUSD chart by TradingViewSome key numbers to remember:

- ETH ETFs reached $4.01 billion in 231 trading days;

- 1 billion added in just 15 sessions (i.e., 6.5% of the time for 25% of the flows);

- BlackRock: $5.31 billion in gross inflows; Fidelity: $1.65 billion;

- Grayscale: $4.28 billion in cumulative withdrawals;

- Ethereum lost 5% in one week but maintains net inflows.

Is this catch-up sustainable? Maybe. The next hot point: declarations from major asset managers in mid-July (13F filings). If they also put ETH in their long-term portfolios, the curve could reverse.

Statistics around Bitcoin, Ethereum, and their ETFs increasingly interest governments. Japan recently even considers a tax reform favorable to digital assets and opening up to crypto ETFs. This could offer calmer skies to a sector still shaken by volatility, but whose foundations are strengthening step by step.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.