Michael Saylor Goes All-In on Bitcoin Again – Massive New Buy Signals Unshakable Conviction

MicroStrategy's CEO just slapped the ask on another nine-figure BTC purchase—because when life gives you drawdowns, you double down harder.

The 'laser eyes' playbook: Saylor's latest move proves institutional crypto accumulation isn't dead—it's just getting started. While Wall Street hedgies paper-hand during corrections, the OG Bitcoin maximalist keeps stacking sats like digital gold is going out of style.

Timing the bottom? With BTC still 60% off ATH, this buy either marks genius-level contrarian plays... or another case of 'throw good money after bad' in crypto's endless casino. Either way—nobody can accuse Saylor of lacking conviction.

In brief

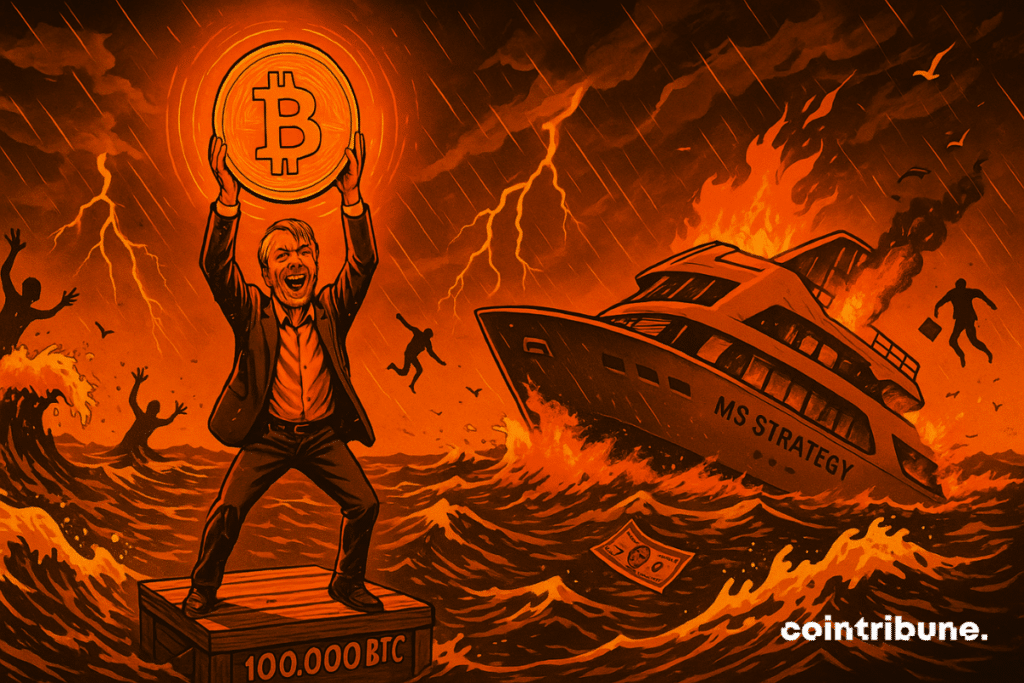

- Strategy suffers a $5.9 billion loss and faces legal proceedings.

- Despite the accusations, Michael Saylor continues to show a willingness to buy more bitcoin.

Strategy under pressure after massive bitcoin-related losses

According to data, the company Strategy recordson its crypto portfolio in the first quarter of 2025. The MSTR stock price also fell by 9% (despite a 28% rebound since April).

For many crypto experts, this decline stems from an accounting change initiated in January related to a FASB rule. This rule indeed allows companies to reflect the market value of their crypto assets in their balance sheets.

BTCUSDT chart by TradingViewThat’s not all! Michael Saylor and other Strategy executives are also the subject of a legal complaint. An institutional investor, Abhey Parmar, accuses them of hiding the extent of risks linked to. He also points to $31.5 million in insider trading conducted while the shares were allegedly inflated.

According to Cointelegraph, a parallel lawsuit in the form of a class action was filed in May. It denounces the lack of transparency around the bitcoin investment strategy.

Despite controversies, Strategy confirms its pro-bitcoin strategy

In this heated context, Michael Saylor has not given up on his radical approach. On June 22, he posted on X a chart illustrating the group’s previous BTC purchases. All accompanied by a cryptic message: “Nothing stops this orange”!

This type of communication often precedes. Currently, Strategy holds more than 592,000 BTC. This represents nearly $60 billion. Making it the largest Bitcoin Cash holder in the world among publicly traded companies.

Despite fraud suspicions, massive losses, and criticisms over still unclear crypto regulations, Saylor continues to show.

One thing is certain: Michael Saylor’s strategy raises as much admiration as controversy. A model that could inspire or discourage other players in the bitcoin market!

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.