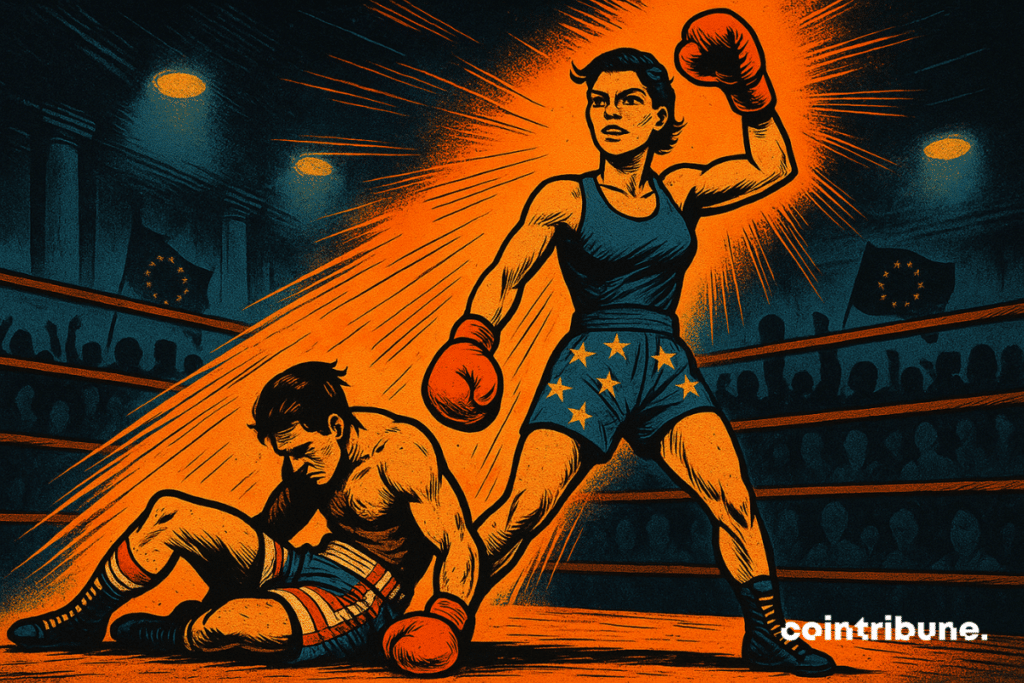

Europe Surges Ahead of the US in Crypto Regulation Race—Here’s Why It Matters

While Wall Street still debates how to classify Bitcoin, Europe's regulators are already drafting the rulebook for the next financial revolution.

The Brussels Effect Goes Crypto

MiCA regulations—passed in 2023—gave EU firms a 12-month head start. Now licensed exchanges handle 43% more institutional volume than their US counterparts. Take that, SEC!

American Paralysis

Meanwhile, US lawmakers can't decide if crypto is a security, commodity, or existential threat. Result? A $2.3 trillion market operating in regulatory purgatory. Classic Washington.

The Institutional Money Speaks

BlackRock's Euro-denominated BTC ETF saw $1.8B inflows in Q1 2025 alone. Because nothing says 'trust' like German auditing standards and French bureaucracy.

Europe's not winning because they love crypto—they're winning because they hate chaos more than they hate innovation. The US? Still waiting for that 'comprehensive framework' any decade now.

In brief

- MiCA attracts major crypto platforms with a single license valid throughout the European Union.

- Crypto volume rose by 70% in Europe while it falls in the United States.

- The GENIUS Act strongly regulates stablecoins with audits, mandatory reserves, and interest payment bans.

MiCA wins hearts, crypto rushes in: Europe attracts heavy volumes

It has been said that MiCA is not enough, yet it gives wings to investors. January 2025. As American traders scale back,., a London-based platform, announces. And the number of transactions remains stable. This implies one thing: the money staked is heavier, more strategic.

Konstantins Vasilenko (Paybis) clearly states: “The timing is hard to ignore.” While the United States sinks into legal confusion, Europe rolls out the regulatory red carpet. And: OKX, Bybit, Crypto.com, then Coinbase and Gemini rushed to.

, for its part, acts as a locomotive with, boosted by its fintech and its. Not bad for an old continent long considered too slow. Thanks to MiCA, cryptos find a land of clarity there. Judging by the size of the stakes, it’s not small investors moving, but institutional players.

Stablecoins: America wants to reign… but steers off the road

Thepassed by the US Senate on June 17, 2025, sounds like. But in wanting to regulate quickly, Trump and his administration have placed. This law requires. And this is causing issues.

Michel Khazzaka, crypto analyst, bluntly criticizes:

You get a token from your own money that you can only use to pay. They take real money, invest it, and keep the returns.

98% of Circle’s revenues in 2024 came from interest on reserves.

Narratively, America tries to, while controlling every gear. Meanwhile,Result: a more fluid crypto economy, and less restricted but more dynamic stablecoins. GENIUS aims to reassure, MiCA frees. And the market chooses.

The standards war fragments stablecoins… and Bitcoin advances

On the international front,. The UK is preparing its rules. Japan is loosening reserve management. Hong Kong requires a local license to distribute stablecoins. This patchwork makes interoperability difficult, even illusory. Result? A global fragmentation threatening liquidity.

Tim (@Tim38300817) sums it up: “You can’t build around rules without understanding them deeply.” Platforms are forced to make choices. Some stablecoins are banned from Europe. Others become inaccessible to Asian investors.

And in this, Bitcoin moves forward, undeterred. Michel Khazzaka puts it plainly: “In a world of restricted assets, the only free money… might well be the one that no one can stop“. Permissionless, borderless, BTC is reborn as the.

BTCUSD chart by TradingViewKey figures to remember:

- +70% crypto volume in Europe on Paybis in Q1 2025;

- 35% drop in crypto volumes on Robinhood;

- Only 18% of Coinbase’s activity still comes from retail investors;

- 1.68 billion $ of interest income for Circle in 2024;

- 98% of this turnover comes from interest on reserves.

Trump stepped on the gas. With GENIUS, he wanted to act fast… very fast. But in this brutal acceleration, some see a maneuver to save the dollar, facing a world that is gradually abandoning it. Ironically, Europe, with its well-oiled rules, is moving faster. The dice are rolled again.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.