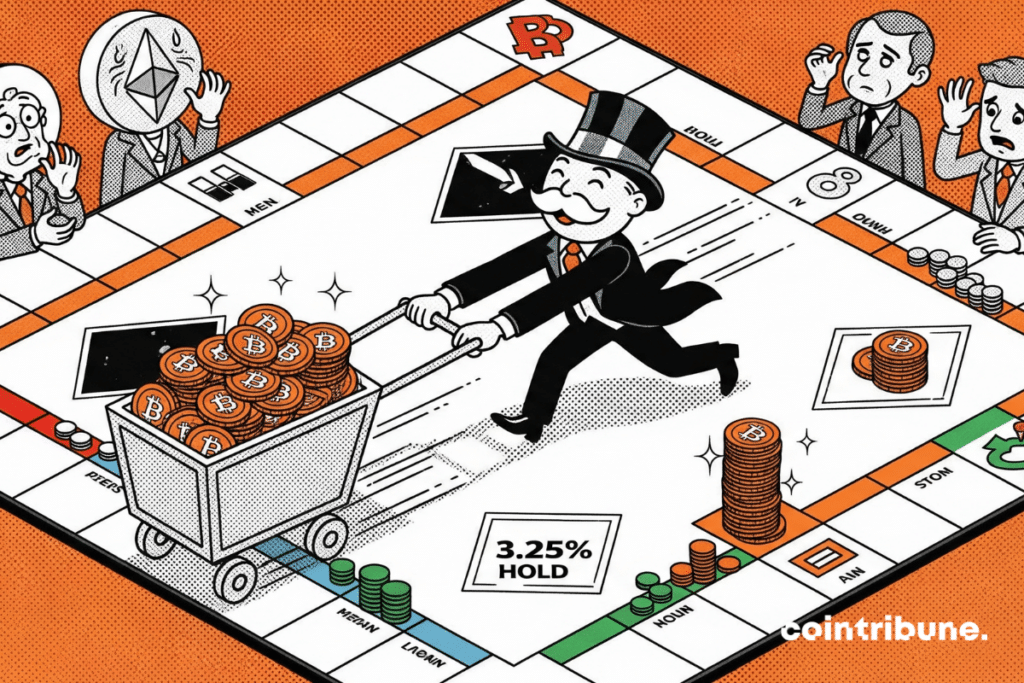

BlackRock Now Holds Over 3% of All Bitcoin—ETF Dominance Reaches Critical Mass

Wall Street's quiet coup is complete: BlackRock's Bitcoin ETF now commands more than 3% of the entire supply. The institutional invasion just hit hyperdrive.

When the world's largest asset manager sneezes, crypto catches a cold—but this time, they bought the whole pharmacy. Their spot Bitcoin ETF has vacuumed up enough coins to make central bankers twitch.

The implications? A seismic shift in market dynamics. With this much supply locked in cold storage, volatility could get squeezed like a Robinhood trader during a margin call. Meanwhile, crypto OGs are left wondering—when did Satoshi's decentralized dream get a BlackRock shareholder report?

One thing's clear: the 'institutional adoption' narrative just got hard data. Whether that's good for Bitcoin depends on how much you enjoy watching hedge funds repackage disruption as a quarterly earnings bullet point.

In brief

- BlackRock holds 3.25% of bitcoin via its ETF, reinforcing the market’s institutional dominance.

- BTC transactions are now dominated by large investors, while the retail influx is waning.

BlackRock boosts ETFs with $69.7 billion in bitcoin

YES! In less than 18 months, BlackRock’s iShares bitcoin Trust (IBIT) ETF has become a key player in the market. With, it now holds more than half of the US Bitcoin ETF market share. This represents exactly 54.7%.

According to data, this figure alone represents 3.25% of all bitcoin in circulation. This illustrates a strategic accumulation by institutional investors.

BTCUSDT chart by TradingViewBlackRock’s fund thus ranks 23rd globally among ETFs, across all sectors. This performance is supported by massive institutional flows. We refer to the $388 million of BTC that flowed into American ETFs in a single day. This marks. Proof of growing interest in index funds backed by digital assets!

ETF: a market dominated by whales, small players are abandoning ship

While Bitcoin ETFs record record volumes, the market structure is evolving. According to Glassnode, 89% of transactions on the Bitcoin network exceed $100,000. This proves that major investors now dictate the rules of the game. The average volume per transaction reaches $36,200, and small holders are becoming rare.

Another fact revealed by CryptoQuant: the cohort of short-term holders has gone from 5.3 to 4.5 million BTC in less than a month. Thishighlights a slowdown in retail activity.

If this trend continues, the next major support could be around $92,000. This corresponds to the realized price level of traders.

The market thus seems to be entering an era where ETFs and institutions take over from individuals. If a new catalyst emerges, the rise in demand could push bitcoin into a new sustainable bull market.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.