BREAKING: SEC Poised to Greenlight First Altcoin Spot ETF in 2025 – Here’s What It Means

The crypto world just got its biggest regulatory nod since Bitcoin ETFs. The SEC is reportedly finalizing approval for the first-ever altcoin spot ETF—and it could drop before year-end.

Wall Street’s playing catch-up (again). While Bitcoin maximalists pop champagne, altcoin traders are eyeing this as the ultimate validation play. No more synthetic exposure—real altcoins hitting traditional markets.

The fine print? We’re still waiting on which altcoin gets the golden ticket. Ethereum’s the obvious frontrunner, but don’t count out dark horses like Solana or XRP. The SEC’s sudden flexibility smells like political pressure—or maybe they finally checked those 2024 election donation disclosures.

One thing’s certain: when suits and degens finally agree on an investment vehicle, you know the fees will be criminal either way.

In brief

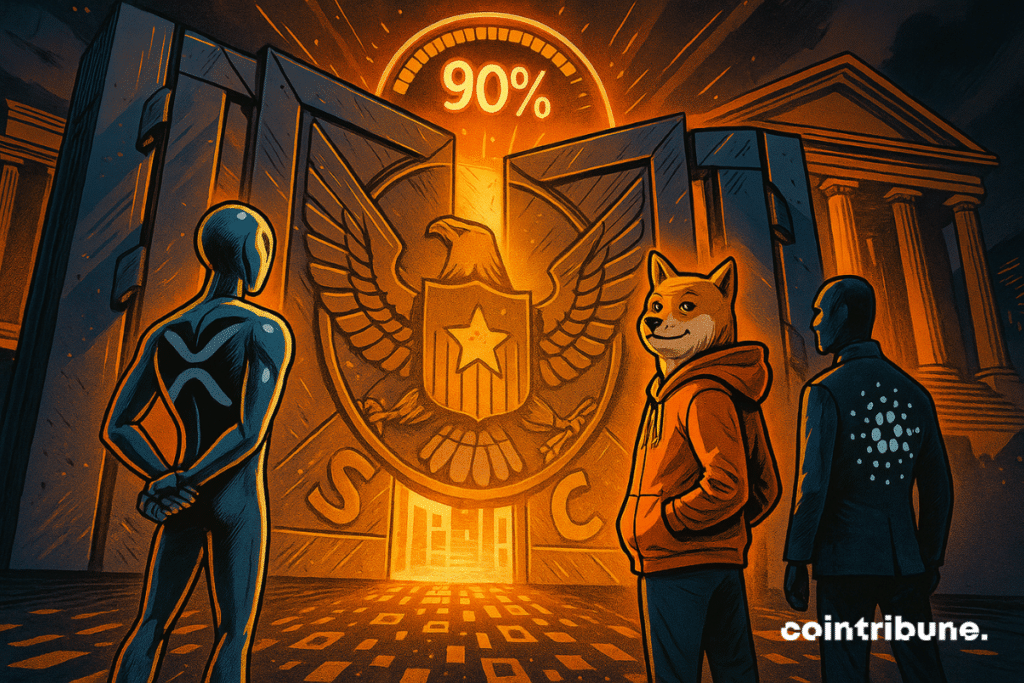

- Bloomberg analysts have raised the probability of spot ETFs approval for XRP, Dogecoin, and Cardano to 90 %.

- This reassessment marks a major shift in institutional perception of altcoins by regulators.

- Other altcoins such as Solana, Litecoin, Polkadot, and Avalanche are also on track to receive approval.

- Paul Atkins’ arrival at the head of the SEC promotes a more open approach to cryptos.

A major probability shift for altcoin ETFs

While the approval of many major crypto ETFs by the SEC has been postponed to this summer, Bloomberg analysts Eric Balchunas and James Seyffart have significantly revised their projections regarding the approval of several spot crypto ETFs.

In a statement published on X, James Seyffart stated: “Eric Balchunas and I are raising our probabilities for the vast majority of spot crypto ETFs to 90 % or more”.

https://twitter.com/JSeyff/status/1936117896347803748This reassessment directly targets assets like XRP, Dogecoin, and Cardano, which until now were still considered less likely in the short term. This statement comes as the regulatory climate seems to be easing, and the dialogue between the SEC and sector players intensifies.

XRPUSDT chart by TradingViewHere are the key points from the new forecasts published by Bloomberg :

- XRP, Dogecoin, and Cardano are now considered to have a 90 % or greater chance of obtaining regulatory approval for a spot ETF by the end of this year ;

- This estimate represents an increase from previous projections, which were still below this threshold less than two weeks ago ;

- According to analysts, the SEC’s active engagement with the issuers of these ETFs is “a very good sign” and indicates that the regulatory authority may be in a validation phase rather than opposition ;

- ETFs for other altcoins such as Litecoin, Solana, Polkadot, and Avalanche are also benefiting from similar approval probabilities this year.

These estimates, coming from two prominent figures, reflect a clear understanding of the current dynamics between regulators and institutional players in the crypto market.

The SEC’s direct involvement, through technical exchanges with project stakeholders, tends to show that the regulatory status quo is cracking, in favor of a gradual opening to a diversification of eligible assets.

A changing regulatory climate favorable to crypto ETFs

Another decisive factor in this rise of Optimism lies in the change of leadership at the head of the SEC. Since April, the American agency has been chaired by Paul Atkins, who succeeded Gary Gensler.

Known for his more conciliatory view toward cryptos, this new leadership seems to be initiating a strategic reorientation. Bloomberg analysts see in this context a favorable ground for approving products previously on hold or deemed too risky.

Evidence of this is a clear signal : the SEC asked solana ETF issuers to update their S-1 forms, a step generally seen as preparatory to imminent approval.

This development goes beyond Solana. In addition to XRP, DOGE, and ADA, spot ETFs for Litecoin, Polkadot, and Avalanche also now benefit from a 90 % or higher probability rate according to the same analysts.

This dynamic reflects a broadening of the range of assets considered “legitimate” by American institutions, and potentially eligible for regulated exposure through traditional financial instruments.

If these approvals were to materialize, the implications for the ecosystem WOULD be multiple. On the one hand, they would open the way for a new wave of institutional investment in cryptos still seen as speculative today. On the other hand, they could strengthen transparency and governance requirements for the projects concerned, prompting maturity.

At the macroeconomic level, the SEC seems eager to catch up on its regulatory lag compared to more proactive jurisdictions, as evidenced by the four roundtables on crypto regulation in preparation, similar to Hong Kong or the European Union, and to prevent the United States from losing its leadership in digital finance.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.