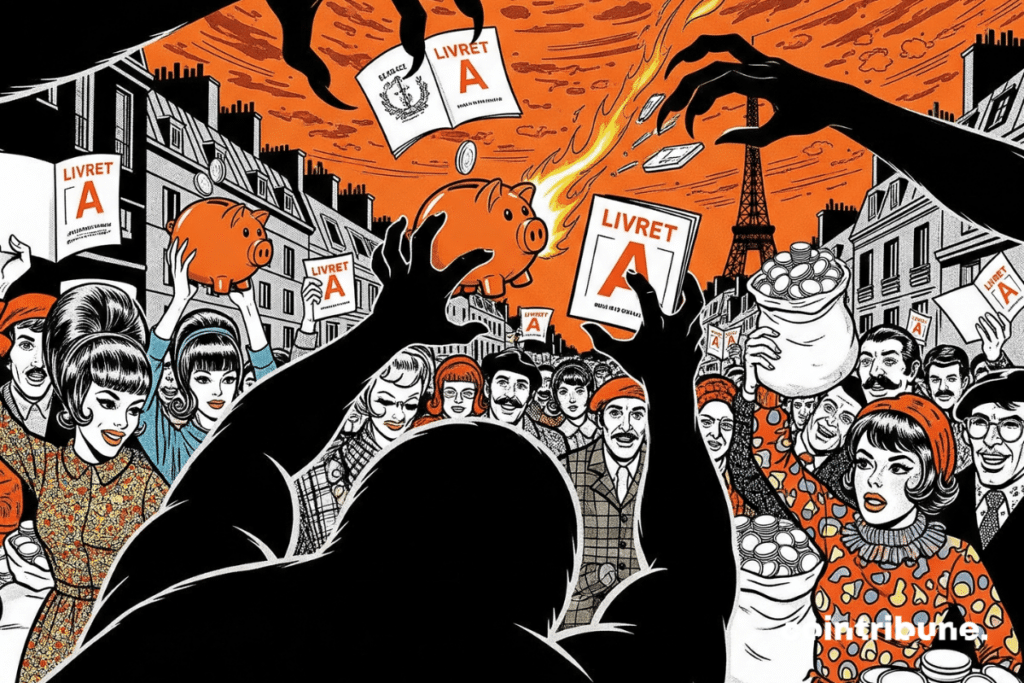

French Savings Rate Hits Staggering 18.8% – A Sign of Crisis or Crypto Opportunity?

French savers are hoarding cash like never before—pushing the national savings rate to an all-time high of 18.8%. Is this fiscal prudence or fear masquerading as virtue?

The Irony of Thrift

While traditional finance celebrates this 'responsible' behavior, smart money knows: parked euros lose value faster than a meme coin in a bear market. Inflation doesn’t care about your passbook.

Where’s the Yield?

Banks offer crumbs for deposits while DeFi protocols serve double-digit APYs. Yet the masses still prefer the 'safety' of guaranteed erosion. Old habits die hard—even when they’re financially suicidal.

Crypto’s Open Invitation

That 18.8% could be earning real returns in stablecoin farms or Bitcoin’s appreciating scarcity. But hey, enjoy your 0.5% 'high-yield' savings account—the 21st century’s most tragic financial relic.

In brief

- The savings rate reaches 18.8%, revealing growing distrust towards consumption.

- Despite a favorable context, the French prefer secure investments for fear of a financial crisis.

Savings sharply increase, despite a favorable financial context

In France, therose to 18.8% of their disposable income in the first quarter of 2025 (compared to 17.7% at the end of 2024). Even more striking: the financial savings rate jumped to 9.8%. This designates the portion placed in financial assets.

For analysts, this is a historic record. These figures indeed contradict the forecasts of the Banque de France, which anticipated a gradual return to the pre-Covid level (around 15%).

Yet, everything seemed to indicate. In 2024, purchasing power had increased by 2.6%. As for inflation, it had clearly eased. Even traditional savings products such as the Livret A did not slow down accumulation (despite a decrease in yields). A paradox that is mainly explained by widespread distrust!

Confidence Crisis: Finance Victim of a Worrying Climate

Why such cautiousness while the economic situation is improving? According to economist Philippe Crevel, the combined economic, political, and geopolitical context leads the French to be cautious. This notably refers to concerns around:

- the war in Ukraine;

- dissolution;

- the current policy of the United States;

- the growing public deficit.

All this weighs heavily. Especially, this accumulation of uncertainties fuels a decline in economic confidence. Households fear a rise in taxes. They therefore prefer to secure their resources.

Certainly, this reflex could soothe financial markets. That said, it poses a risk for.

If the State wants to mobilize this windfall, it will have to restore confidence or channel savings towards strategic investments. Failing that, this caution could become structural. Enough to sustainably redraw French finance!

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.