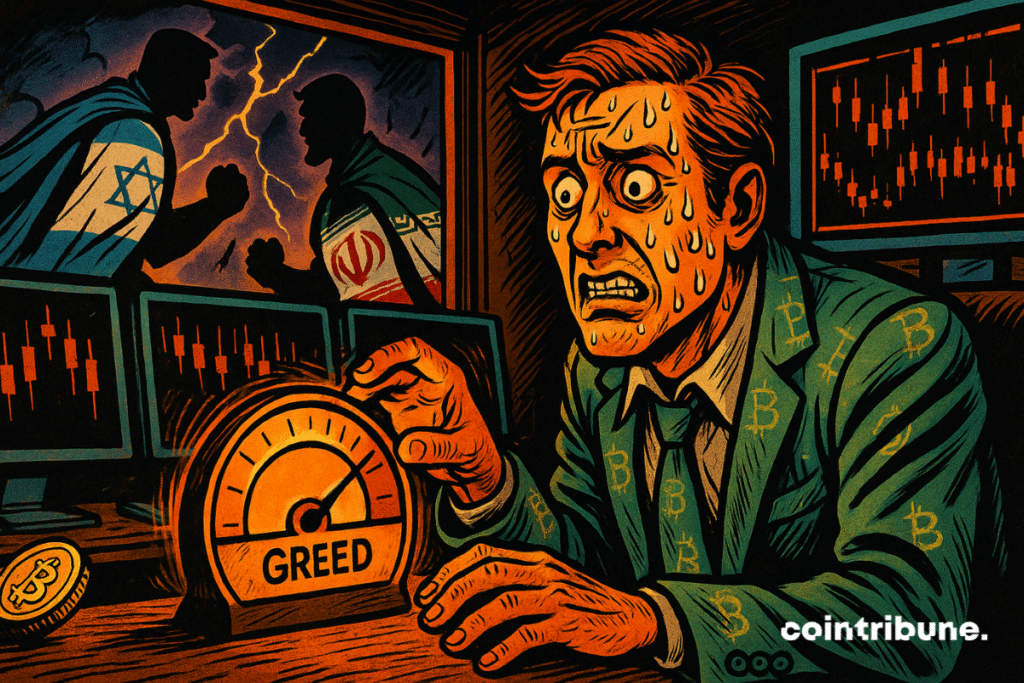

Crypto Defies Geopolitics: Fear & Greed Index Holds Bullish Despite Israeli-Iranian Tensions

Crypto markets shrug off Middle East tensions as investor sentiment stays firmly in greed territory. The Fear & Greed Index—that emotional barometer of digital asset traders—remains stubbornly optimistic even as traditional markets wobble. Here''s why crypto investors keep buying the dip while Wall Street hedges.

Blood in the streets? More like buy orders.

While gold bugs and oil traders profit from safe-haven plays, crypto''s risk-on crowd sees opportunity. Bitcoin''s resilience at key support levels suggests institutional money isn''t flinching—either that or retail traders are doubling down on hopium.

The decoupling narrative returns

Remember when crypto was supposed to correlate with tech stocks? That theory''s looking shakier than a shitcoin whitepaper. The Nasdaq''s down 3% this month while major cryptos hold steady—proving once again that crypto markets dance to their own erratic rhythm.

Warning lights flashing beneath the surface

Liquidity''s thinning faster than a trader''s hairline during a 20% correction. Derivatives markets show overleveraged longs, and that ''bullish'' sentiment could flip faster than a crypto influencer''s allegiance. But for now? The casino stays open—and the degens keep stacking chips.

As one hedge fund manager quipped: ''In crypto, we don''t need economic models—just a working inverse of common sense.'' The market''s either brilliantly prescient or dangerously detached. Place your bets.

In Brief

- The crypto market maintains its greed despite Israel-Iran tensions.

- Bitcoin remains strong, but the 100,000 $ threshold is crucial.

- A prolonged conflict could trigger a wave of fear.

A Surprisingly Resilient Greed

Since the Israeli strikes on Iran, traditional markets have been trembling while Bitcoin shows remarkable resilience. The Crypto Fear & Greed Index, a true barometer of emotions in the crypto market, remains at a surprising level of greed (60), despite a slight drop in Bitcoin, now stabilized around $105,222. This steadiness is all the more surprising as the current situation oddly recalls that of April 2024, when a direct Iranian retaliation caused BTC to falter by 8.4%.

Why this paradox? In reality, crypto investors display an almost provocative confidence in Bitcoin, regarded as a safe-haven asset amid traditional monetary and geopolitical crises.

Anthony Pompliano, a crypto entrepreneur, does not hesitate to call bitcoin “relentless,” highlighting once again its ability to hold firm against geopolitical storms.

However, this resilience should not mask real risks. Over $1.74 billion in long positions hang on a critical threshold: the psychological barrier of $100,000. The slightest breach could trigger a domino effect with dramatic consequences.

Between Euphoria and Caution: The Limit is Fragile

Past experience shows that this greed could quickly turn into fear. Last year, after peaking at 72 at the start of the Israeli-Iranian hostilities, the Crypto Fear & Greed Index plunged sharply to 43. Bitcoin, currently flirting with its historic highs, could face the same scenario if tensions persist.

BTCUSDT chart by TradingViewOn the other hand, Ether, often seen as more sensitive to market shocks, has already undergone a significant correction of nearly 11%. This divergence reminds investors that crypto is far from an indestructible monolith.

Bitcoin ETFs, for their part, continue to attract massive inflows, a sign of persistent institutional confidence, while Ether ETFs now face withdrawals after a prosperous period of 19 consecutive days of inflows.

Towards a Decisive Test for Cryptos

The key now lies in the duration and intensity of the Israeli-Iranian tensions. If the conflict prolongs or intensifies, greed could quickly give way to widespread fear, forcing investors to reconsider their positions.

The Fear and Greed Index reflects this deceptive calm in the crypto market. Za, a renowned analyst, remains cautious: “Bitcoin doesn’t seem worried for now, but this apparent calm may hide latent volatility.” Recent history indeed shows that crypto investors’ Optimism can abruptly shift due to a sudden geopolitical escalation.

Ultimately, the current resilience of cryptocurrencies against the Israeli-Iranian conflict may be a temporary illusion. Caution is therefore advised: closely monitoring the conflict’s evolution and staying ready to adjust positions remains the best strategy to navigate this particularly uncertain period even if long-term holders keep buying.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.