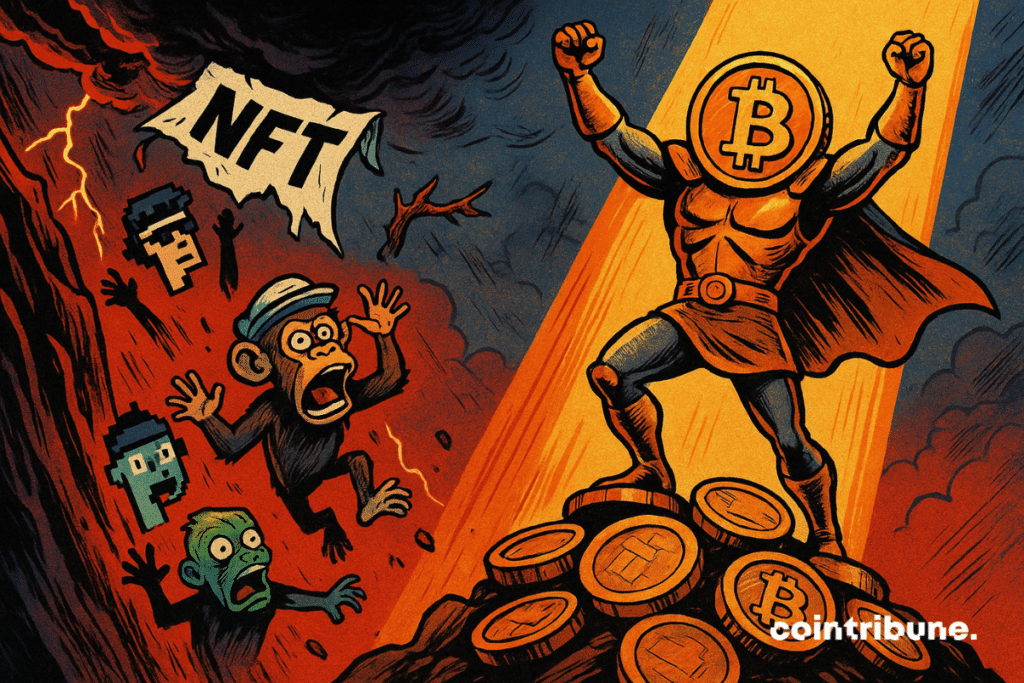

NFTs Flatline in May While Bitcoin Flexes—Crypto’s ’Store of Value’ Narrative Strikes Again

As Bitcoin notched another month of bullish momentum, NFT markets defied logic—and gravity—with a dismal sales slump. Here’s why digital art got left behind while ’digital gold’ stole the show.

The Great Decoupling

No one told JPEG speculators that crypto’s risk-on darling would get ghosted. Trading volumes cratered despite BTC’s rally—proving once again that in crypto, even ’blue-chip’ NFTs are still just illiquid meme bets with better PR.

TradFi Sneers, On-Chain Adapts

Wall Street quants will smirk at another ’utility’ narrative crumbling (remember when bored apes were collateral?). Meanwhile, degens are already pivoting—blurring the lines between NFTs and DeFi with leveraged fractionalized punks. The cycle continues.

One immutable truth remains: In crypto, the only thing harder than explaining NFT valuation is explaining why they’re not mooning when Bitcoin is.

In brief

- NFT sales dropped by 21% in May despite an increase in the number of buyers.

- The market is becoming more selective, driven by a few star collections rather than the blockchains themselves.

A market paradox: more buyers, but fewer sales

There is something ironic about seeing a market welcoming more buyers… while selling less. In May, non-fungible tokens recorded $474 million in sales, a drop of 21.25% compared to April.

Yet, the number of buyers ROSE by 16.45%, and sellers too, though more modestly (+1.57%). This paradox illustrates a troubling dynamic: a growing audience, but slowing transactions.

Moreover, this decline does not only affect smaller chains. Even Ethereum, still the undisputed number one in volume, saw its sales fall by nearly 21%, stabilizing around $140 million.

Diversification was not enough to stem the decline: Polygon, often touted as a dynamic alternative, saw its volumes collapse by 47.38%. A disenchantment that seems more structural than cyclical.

Bitcoin resists, Avalanche explodes: outsiders strike back

While most blockchains retreat, bitcoin shows a 20.16% growth in the NFT sector, reaching $74.5 million in May. A figure all the more impressive given that Bitcoin-backed NFTs are relatively recent on the scene.

BTCUSDT chart by TradingViewThe Ordinals protocol and related innovations have allowed the Bitcoin ecosystem to quickly establish itself as a credible player in this segment long dominated by Ethereum.

Even more spectacular: the meteoric rise of Avalanche. With an increase of over 1200%, Avalanche emerges as the surprise of the month.

This explosion is largely driven by the launch of the XSY Deposit project, which alone generated more than $30 million. This once again proves that a single flagship project can revitalize an entire blockchain—at least temporarily.

Collections that dictate trends more than blockchains

What May highlights is that it is no longer necessarily the blockchains pushing the momentum, but the collections themselves. Courtyard, on Polygon, dominated the rankings with nearly $60 million. Dmarket (Polkadot/Mythos) was close behind, and XSY Deposit rounded out the podium. As for Doodles, its 226% rise proves that storytelling and community effect can still work miracles.

This shift of power—from infrastructures to projects—underlines the NFT market’s growing maturity. It is no longer enough to have a fast or cheap blockchain; you need to offer an experience, a universe, a rarity that attracts.

Bitcoin is increasingly establishing itself in a sector once far from its initial DNA. At this pace, it could soon surpass solana in terms of cumulative NFT sales. But will that be enough to reverse the overall trend? Nothing is less certain. Because while the spotlight shines on isolated successes, the overall scene remains gloomy.

Bitcoin’s progression in the NFT world is undeniable, but it struggles to mask market fatigue signs. Overall volume is declining, speculation concentrates on a few niches: the market specializes and fragments. In this landscape undergoing major reshaping, SharpLink surprises by betting one billion dollars on Ether, briefly rekindling investor enthusiasm. Still, this isolated impulse does not answer the real question: are we facing healthy consolidation… or the prelude to a gradual disengagement of the general public?

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.