Meta Shareholders Deliver Near-Unanimous Verdict: Bitcoin Gets a 99.92% Rejection From Treasury

In a landslide vote that borders on corporate theatrics, Meta’s shareholders just slammed the door on Bitcoin—hard. The social giant’s treasury won’t be touching crypto anytime soon.

Wall Street shrugs while crypto Twitter melts down. Another day, another ’decentralized’ dream crushed by old-school shareholder math.

In brief

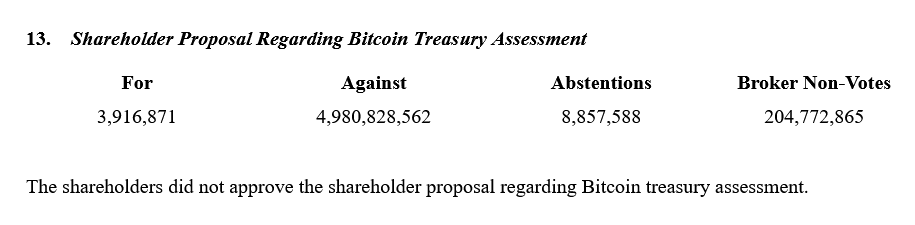

- Meta shareholders rejected the idea of adding bitcoin to the treasury by 99.92%.

- Unlike other companies, Meta remains frozen in the face of new financial allocation practices involving cryptos.

- Paradoxically, Meta is experimenting with stablecoins to pay its creators, revealing a cautious and segmented crypto strategy.

Bitcoin turned down at Meta: shareholders close the door on boldness

On May 28, 99.92% of Meta shareholders rejected a resolution to include BTC in their treasury. Proposed by Ethan Peck, this initiative was crushed by Mark Zuckerberg’s decision-making weight! He alone holds 61% of the voting rights.

This Soviet-era score signals the board’s impermeability to new ideas. This holds true even when supported by solid macroeconomic arguments against declining bond yields.

Why Meta refuses to integrate BTC into its treasury

While GameStop, MicroStrategy, or more recently H100 explore BTC as a way to protect their cash reserves, Meta will not buy bitcoins, as shareholders reject the idea of a treasury. This discrepancy raises doubts about the group’s ability to embrace emerging financial dynamics.

By refusing BTC, Meta sends a signal of caution… or stagnation. At a time when financial innovation is becoming a natural extension of technological strategy, the lack of movement is questioning.

Mark Zuckerberg slows down bitcoin: towards a mistimed strategy?

The case reveals a DEEP tension between Zuckerberg’s concentration of power and the agility required to integrate bitcoin into modern treasury strategies. By locking down any internal debate, Meta stifles a disruptive proposal driven by the market’s most capitalized cryptocurrency.

BTCUSD chart by TradingViewWhile actors explore Bitcoin to diversify their liquidity, Meta locks itself into a posture of caution. This waiting, under the guise of stability, could quickly turn into strategic inertia, unsuitable for a rapidly changing economic environment.

Meta refuses bitcoin as a treasury asset, but explores stablecoins to pay its creators. This paradox highlights a fragmented crypto strategy, revealing tension between controlled innovation and fear of volatility. The tech giant proceeds with cautious steps in the crypto universe.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.