Bitcoin at $250K? Dogecoin Creator Scoffs at the Idea

As Bitcoin flirts with the quarter-million-dollar fantasy, the mind behind Dogecoin isn’t buying it—literally or figuratively. Cue the meme-coin laughter.

While crypto maximalists hyperventilate over six-figure BTC predictions, the OG joke-currency architect dismisses the hype with a satirical shrug. After all, when your legacy includes turning a Shiba Inu into a $40B asset, you’ve earned the right to smirk at ’serious’ price targets.

Wall Street analysts scramble to justify valuations while decentralized chaos reigns supreme. Somewhere, a Goldman Sachs VP just billed 300 hours to ’research’ whether memes are the real store of value.

In Brief

- Billy Markus mocks a bitcoin prediction at $250,000, denouncing the speculative excesses of the market.

- Renowned analysts like Brandt, Kendrick, or Woo target more moderate goals, between $118,000 and $150,000.

Thisbitcoin dream is buzzing but is it based on air?

A shocking forecast comes from an unknown analyst who promises bitcoin at $250,000 before the end of 2025. An increase of more than 130% in seven months, while BTC is currently around $110,000, after having surpassed the $111,000 mark. This type of projection, without serious technical or macroeconomic basis, helps to sustain a speculative bubble in a market that is otherwise stabilizing.

Billy Markus, Dogecoin co-founder known on X (formerly Twitter) under the pseudonym “Shibetoshi Nakamoto“, did not miss the chance to mock it.

A scathing tweet that alone sums up the cyclical speculative hysteria returning in the crypto world. Far from being a simple troll, Markus regularly reminds his 2.1 million followers of the faults of an ecosystem hungry for buzz but poor in rigor.

Bitcoin predictions based on solid data

In contrast to these fanciful rises, several recognized analysts propose much more moderate forecasts.

- Peter Brandt anticipates a price between $123,000 and $150,000 by September;

- Geoffrey Kendrick from Standard Chartered targets $120,000 in the second quarter of 2025;

- Willy Woo estimates $118,000, conditional on a clear break of the previous all-time high.

These estimates are based on macroeconomic data, valuation models, and a rational reading of bitcoin cycles. Unlike the wild forecasts, which only serve to create buzz. Worse, they reinforce a short-termism dynamic, attracting poorly informed investors seeking quick gains.

BTCUSD chart by TradingViewUnfortunately, this phenomenon fuels BTC volatility and undermines the credibility of an already fragile sector in the eyes of regulators. By valuing spectacular prophecies rather than founded analyses, the crypto ecosystem risks falling back into the pitfalls that followed previous bubbles.

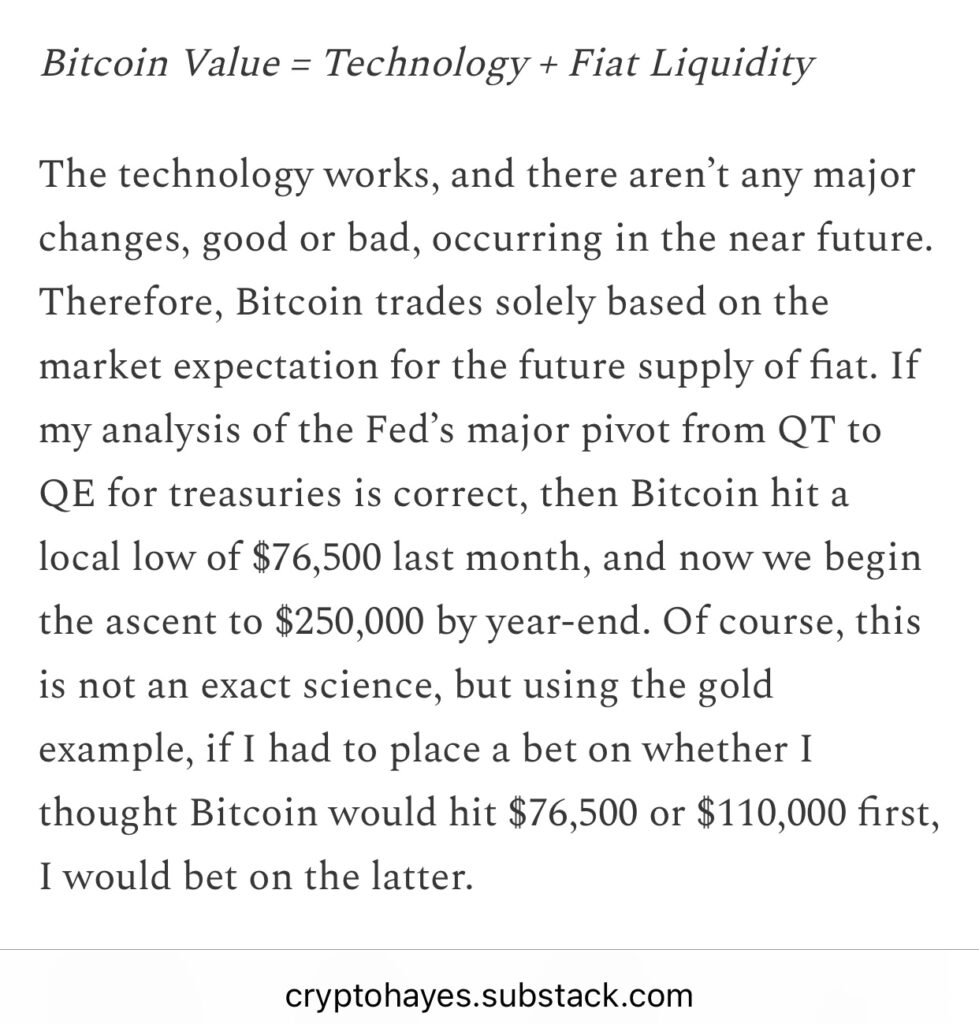

$250,000 for BTC? Some Believe Firmly

While the $250,000 target may seem unrealistic for bitcoin, it is nevertheless supported by established figures. Arthur Hayes already mentioned such an increase in April 2025, conditional on a return of quantitative easing by the Fed. He reiterated his position in May at Token2049 in Dubai.

On his side, Joe Burnett from Unchained expressed in early May that a BTC at $250,000 by the end of 2025 WOULD not surprise him. These projections rely on increased global liquidity and U.S. budget deficits as potential catalysts for this bullish scenario.

Billy Markus’s sarcastic intervention thus acts as a salutary safeguard. It humorously reminds us that a prediction only has value if it is based on structured and verifiable analysis. At a time when bitcoin threatens a critical support below $107,000, the challenge is not to fantasize about a price but to understand the dynamics that support it.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.