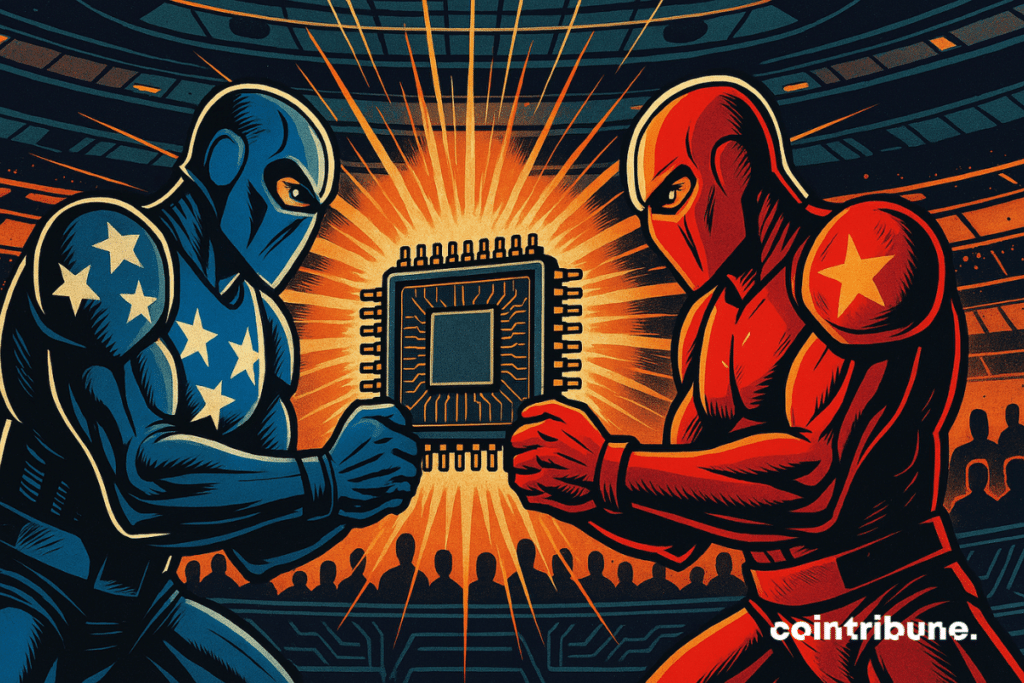

US Chip Sanctions Backfire: China’s AI Sector Gets an Unwanted Turbocharge

Washington’s latest export controls were meant to kneecap China’s tech ambitions—instead, they’re fueling a homegrown revolution.

How Beijing turned defense into offense

When the Biden administration slapped restrictions on advanced AI chips last year, the goal was simple: slow China’s ascent. Twelve months later, local manufacturers are pumping out competitive alternatives while Tencent and Alibaba redesign systems to work with less. The irony? America just handed Chinese firms the ultimate protectionist subsidy—by forcing them to innovate.

The great semiconductor decoupling

SMIC’s 7nm breakthroughs and Huawei’s Ascend chips prove the cat’s out of the bag. Now, with billions in state funding pouring into domestic fabs, China’s tech giants are doing what they do best—building parallel ecosystems. Wall Street analysts (who still can’t price crypto properly) predict full self-sufficiency by 2028. Who needs Nvidia when you’ve got industrial policy and forced adaptation?

Sanctions: the mother of invention? More like the VC round nobody wanted—but might just pay off.

In Brief

- Nvidia CEO warns about the failure of American restrictions against China.

- Nvidia lost 15 billion and saw its market share cut in half.

- China is investing massively and supporting its technological champions in the field of AI.

- Restrictions have stimulated local innovation and strengthened Chinese technological sovereignty.

Nvidia Sounds the Alarm Over a Financial Chasm Linked to Restrictions

Recent talks in Geneva between the United States and China have hinted at a tariff détente. A temporary agreement on customs tariffs seems to ease tensions. Yet,. Jensen Huang, Nvidia’s CEO, paints a worrying picture. According to him, restrictions on exporting AI chips to China are. These measures, initiated under the TRUMP administration, have cost Nvidia billions.

The company’s market share in China has dropped from 95% to only 50%. The CEO mentions, targeted by the restrictions. These controls also pushed Nvidia to create downgraded versions to circumvent the rules, but this is not enough to offset the sales decline. Despite a stated willingness to reduce tensions, the economic landscape remains undermined by these trade wars. The Nvidia CEO warns:

Ultimately, export controls have been a failure.

Huang emphasizes. The global economy, especially the AI sector, bears the heavy cost.

China Strikes Back and Invests Massively: A New AI Power Rises

Taking advantage of these unfinished wars, China has responded. It has accelerated. Companies likehave launched competitive, even superior technologies. For example, thesurpasses in power some Nvidia products.

The Chinese government has also provided. Jensen Huang acknowledges that “local companies are very talented and determined“.

Moreover, China concentrates, a considerable asset. This network of skills combined with massive investments raises fears of a shift. American export controls have paradoxically boosted Chinese technological sovereignty.

In this context, China no longer merely aims to catch up.This rise raises major geopolitical questions, notably about the future security and technological dominance. While Nvidia and other US players seek solutions, competition only intensifies.

Chinese gains are also the result of a clear strategy mixing innovation, diplomacy, and political will.

Political, Technological, and Economic Stakes Around AI

The battle over AI chips takes place in a tense political context. Thehas tried to adapt the control rules. It is abandoning the third-party system to. This new approach could complicate strategies for companies like Nvidia. They will have to navigate through several different regulations. The stakes go beyond just technology. They touch the global economy and geopolitical supremacy.

a key sector for defense and industry, the foundation of a financial revolution. Nvidia is at the heart of this fight, with a valuation exceeding 130 billion dollars.

However, the reality on the ground is harsh: financial losses are piling up. China, on its side, knows how to take advantage of these weaknesses. It also exploits commercial rivalries to strengthen its position, as evidenced by its reaction to American restrictions on AI chips. Here are some key figures illustrating this dynamic:

- Nvidia’s market share in China dropped from 95% to 50%;

- Losses related to the H20 chip amount to approximately 15 billion dollars;

- China gathers 50% of global AI researchers;

- Nvidia plans to invest in new technologies despite the pressure;

- The Chinese AI market is estimated at around 50 billion dollars for 2026.

This situation demonstrates the. It mixes commercial rivalries, technological advances, and diplomacy. Political decisions have direct impacts on the economy and innovation. China and the United States confront each other on multiple fronts, including AI, the engine of the future.

China, a skilled negotiator, plays with economic diplomacy. But behind their commercial façade, Chinese leaders maintain a clear strategic vision. Their recent decision to reduce their holdings of US Treasury bonds worries more than one observer. Facing Donald Trump, they know how to step back. This caution illustrates their desire to exert lasting influence, well beyond immediate negotiations. AI is now a field where diplomacy meets economic and technological power.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.