Crypto Fund Goes on 7,000 BTC Buying Spree—Just as Legal Storm Hits

An unnamed investment strategy just dumped nine figures into Bitcoin—right as regulators came knocking. The move screams ’bullish defiance’ or ’reckless timing,’ depending who you ask.

Legal headaches vs. diamond hands: While the lawsuit details remain under wraps, the whale-sized accumulation suggests institutional players still see blood in the water. Or they’re betting the SEC will lose yet another courtroom battle—wouldn’t be the first time.

Bonus jab: Wall Street still can’t decide if crypto is a scam or the biggest missed opportunity since ignoring Amazon in 1997. Meanwhile, the OGs keep stacking sats.

In brief

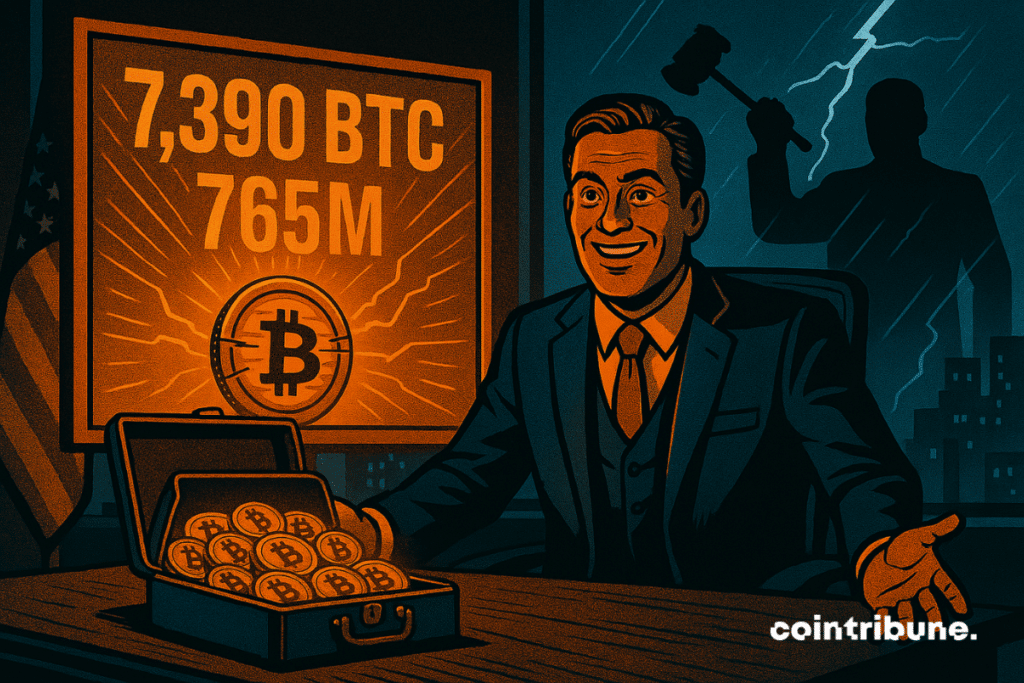

- Strategy bought 7,390 BTC for 765 million dollars, bringing its total to 576,230 BTC.

- The company holds bitcoins with a current value of 59 billion dollars with a gain of 19.2 billion.

- A lawsuit accuses Strategy of underestimating the risks related to bitcoin volatility in its communication.

- Other companies, like AsiaStrategy, are following Strategy’s example by adopting similar bitcoin treasury strategies.

Michael Saylor, the chess player of bitcoin continues his game

Michael Saylor keeps comparing bitcoin to a game of chess, where every strategic move counts. His vision is clear:. His latest acquisition,, illustrates this determination. In a post on X, he states:

Never bet against a man who buys orange ink by the barrel.

This metaphor reflects his unshakable confidence in the queen of cryptos.

His company, formerly, acquired at an average price of 69,726 dollars. This heavy strategy influences the perception of bitcoin in the global economy.

It reassures some investors, while others see an increased risk in such concentrated exposure.

Bitcoin, market and controversies around massive purchases

The latest purchase of 7,390 bitcoins represents an investment of 765 million dollars. The total valuation of. This position generates.

Yet, this strategy is not without consequences.accuses the company and its executives of understating the risks related to Bitcoin price volatility in their financial communication. The lawyer behind the lawsuit cites failures in financial disclosure.

On X, the developer 0xngmi nuances this critique:

The lawsuit seems to come from people complaining that MicroStrategy underestimated how much money it could lose if bitcoin dropped.

He adds: “You buy a company that calls itself a ‘leveraged play on bitcoin,’ what do you expect to happen if bitcoin goes down?” This divergence reflects, between confidence in growth and caution towards volatility.

A winning strategy that attracts other companies

Despite the controversy,. AsiaStrategy, an Asian watchmaking company, saw its stock price rise by more than 60% after adopting a similar strategy. A listed company in Bahrain also ventured into a BTC treasury, in partnership with 10X Capital.

- 7,390 BTC recently acquired by Strategy;

- 576,230 BTC held in total;

- Valuation: 59 billion dollars;

- Unrealized gain of 19.2 billion;

- Bitcoin yield of 16.3% in 2025 (YTD).

These figures demonstrate that BTC is establishing itself as a growing pillar in the digital economy. They also testify to the confidence of institutional players, ready to face the challenges and surf on volatility.

Strategy buys BTC regardless of its price. This consistency illustrates a will to MOVE forward, regardless of difficulties. Through its transactions, the company asserts its place in the bitcoin economy and shows its long-term commitment. Facing criticism, it remains true to its vision, convinced that the future belongs to bitcoin.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.