Banking’s 4% Squeeze: How New Capital Rules Could Choke Growth—or Force a Crypto Exodus

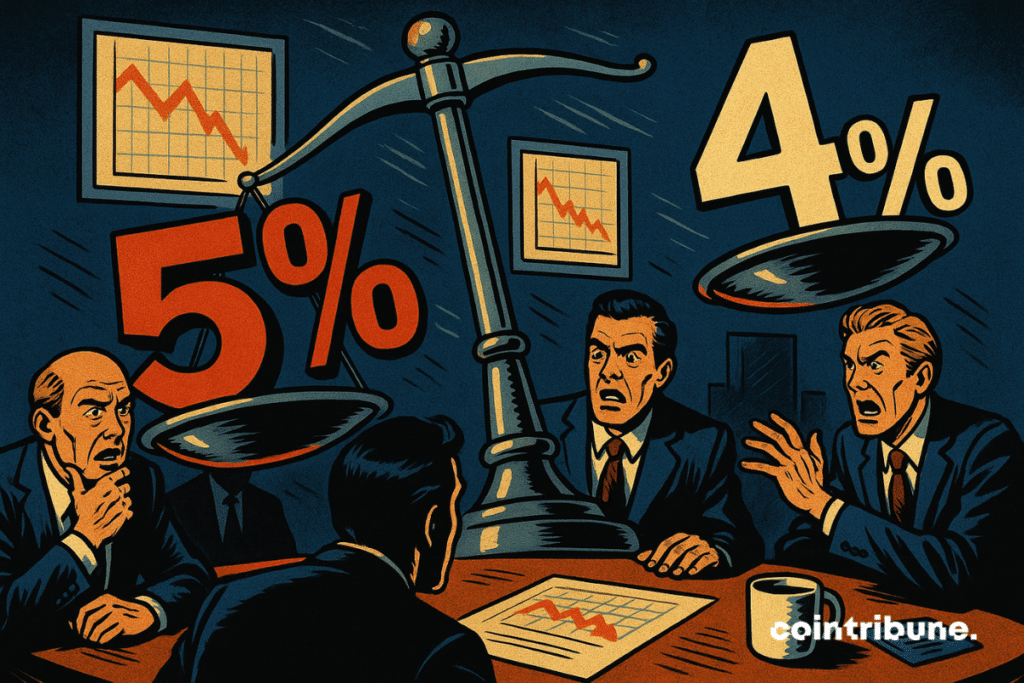

Wall Street’s latest regulatory haircut just got brutal. The Fed’s new capital requirements—slashing buffers from 5% to under 4%—are either a prudent safeguard or a straitjacket for lending, depending on which banker you ask.

The Compliance Guillotine

Expect smaller banks to ax riskier loans first. Mortgage approvals? Small business credit lines? Say hello to the 2025 credit crunch.

The DeFi Loophole

Meanwhile, crypto’s licking its chops. With traditional rails tightening, decentralized finance suddenly looks less ’wild west’ and more ’only viable exit.’ Smart money’s already bridging to stablecoins—because nothing inspires innovation like regulatory desperation.

One thing’s certain: when banks can’t bank, the economy pays. Unless, of course, you’re holding ETH.

In Brief

- The United States plans to relax the leverage ratio imposed after the 2008 crisis.

- This reform aims to free up capital to support the economy and bond markets.

- The SLR currently requires banks to hold 5% equity, unweighted.

- Critics fear a renewed weakening of the financial system in case of a sudden shock.

Why Ease the SLR? Supporters Want to Revive the Economy

For the promoters of this reform, the goal is clear:. The rules imposed after 2008 are considered too rigid in a world where liquidity has become crucial. By easing the SLR,, while more easily financing businesses.

This measure is part of theadvocated by the TRUMP administration. By aligning US standards with those of Europe or Asia, authorities intend to strengthen the competitiveness of national financial institutions.

“Penalizing banks that hold low-risk assets, such as Treasury bonds, compromises their ability to support market liquidity“, stated Greg Baer, director of the Bank Policy Institute. Translation: regulatory barriers must beso that the banking system can play its role during crises.

Furthermore, some experts believe the SLR unnecessarily hinders banks’ agility in an environment where adaptability is vital. “The US Treasury market can freeze during a crisis partly because of the SLR“, warns Darrell Duffie, professor at Stanford.

The message is clear:means more resilience for the economy.

A Reform That Benefits Banks… and the Economy?

The easing of the SLR breathes new life into major American banks. It WOULD allow them to free up capital to finance activities deemed more productive, directly benefiting the economy. Institutions like JP Morgan or Goldman Sachs see.

Moreover, this change would encourage the resumption of certain operations abandoned since 2014. Banks could reposition themselves in.

In the long run, this reform could also lower borrowing costs by increasing demand for public securities. Donald Trump sees this as an opportunity to boost the US economy while. Another alternative to Bitcoin and other cryptocurrencies, assets he seems to favor lately.

Many observers also point out that current SLR requirements in the US (5%) are much stricter than in other parts of the world, where they range between 3.5% and 4.25%. Reform supporters therefore see this as a simple rebalancing.

However, positive effects assume. The economy is delicate, and every lever pulled can produce unexpected side effects. This gray area is where the debate intensifies.

What is the SLR and Why Was It Established?

The SLR was introduced in 2014. It requires major banks to hold. This rule aimed to prevent the economy from falling back into a crisis like in 2008.

Concretely, here is what you need to remember:

- The eight largest American banks must maintain capital equivalent to 5% of their assets;

- In Europe or Asia, the ratio ranges between 3.5% and 4.25%;

- In times of market stress, this cushion limits chained bankruptcies;

- The ratio is calculated without accounting for the specific risk of each asset;

- Its reform could increase banks’ share in public debt, estimated at 1.8 trillion dollars out of a total of 28 trillion.

But critics do not relent. According to Senator Elizabeth Warren:

These proposals would put our entire economy at risk of another crash paid for by taxpayers.

Translation: the memory of 2008 remains vivid.

As the SLR reform approaches, another decision complements this major move. The Office of the Comptroller of the Currency (OCC) recently authorized American banks to buy, sell and hold cryptocurrencies. This convergence of banking deregulation and openness to digital finance reflects a clear ambition: to strengthen the economic power of the United States in a rapidly changing world.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.