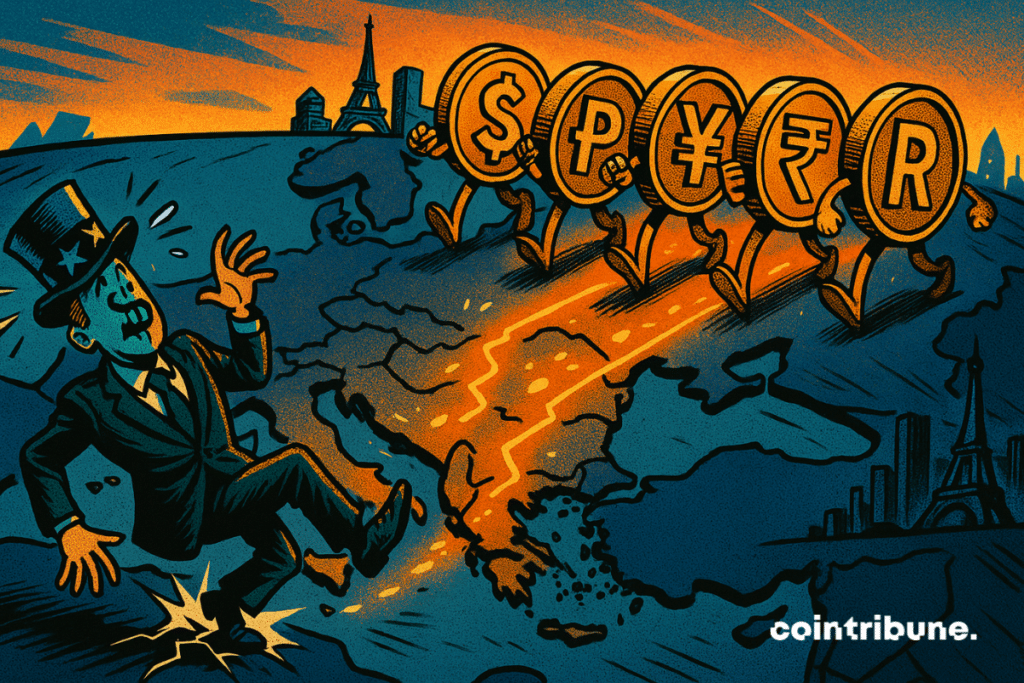

BRICS Currencies Storm Europe as Dollar’s Grip Weakens—Bankers Reach for the Antacids

Move over, greenback—BRICS nations are flipping the script. Local currencies from Brazil, Russia, India, China, and South Africa are gaining serious traction in European markets. Dollar dominance? Looking shaky.

Why this matters: When reserve currencies shift, tectonic plates move in global finance. And right now, Europe’s financial infrastructure is quietly building rails for yuan, rupee, and ruble transactions. No fanfare, just pragmatism.

The irony? Western banks spent decades pushing dollar hegemony—now they’re scrambling to hedge against their own system. Guess those ’exotic currency’ desks aren’t so exotic anymore.

Bottom line: The dollar isn’t collapsing tomorrow, but the scaffolding for a multipolar financial world just got reinforced. Cue the ’de-risking’ PowerPoints from every consultancy on earth.

In Brief

- The US dollar is losing ground in Europe, where companies now demand transactions in local currencies.

- European banks and financial institutions are increasingly receiving requests to bypass the dollar in settlements.

- This development fits within the strategy promoted by the BRICS to advance local currencies on the global stage.

- Financial technology and increased liquidity now facilitate direct settlements between non-US currencies.

A New Landscape for European Exchange Bureaus

Requests from European clients to carry out transactions in local currencies rather than dollars are multiplying.

According to Luxembourg Times revelations, several European banks, brokers, and financial entities have been facing an unprecedented evolution over the past few months in how their international clients want to conduct their transactions.

For the first time, foreign institutional funds are explicitly requesting to avoid the US dollar in settlements. European financial institutions are receiving requests for transactions, including hedges, that bypass the US dollar.

These requests involve the direct use of local currencies such as the Chinese yuan, Emirati dirham, Hong Kong dollar, or even the euro. The phenomenon, though discreet, is described as a significant shift by the actors involved.

This questioning of the pivotal role of the dollar in international flows is concretely observed in several operational cases. For example, when a Japanese company transferred money to a fund based in the Philippines through a European bank, the classic process involved first converting to dollars before another exchange to the Philippine peso.

Now, clients demand this intermediate step be removed. The requests notably concern:

- Abandoning the dollar as a bridge currency in international transfers;

- Direct processing in local currencies even in transcontinental operations;

- Fiscal and regulatory optimization through simplification of monetary circuits;

- An ideological response aligned with the objectives of the BRICS alliance, aiming to assert regional economic sovereignties against the hegemony of the greenback.

This shift clearly fits within the strategic line promoted by BRICS countries, who have been calling for a reconfiguration of the global monetary system for several years.

The fact that these requests are now reaching European compliance offices shows that this ideology goes beyond diplomatic speeches. It is beginning to transform the concrete practice of global payments.

A Change Favored by Technology and Market Conditions

While the geopolitical ideology of the BRICS drives this dynamic, the technical factors enabling it are just as decisive.

Gene Ma, China research director at the Institute of International Finance (IIF), identifies the two main levers: “the increase in transactions between non-US currencies is mainly due to technological development and increased liquidity.”

In other words, it is not just a rejection of the dollar motivating stakeholders but also the growing perception that direct settlements between local currencies are technically viable, faster, and not necessarily more expensive.

The currency derivatives market illustrates this trend. According to reported information, requests for derivative products allowing hedging against fluctuations in local currencies without using the dollar are on the rise.

These tools were previously little used outside the dollar circuit, but the rise of fintech infrastructures and the diversification of liquidity pools make these strategies more accessible.

The legacy of trade tensions between the United States and several regional blocs, initiated by Donald Trump, also weighs on investor confidence in the greenback’s role as a monetary pivot. Even though US tariff measures are currently paused, the climate of uncertainty persists.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.