Moody’s Axes US Credit Rating—First Downgrade Since Woodrow Wilson Was President

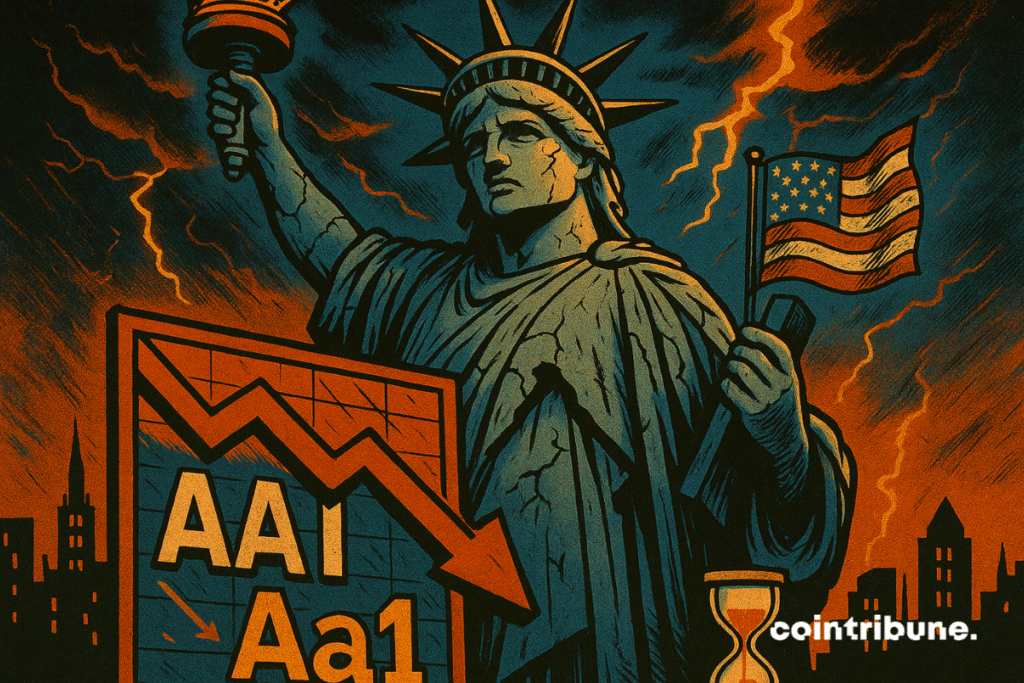

Wall Street’s favorite guilt-tripper just dropped a truth bomb: Moody’s slashed the US credit rating from AAA to AA+, marking the first demotion since 1919. The move comes as Washington plays chicken with the debt ceiling—again.

Why it matters: When the ’risk-free’ benchmark starts looking risky, every asset from Treasuries to crypto gets repriced. Bitcoin maximalists are already crowning this as ’fiat’s funeral.’

The fine print: The downgrade cites ’political dysfunction’ and rising deficits. Translation: Congress can’t stop printing money long enough to pay the bills. Meanwhile, BTC quietly notches another ATH as institutional investors hedge against dollar decay.

Bottom line: The house always wins—until the foundation cracks. Maybe Satoshi was onto something after all.

In brief

- Moody’s downgrades the US rating to Aa1, warning of a debt that has become too massive.

- US debt will reach 134% of GDP by 2035, according to official projections.

- Interest charges could absorb 30% of federal revenues within ten years.

Moody’s downgrades the United States: a warning signal for the global economy

On May 16, 2025, Moody’s lowered the, dropping. This downgrade, the latest among the major rating agencies, marks a historic milestone. It reflects a loss of confidence inand persistent deficits. Moody’s states:

Successive US administrations and Congress have failed to reverse the trend of annual budget deficits and rising interest costs.

This downgrade is not just symbolic. It warns investors and could raise the financing cost for the United States. This increase could, where the dollar remains the cornerstone. Moreover, this signal weakens America’s position as a global economic leader, casting a shadow over the country’s credibility.

Stephen Moore, a TRUMP ally, strongly criticizes this decision, calling the.

The markets reacted by a rise in Treasury bond yields, reflecting the prevailing nervousness. The challenge is huge: to break this spiral before it permanently hampers the American and global economy.

American debt: a burden threatening economic stability

The weight of American debt is at the heart of concerns. Currently,. Moody’s predicts it will reach 134% of GDP by 2035, up from 98% in 2024. This surge is driven by growing deficits, rising mandatory expenditures especially interest payments, and stagnant tax revenues.

The report specifies that interest charges will go from 18% of federal revenues in 2024 to nearly 30% in 2035. This weight burdens the budget and limits the room for bold economic policies. Moreover, if the extension of the 2017 tax cuts is confirmed, it could further increase deficits, adding nearly 4 trillion dollars over ten years.

These figures reflect. Consequently, the ability to invest in growth, innovation, and competitiveness is challenged. This trend could lead to a gradual decline in living standards and a weakening of American economic institutions.

American economy today: tensions and future prospects

The American economy is going through a delicate period. The trade war initiated by Trump, with its tariffs, has created. Furthermore, budget cuts aim to reduce public spending, but their impact is uncertain.

The inability to stabilize the debt fuels concerns. Efforts to reduce deficits face political opposition and structural constraints. Theis felt, particularly with rising bond yields. This context creates an atmosphere of uncertainty for businesses and consumers.

- Federal debt: 36 trillion dollars (2025);

- Debt-to-GDP ratio: 98% in 2024, projected at 134% in 2035;

- Interest burden: 18% of revenues in 2024, 30% projected in 2035;

- Fiscal impact of tax cuts: +4 trillion over ten years;

- Expected inflation: 2.9% in 2024.

Faced with these challenges, voices are rising to advocate an alternative to mere budget cuts. Among them, Bitcoin is gaining popularity as a safe haven and diversification tool. Donald Trump himself seems to pay particular attention to this new factor, which could influence economic strategy in the coming years.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.