VanEck Drops Tokenized Treasury Fund—Because Nothing Says ’DeFi’ Like Uncle Sam’s Bonds

Wall Street meets blockchain (again): VanEck just launched a tokenized fund pegged to US Treasury securities—the ultimate ’safe haven’ play dressed in crypto’s edgiest jargon.

How it works: Each digital token represents a slice of the fund’s holdings in T-bills, letting investors chase yield while pretending they’re not just reinventing ETFs with extra steps.

The irony? This ’innovative’ product basically packages government debt—the same stuff your boomer uncle buys—into blockchain wrappers. Progress!

In Brief

- VBILL can be issued through multiple blockchains at any time.

- The fund is intended for qualified investors and minimum subscriptions are $100,000 or $1,000,000, depending on the blockchain.

- The new product arrives to boost an almost $7 billion market in tokenized U.S. Treasury securities.

VBILL: Exposure to Treasury Securities Across Multiple Blockchains

VanEck, which filed for a BNB ETF in the United States, has just launched the VanEck® Treasury Fund, Ltd. (VBILL) through a partnership with the tokenized RWA platform Securitize. It is a tokenized product that exposes investors to money market funds backed by U.S. Treasury securities.

According to the global investment manager, VBILL offers 24/7 liquidity and real-time settlement, through onramps via the stablecoin USDC.

Initially, the tokenized fund is available on the Avalanche, BNB Chain, Ethereum, and solana blockchains. Interoperability between blockchains is enabled by the Wormhole protocol to facilitate secure and seamless token transfers.

The new tokenized RWA utilizes integrated services from Securitize, including tokenization, fund administration, transfer agency, and brokerage features to enhance market access, liquidity options, and operational efficiency.

Another feature of the new tokenized investment product is “atomic liquidity” through the U.S. dollar-backed stablecoin AUSD, issued by the financial infrastructure company Agora.

This collaboration combines the best of Securitize’s fully integrated tokenization model with VanEck’s DEEP asset management expertise. With VBILL, our combined efforts demonstrate tokenization’s ability to create new market opportunities with the speed, transparency, and programmability of blockchain technology.

co-founder and CEO of Securitize, Carlos Domingo.VanEck’s Digital Assets Product Director, Kyle DaCruz, considered that tokenization of Treasury securities represents “a secure, transparent, and liquid tool for cash management, further integrating digital assets with traditional financial markets”.

Tokenized funds like VBILL are increasing market liquidity and efficiency, reinforcing our commitment to generate value for our investors.

Issuances and Subscriptions

VBILL shares are issued and recorded on blockchain networks, offering investors greater transparency and faster settlement times compared to traditional fund structures. According to VanEck, the fund targets institutional and qualified investors. Minimum subscriptions start at $100,000 for investments on Avalanche, BNB Chain, and Solana, and $1,000,000 on Ethereum.

Regulation, Custody, and Management

The VanEck® Treasury Fund, Ltd. is organized under the laws of the British Virgin Islands, with Van Eck Absolute Return Advisers Corporation acting as investment manager and Van Eck Securities Corporation as marketing agent. Securitize Markets, LLC serves as the placement agent for the offering.

VanEck also reported that it will be administered by Securitize Fund Services, with RedStone acting as the oracle network to provide daily net asset value (NAV) calculations. The fund’s asset custodian is State Street Bank and Trust Company.

Nearly $7 Billion in Tokenized Securities

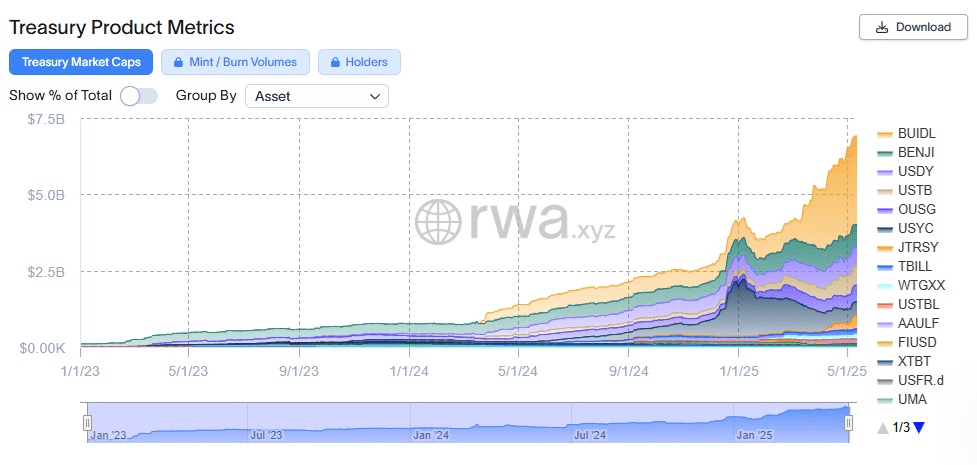

Data from the platform RWA.xyz at the time of this edition indicated $6.91 billion in RWA tokens solely from U.S. Treasury securities. This represented 45 assets distributed among 18,029 holders.

Of the total, $5.3 billion were tokens minted on the ethereum network, $455.1 million on Stellar, $295.5 million on Solana, $187.4 million on Arbitrum, $120.5 million on Avalanche, and $139.6 million off-chain.

Contrary to the $21 billion market capitalization of tokenized assets, the CEO of Plume recently stated that the RWA market isn’t really worth that much.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.