Dogecoin Active Addresses Spike—Is the Meme Coin Gearing Up for Another Run?

Dogecoin’s network activity just flashed a bullish signal—active addresses surged 40% in a week. Traders are watching closely as the meme coin defies its ’joke asset’ reputation yet again.

Behind the Metrics: What’s Driving the Surge?

Speculation points to three factors: Elon Musk’s latest X.com integration teaser, a wave of Asian retail traders rotating out of altcoins, and that timeless crypto catalyst—pure, unadulterated FOMO. The 24-hour trading volume tells the story: $2.3 billion changed hands while Wall Street analysts were busy downgrading Coinbase.

Doge’s Next Move: Moon or Meme Graveyard?

The coin now faces its 2021 ATH like a skateboarder eyeing an unfinished halfpipe—either it sticks the landing or becomes another cautionary tale about buying the dip during SNL season. One thing’s certain: the ’people’s crypto’ still moves faster than a hedge fund’s algorithmic trader after spotting a tax loophole.

In Brief

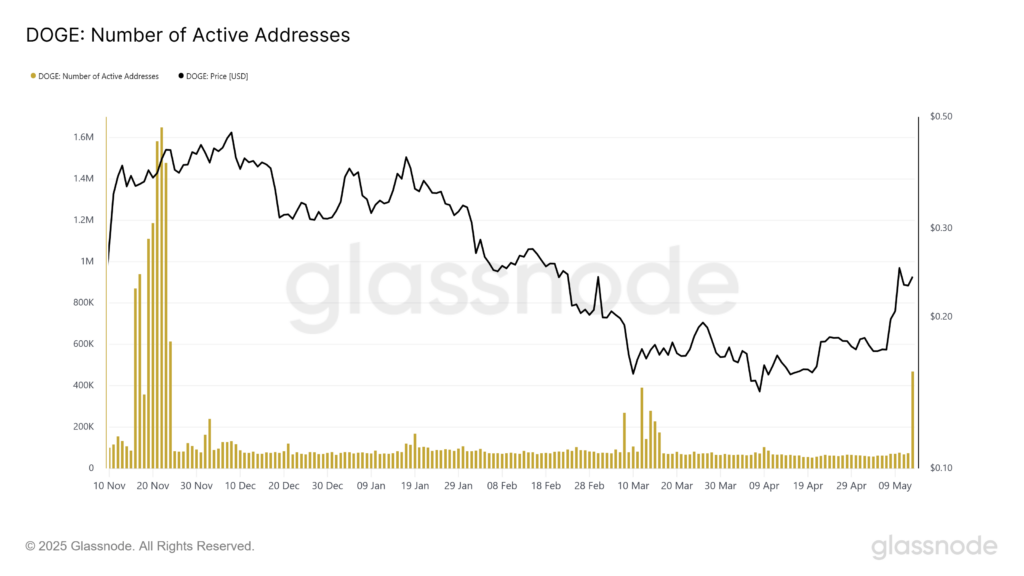

- Dogecoin active addresses surged 528% in 24 hours, reaching 469,477.

- Open interest on DOGE futures climbed 70% to $1.65 billion.

- Four Dogecoin ETF applications are currently under SEC review, with decisions expected as early as May.

- DOGE price could target $0.40 if the $0.24 resistance is broken.

A Spectacular Awakening of the DOGE Network

On May 13, 2025, the dogecoin network experienced a dramatic surge in activity. Active addresses literally exploded, jumping from 74,640 to 469,477 in just 24 hours—a dizzying 528% increase, according to Glassnode data.

This spectacular surge follows the SEC’s approval of the filing for the 21Shares Dogecoin spot ETF. The announcement was confirmed by the financial services company on X on May 14, creating a wave of Optimism in the market.

This frenzy is not isolated. Open interest on Doge futures jumped 70% in one week, rising from $989 million to $1.65 billion. Even more intriguingly, this increase happens despite a price decline, suggesting significant speculative positioning in anticipation of a major move.

Data from Cointelegraph also reveal strong spot demand. The cumulative volume delta (CVD) over 90 days has shown buyer dominance since early March, a pattern similar to the one preceding the 385% rally to $0.48 in Q4 2024.

DOGEUSDT chart by TradingViewDogecoin ETFs: Catalysts for the Next Leap!

The current enthusiasm centers on four Dogecoin ETF applications under review by the SEC. 21Shares, in partnership with House of Doge – the corporate branch of the Dogecoin Foundation – filed its application on April 9. Nasdaq then submitted the 19b-4 FORM on April 30 to list the ETF.

Other players are not far behind: Bitwise, Grayscale, and Osprey have all filed their own applications. Bloomberg analysts estimate a 75% chance that a Dogecoin ETF will be approved this year, while the prediction market Polymarket shows odds of 64%.

The 21Shares Dogecoin ETF WOULD use Coinbase Custody as the official custodian and aims to track DOGE performance via the CF DOGE-Dollar US Settlement Price index. This structure would reassure institutional investors seeking regulated exposure to memecoins.

Trader Tardigrade has identified a key resistance level around $0.24. A breakout above this level could drive DOGE up to $0.40, signaling sustained bullish momentum.

Meanwhile, Dogecoin supporter Kriss Pax notes an inverse head and shoulders pattern on the daily chart, suggesting potential for a MOVE up to $0.42.

In summary, the explosion of Dogecoin active addresses combined with growing interest in ETFs paints a promising picture for the memecoin. Should the SEC give the green light and the $0.24 resistance yield, DOGE could follow two very different trajectories toward or away from its 2024 highs.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.