Solana and Litecoin Flatline—Will XRP and Dogecoin Be the Next Crypto Casualties?

Solana and Litecoin hit a wall this week, trading sideways while Bitcoin flirts with new highs. Traders are left wondering: which altcoins will follow suit?

XRP and Dogecoin now sit in the danger zone—both showing eerily similar stagnation patterns. Meme coin euphoria fades faster than a Wall Street intern’s optimism.

Key indicators suggest trouble ahead: dwindling volumes, failed breakout attempts, and leverage traders getting liquidated en masse. The ’greater fool’ theory only works until it doesn’t.

One cynical truth remains: when the crypto music stops, retail investors are always left without chairs—while hedge funds quietly exit through the OTC door.

In brief

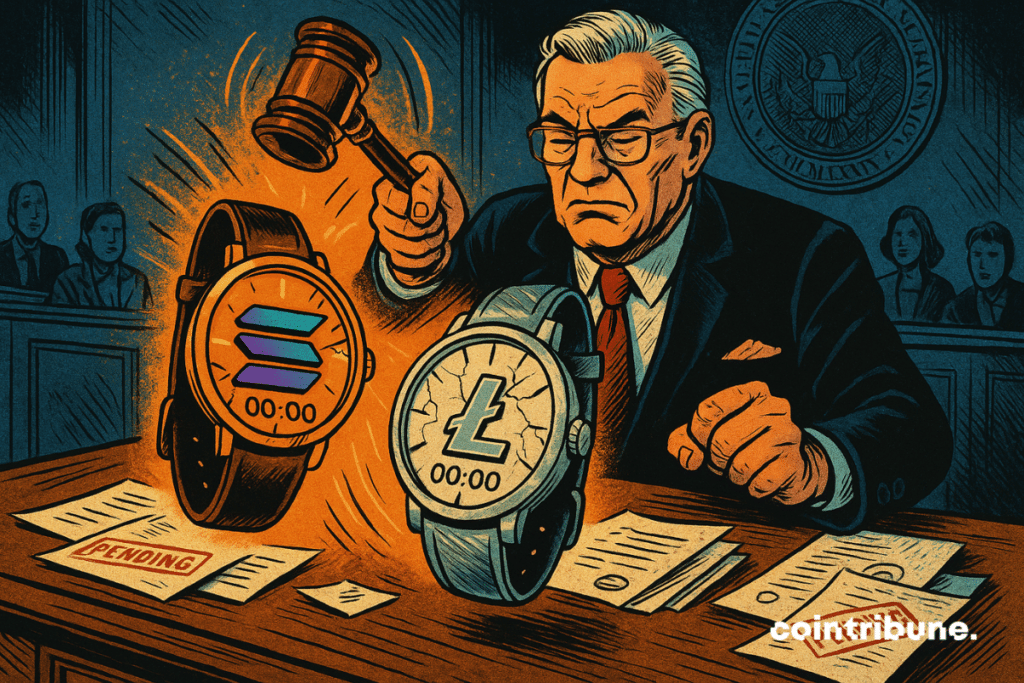

- The American SEC has postponed its decision on the Solana ETF proposed by Grayscale, now delayed until October 2025.

- The Litecoin ETF, filed by Canary Capital, was also delayed in early May, reinforcing the regulator’s wait-and-see attitude.

- New decisions are expected in June for the Polkadot, XRP, and Dogecoin ETFs, still under review by the SEC.

- These regulatory uncertainties could slow the inflow of institutional capital and weigh on the crypto market’s dynamics.

The SEC postpones decisions on the Solana and Litecoin ETF

The SEC officially postponed on May 13, 2025, its decision regarding the highly anticipated solana spot ETF proposed by Grayscale. According to documents filed by the regulator, the deadline is now set for October 2025.

SOLUSDT chart by TradingViewSuch a postponement comes barely a week after another adjournment, that of the Litecoin ETF filed by Canary Capital. As summarized James Seyffart, analyst at Bloomberg Intelligence, in a post on X dated May 5 :

The SEC has once again postponed its decision on the Litecoin ETF. No surprise, but the signal remains negative in the short term.

Indeed, these delays, although predictable, trigger questions in a market where institutional interest in crypto products continues to grow. Spot ETFs are seen as key instruments to channel investment flows into cryptos.

Here are several major points highlighting the importance of these decisions :

- “Bitcoin ETFs represented about 75 % of new investments in the market at the time of their launch,” which contributed to lifting BTC above $50,000 in February 2024 ;

- According to Ryan Lee, analyst at Bitget Research, a Solana ETF could “offer a regulated investment vehicle, likely to attract billions,” even if the expected volumes are smaller compared to bitcoin ;

- Investors remain optimistic : Polymarket shows an 82 % probability of approval for a SOL ETF by the end of 2025, and 80 % for Litecoin.

In this context, the SEC’s caution contrasts with market expectations, which heightens the tension between regulation and innovation.

Imminent decisions for Polkadot, XRP, and Dogecoin

While Solana and Litecoin see their hopes postponed, other projects enter the regulatory decision zone. According to recent documents published, the SEC must rule in June 2025 on several other crypto ETFs.

On June 11, it will be the Grayscale Polkadot ETF that will be reviewed. Two weeks later, on June 24, it will be 21Shares’ turn to defend its own Polkadot ETF. Additionally, a deadline is also set for June 17 for the Franklin Templeton XRP ETF and the Bitwise Dogecoin ETF.

These dates, although official, are not irrevocable. The SEC legally has a total of 240 days to decide, and it does not hesitate to use this margin, as shown by the cases of the Bitcoin and ethereum ETFs.

This phenomenon of “regulatory procrastination” is now well documented. The SEC systematically delays without necessarily issuing an explicit refusal, which maintains uncertainty and temporarily freezes short-term hopes.

Such a strategy could also apply to the Polkadot, XRP, and Doge ETFs, even if no official indication confirms this for now.

This tense and uncertain regulatory climate is not without consequences on investors’ strategies and the institutional perception of the concerned assets. If the SEC continues to slow the process, it could hinder the widespread adoption of certain cryptos that heavily rely on exposure via ETFs to attract large funds. Conversely, a series of approvals in June could trigger a new wave of capital inflows.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.