BIS Report Slams Crypto: ’90% of Payments Are Just Gambling With Extra Steps’

The Bank for International Settlements just dropped a truth bomb—most crypto transactions aren’t buying coffee, they’re betting on digital ponies.

Speculation Masquerading as Innovation

Behind the DeFi buzzwords and NFT hype, the data shows what veterans knew all along: crypto’s ’payment revolution’ is 90% traders chasing pumps. So much for disrupting SWIFT.

Wall Street’s Unwanted Mirror

Funny how decentralized finance ended up replicating the worst habits of traditional markets—just with worse UX and more exit scams. At least hedge funds serve champagne when they rug-pull.

The blockchain doesn’t lie. Until it gets hacked.

In brief

- The majority of global crypto flows are driven by speculation, according to a BIS report.

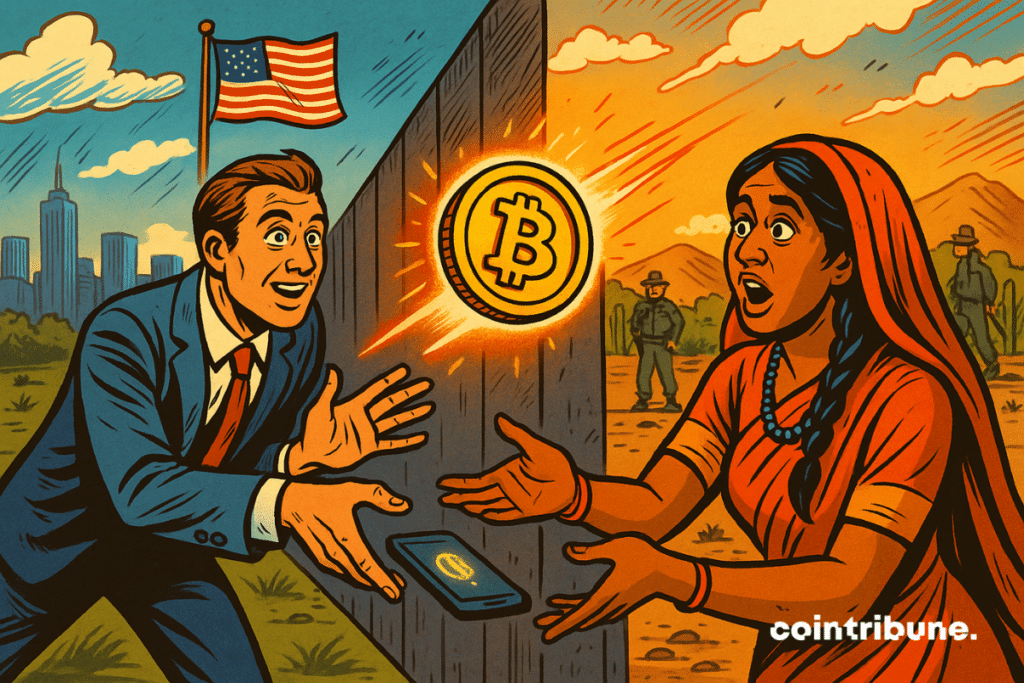

- Bitcoin and stablecoins also serve as an alternative solution to costly transfers in emerging countries.

Crypto: Speculation dominates cross-border payments according to BIS

According to the BIS,were transferred via bitcoin, Ethereum, USDT, and USDC in the second quarter of 2024. Certainly, this figure may create the illusion of massive adoption of crypto-assets. However, the reality is quite different.

ETHBTC chart by TradingViewThe institution indeed points out that the majority of these flows are driven by. In other words, they are highly sensitive to global financing conditions.

Our findings highlight speculative motives and global funding conditions as the main drivers of native crypto asset flows.

The study also establishes a clear correlation between restrictive monetary policies and the decline in volumes. Indeed, it points to increasing interconnection between crypto-assets and traditional finance.

Theis therefore no longer isolated. Its behavior increasingly aligns with that of classic risky asset classes. Volatility is no longer only endogenous to the sector; it is now also dictated by macroeconomic factors.

Crypto: between payment solution and inflation escape

Despite this strong speculative trend, the report highlights. It mainly refers to international money transfers. Stablecoins and low-value Bitcoin are indeed used in emerging markets as alternatives to costly or hard-to-access banking systems.

High transfer fees and rampant inflation in certain regions foster the use of. The study points out that certain countries concentrate a significant share of flows. Notably mentioned are:

- Turkey;

- Russia;

- United States;

- United Kingdom.

In this context, crypto becomes bothand a gateway to global markets, especially for populations excluded from traditional systems.

Crypto thus oscillates between a global speculative tool and an alternative solution for money transfers. The BIS report calls for rethinking the real uses of these digital assets in the face of growing economic and social challenges.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.