Metaplanet Outpaces El Salvador in Bitcoin Holdings—Now Gunning for 1% of Global Supply

Move over, nation-states—corporate Bitcoin whales are rewriting the rules. Metaplanet just flipped El Salvador’s stash, and its audacious new target would make even MicroStrategy blush.

The 1% play: Hitting that magic number would require swallowing ~210,000 BTC at current supply levels. That’s a $15 billion appetite at today’s prices—assuming the coin doesn’t moon further while they accumulate.

Wall Street’s watching: While traditional finance scoffs at ’magic internet money,’ treasury departments are quietly running the numbers on corporate BTC strategies. Spoiler: the math works better when you’re not paying 8% on dollar-denominated debt.

The cynical kicker: Nothing accelerates institutional crypto adoption like watching your competitor’s balance sheet outperform yours—especially when it’s fueled by an asset class you publicly mocked.

In Brief

- Metaplanet surpasses El Salvador with 6,796 BTC, becoming the largest bitcoin holder in Asia.

- Stated goal: 21,000 BTC, or 1% of the global supply, via a strategy inspired by MicroStrategy.

An Acquisition That Redraws the Map of Bitcoin Holders

Metaplanet, a company listed on the Tokyo Stock Exchange, has just completed a significant operation: acquiring 1,241 bitcoins for approximately 129 million dollars. The company now holds 6,796 BTC, valued at around 707 million dollars. This figure exceeds the 6,714 BTC held by El Salvador, the pioneering country in adopting Bitcoin as legal tender.

In addition to holding more BTC than El Salvador, Metaplanet also becomes the largest bitcoin holder in Asia and the tenth worldwide. This paradigm shift highlights the increasing power of private companies in the strategic management of digital assets.

Metaplanet: An Accumulation Strategy Inspired by MicroStrategy

Metaplanet’s strategic direction openly draws inspiration from MicroStrategy’s model. The Japanese company plans to increase its reserves to 10,000 BTC by the end of 2025. In the longer term, the stated goal is to reach 21,000 BTC, which WOULD represent about 1% of the total supply of bitcoin in circulation.

This approach reflects a patrimonial vision of bitcoin comparable to that of digital gold. CEO Simon Gerovich summarized it as follows:

Humble beginnings to rival nation-states.

Behind this ambition lies a desire for financial stability amid an uncertain macroeconomic context.

Innovative Financing Mechanisms for a Rise in Power

To support its bitcoin accumulation strategy, Metaplanet has deployed several structured financial levers. The company has notably:

- Issued bonds amounting to 24.8 million dollars;

- Introduced stock acquisition rights for its investors;

- Founded a new entity in the United States, based in Florida, to raise up to 250 million dollars.

This financial engineering allows Metaplanet to grow without excessively diluting its capital. It also shows how traditional corporate financing tools adapt to the logics of bitcoin acquisition.

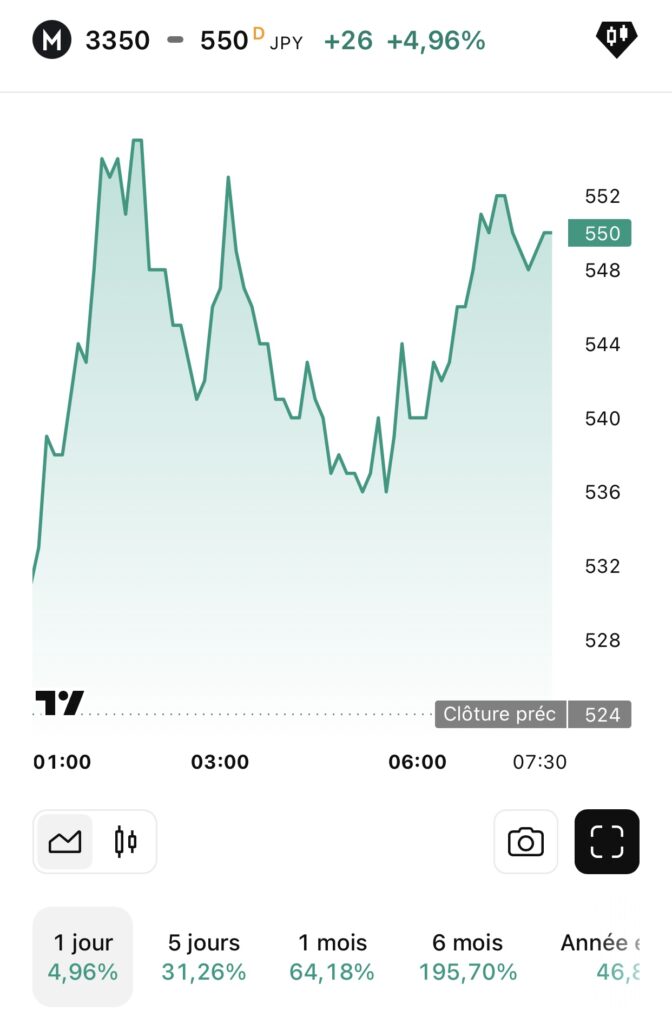

BTCUSD chart by TradingViewAn Operation Praised by Financial Markets

The market impact was immediate. Since the announcement of its latest acquisition of 1,241 BTC, Metaplanet’s stock has risen by almost 5%. Even more significantly, its market capitalization has multiplied by 15 since April 2024. The return on its bitcoin reserves reaches 170% since the beginning of 2025 and 38% for the current quarter.

These results demonstrate the perceived strength of the company’s crypto strategy. They also reinforce the idea that bitcoin is becoming a central asset in valuing innovative companies.

Metaplanet hasn’t just bought bitcoin en masse. It has crossed a symbolic boundary, challenging states on their own turf. By aiming for 1% of the global supply, it redefines power relationships. Is programmable money changing the rules of global power? And what if states are definitively losing their grip?

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.