EU Tightens the Screws: Crypto Transparency Rules Kick In by 2027

Brace for impact—Brussels just fired a regulatory torpedo at crypto’s Wild West era. Starting 2027, every blockchain transaction in the EU faces mandatory disclosure. No more shadowy wallets, no more ’lost keys’ excuses.

The fine print bites:

Exchanges must now KYC every user, track cross-border flows, and report anything fishy. DeFi platforms? They’re not off the hook—developers might inherit liability. (Cue the frantic pivot to ’compliant innovation’ by VCs who funded anonymity-first protocols.)

Silver lining?

Institutional money loves paperwork. This could be the push TradFi needs to finally go all-in on digital assets—assuming they don’t strangle innovation first. After all, nothing says ’progress’ like a 27-nation compliance gauntlet designed by bureaucrats who still think Bitcoin is for buying drugs.

In Brief

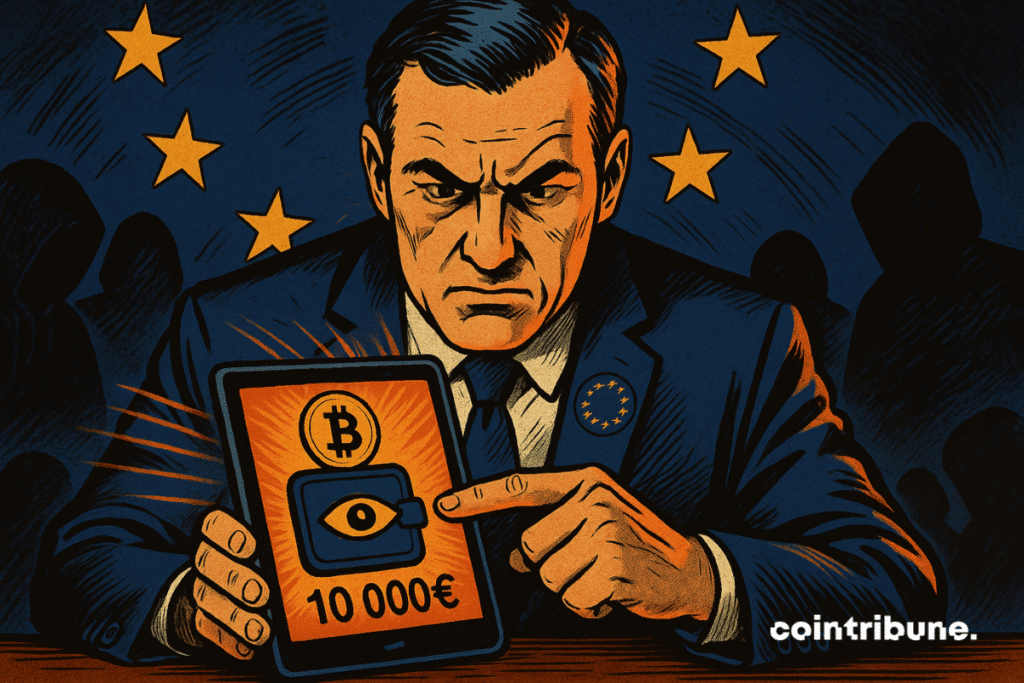

- Starting July 2027, the EU will mandate identification for all crypto transfers exceeding €1,000, ending anonymity.

- Centralized platforms and self-custodial wallets will have to record users’ personal data.

- While some see this as a security advancement, others condemn it as a serious violation of privacy and the decentralized spirit of Web3.

Imposed Transparency: Towards a Generalized Registry of Crypto Wallets

First, the European Union will require all providers of crypto-asset related services to systematically record sender and recipient data.

Centralized platforms such as exchanges and custodial wallets will now have to collect and retain this information, just as banks already do during regular transfers.

Moreover, even self-custodial wallets will be affected. For each transaction exceeding the €1,000 threshold, users will have to answer a series of questions: identity, source of funds, etc.

This regulatory obligation has the stated goal of combating illicit transactions, but it definitively buries the original anonymity promised by Bitcoin and crypto from their inception.

Furthermore, the European Crypto Initiative highlights that financial intelligence units will now have “direct, immediate, and unfiltered” access to transactional data.

Traceability will then become instantaneous. For the authorities, this measure represents a crucial lever in the fight against organized crime, while privacy advocates see it as an unprecedented threat.

Innovation or Infringement on Privacy?

This new European regulation is causing a real outcry within the crypto community. Riccardo Spagni, a prominent figure of Monero, strongly denounces these “intrusive” measures. Crypto-assets ensuring enhanced anonymity are now among the assets excluded from authorized European platforms. According to him, this represents a direct attack on the foundations of digital privacy.

On his side, James Toledano, CTO of Unity Wallet, is particularly concerned about the unintended effects on the decentralized crypto ecosystem.

He believes that equating crypto-assets with traditional financial services betrays the very spirit of peer-to-peer.

The risk also exists that offshore transactions and clandestine P2P exchanges will thrive in the shadows, recalling the turbulent earliest days of the crypto sector.

Crypto and Regulation: Catalyst for New Technologies?

However, far from being a mere constraint, this regulation could also stimulate the emergence of innovative technological solutions within the crypto universe. KYC attestations based on zero-knowledge proofs (ZKP) are already being considered.

These systems WOULD allow user authentication without fully revealing their personal data.

Solutions such as LAYER 2 (secondary layers) and threshold signatures could also represent an effective compromise between imposed transparency and preserved privacy.

Thus, these constraints could paradoxically spur innovation in the crypto universe by fostering the development of safer and more privacy-respecting solutions — provided technology progresses fast enough to adapt, without regulators crossing the red line of outright banning Bitcoin.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.