Meta Tests Crypto Waters Again—Stablecoin Payments May Hit Facebook by 2026

Zuckerberg’s empire quietly files stablecoin patents—because what’s a tech giant without dipping into digital currencies?

Inside the move: Meta explores dollar-pegged tokens for payments, ads, and creator payouts. No volatile Bitcoin swings—just corporate-controlled ’innovation.’

Why now? After the failed Libra/Diem debacle, regulators might actually play ball. Or this is just another distraction from their VR money pit.

Wall Street take: ’Finally, a use case for crypto—helping advertisers bypass credit card fees.’ Cue the eye-rolls from decentralized purists.

In brief

- Meta returns to crypto by integrating USDC and USDT stablecoins to pay content creators.

- This strategy aims to facilitate cross-border payments and bypass traditional banking infrastructures.

- By focusing on adoption rather than issuance, Meta strengthens its position in the global digital economy.

A discreet but ambitious return of Meta to crypto

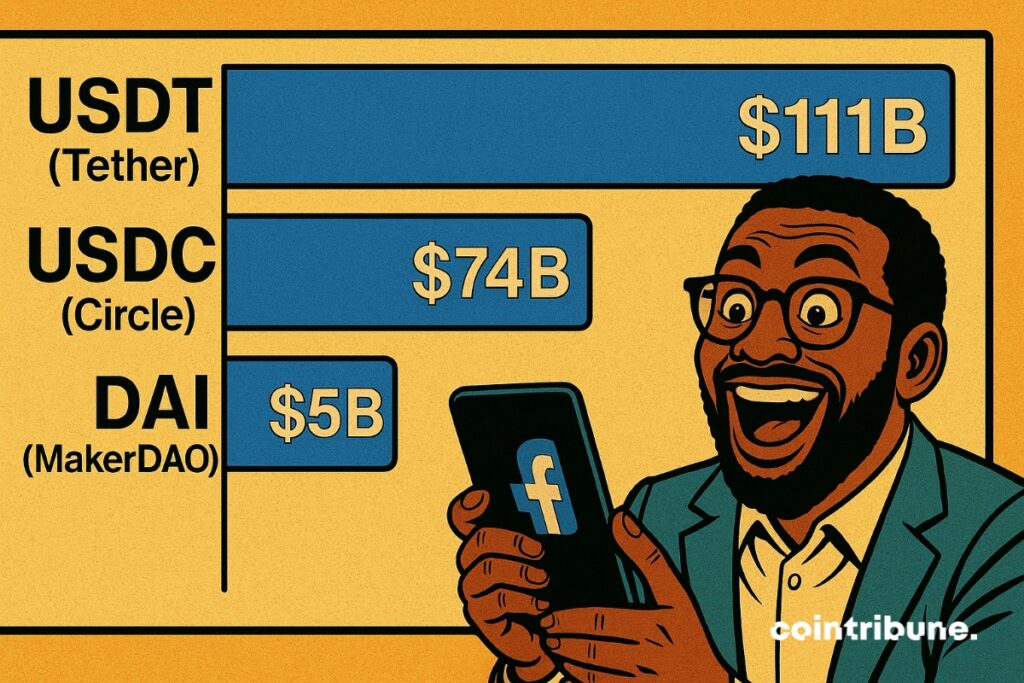

After failing to establish Diem as a global digital currency, Meta is opting for a more pragmatic approach. The goal: to integrate existing stablecoins, like Circle’s USDC or Tether’s USDT, to make payments globally. This decision marks a clear break with the initial ambition to create a proprietary cryptocurrency.

The arrival of Ginger Baker as the head of the initiative underlines the seriousness of the project. Formerly of Plaid and a member of the stellar Foundation board, she represents a commitment to anchoring the project within decentralized finance standards. Meta now relies on crypto infrastructure to strengthen its social platforms without provoking the same resistance it faced during its Libra campaign.

Why are stablecoins attracting Meta again?

Meta’s use of stablecoins meets several strategic objectives. It enables optimization of cross-border transfers by bypassing costly and slow traditional banking networks. For a company like Meta, connecting billions of users, the advantages are many:

- Reduction of transaction costs;

- Acceleration of payments between creators and platforms;

- Portability of funds in unstable monetary environments.

By targeting USDC and USDT, Meta relies on assets already widely adopted, facilitating their integration without requiring complex learning. The company thus equips itself with a stable, digital, and global payment method, without incurring the political risks of a private currency. The model evolves: from currency issuance to facilitating crypto liquidity.

A crypto strategy at the crossroads of regulation

Meta’s return to the digital asset universe faces a shifting regulatory environment. In the United States, the GENIUS law, which aimed to regulate stablecoins and make them a lever of dollar’s international influence, was recently blocked in the Senate. This legislative deadlock reflects the political tensions surrounding these new financial instruments. Meta, which already saw its Libra project strangled by authorities, seems to have learned lessons.

By opting for crypto tokens already compliant, it limits its direct exposure. However, legal uncertainties remain: any regulatory changes could slow down or condition the deployment of these payment systems. Meta’s strategy will have to contend with these constraints to endure.

What are the stakes for content creators?

Integrating stablecoins opens new prospects for content creators, especially in emerging countries. Where banking systems are failing or absent, receiving payments in stable crypto could transform access to monetization. This WOULD allow Meta to:

- Stimulate local content production;

- Diversify creators’ income;

- Build loyalty among a base of user-producers.

In this logic, Instagram, Facebook, or Threads could become channels for cross-border payments. Crypto imposes itself as a lever of financial inclusion by enabling creators to monetize without a traditional bank account. Meta could thus extend its influence, not only social but also economic, by becoming the interface for distributing digital revenues worldwide.

A few months after a shareholder proposed Meta invest its treasury in bitcoin, it now relies on stablecoins as an integration strategy. This repositioning marks an evolution in tech: integrating into the crypto ecosystem rather than competing with it. A dynamic that could transform social networks into key players of digital finance and Web3.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.