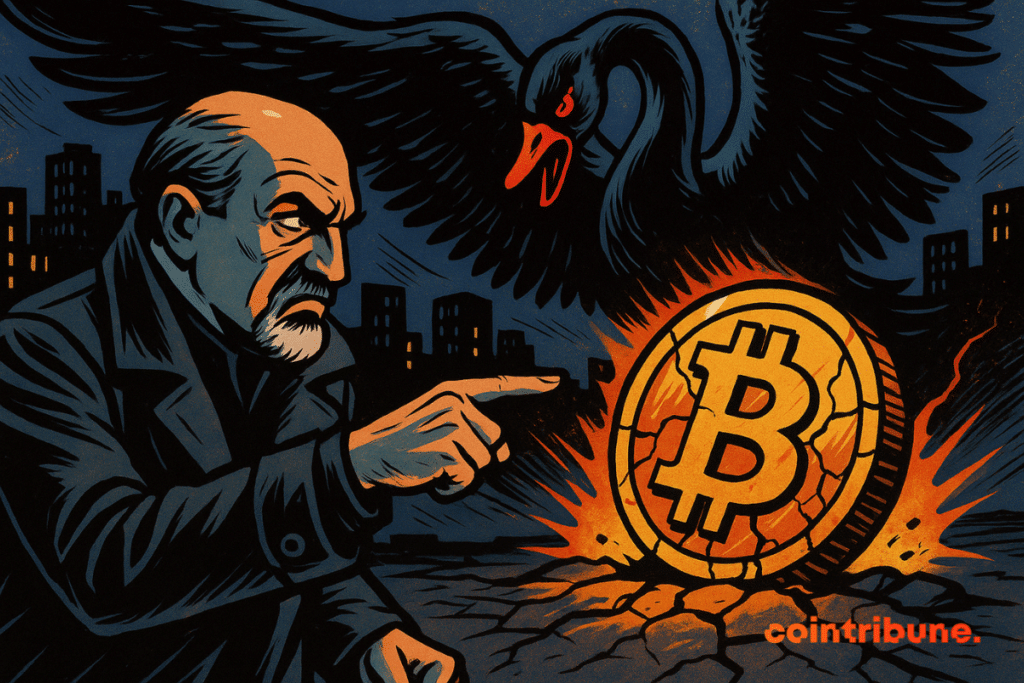

Nassim Taleb Slams Bitcoin Again: ’A Technological Tulip With No Roots’

Famed statistician and volatility trader Nassim Taleb just took another swing at Bitcoin—calling it a ’technological tulip’ in his latest broadside against crypto.

The author of ’The Black Swan’ has never been shy about his skepticism, but this latest jab cuts deeper. No charts, no hedging—just a merciless comparison to history’s most infamous bubble.

Meanwhile, crypto traders shrug and check their portfolios. After all, tulips never yielded 200% annual returns—or survived a dozen ’extinction events.’

Bonus jab: Wall Street still can’t decide if it wants to regulate Bitcoin or replicate it. Spoiler—they’ll probably do both, badly.

In Brief

- Nassim Taleb compares Bitcoin to a speculative bubble, calling it a “technological tulip.”

- He criticizes its volatility, lack of real monetary utility, and inefficiency as a store of value.

- Despite this, Bitcoin continues to be supported by its decentralization, scarcity, and growing adoption.

Technological tulip?

Nassim Nicholas Taleb does not mince his words. In his latest article, he accuses bitcoin of arising from no economic need.

For him, BTC follows a trend rather than real utility. He readily compares the phenomenon to the tulip bubble of the 17th century. Thus, he suggests that the value falls as soon as the craze fades.

For Taleb, bitcoin lacks monetary foundation. He laments the absence of state recognition as a means of payment.

According to him, the price would approach zero outside speculation. He believes that states have never embraced this asset to settle bills. Consequently, the crypto would be confined to a mere financial betting object.

Finally, he points to bitcoin’s extreme volatility. He mentions brutal swings of more than 50% within a few days.

For him, this instability rules out any hedge against a systemic crash. He rejects the idea of a SAFE haven. In fact, he nicknamed it a “fool detector” in a previous post.

However, beyond these indictments, it is worth exploring what really drives bitcoin.

Beyond the criticism: what really makes Bitcoin work

Decentralization remains the cornerstone of Bitcoin. Each node in the network validates transactions without going through a single authority. Thus, trust relies on the algorithm and not on a third party. Hence, participants rely on coded rules. This model breaks traditional monetary monopolies.

Security is based on Proof-of-Work. Miners dedicate huge energy resources to dig hashes. This competition makes forgery extremely costly. Consequently, no one can alter the chain without devoting prohibitive means. Finally, the bitcoin reward encourages maintaining the network’s honesty.

BTCUSDT chart by TradingViewProgrammed scarcity strengthens bitcoin’s attractiveness. The protocol limits issuance to 21 million tokens.

Successive halvings intensify the scarcity effect. Thus, bitcoin positions itself as a store of value against inflation. Moreover, adoption is expanding among investors and real-use cases. The world is watching.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.