European Consortium Plans 260K Bitcoin Acquisition Spree—Target Hit by 2035

Move over, gold—a mystery European player is betting billions on Bitcoin as the ultimate store of value. The group’s audacious 260,000 BTC target would make them a top-5 holder... assuming they don’t get rekt by volatility or regulators first.

Finance traditionalists scoffed—’Typical crypto bros chasing digital fool’s gold.’ Meanwhile, the Bitcoin whitepaper just got 10% harder as institutional FOMO reaches fever pitch.

In brief

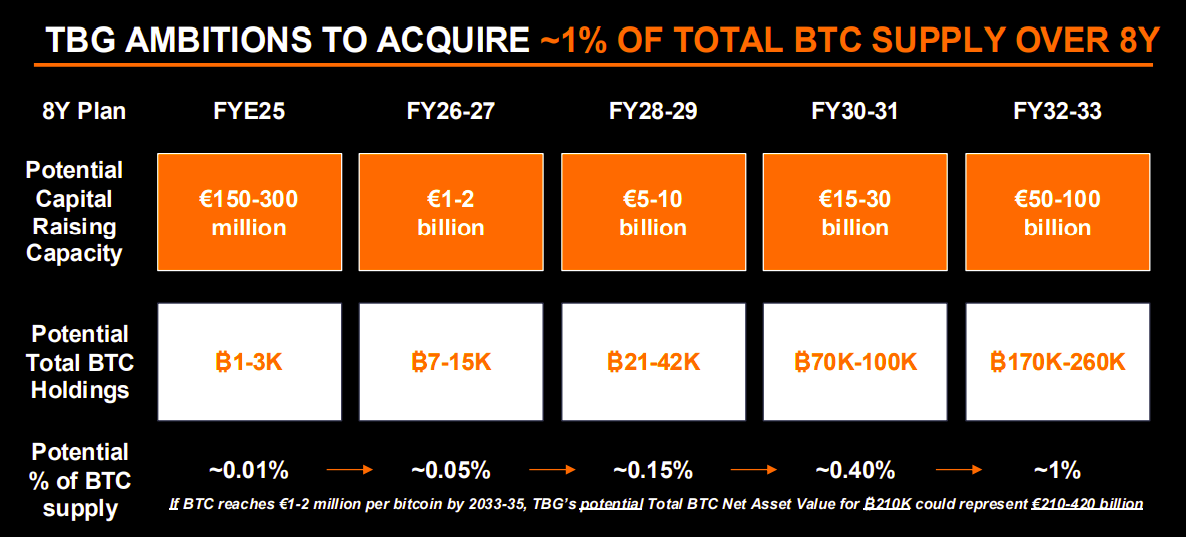

- The Blockchain Group aims to hold 1% of the total bitcoin supply by 2033.

- The company will fund this plan through equity, debt, cash flow, and strategic acquisitions.

- CEO Alexandre Laizet sees bitcoin as “the only credible strategic reserve.

A long-term strategy that makes noise

The Bitcoin news: The Blockchain Group did not settle for a flash in the pan., quantified, spread over ten years.. “If bitcoin reaches 1 to 2 million euros, 210,000 BTC would represent between 210 and 420 billion euros in net value“, specifies the TBG annual report. A bold hypothesis, but not unrealistic according to its leaders.

To finance this plan, TBG envisions: stock issues via dynamic warrants, convertible bonds into bitcoins, operational cash Flow from its trading platforms, and even.

Thisrecalls MicroStrategy, but with a European touch. The company bets on “rapid accumulation under the most creditable conditions possible“. In other words: buying without diluting too quickly, nor risking extreme leverage.

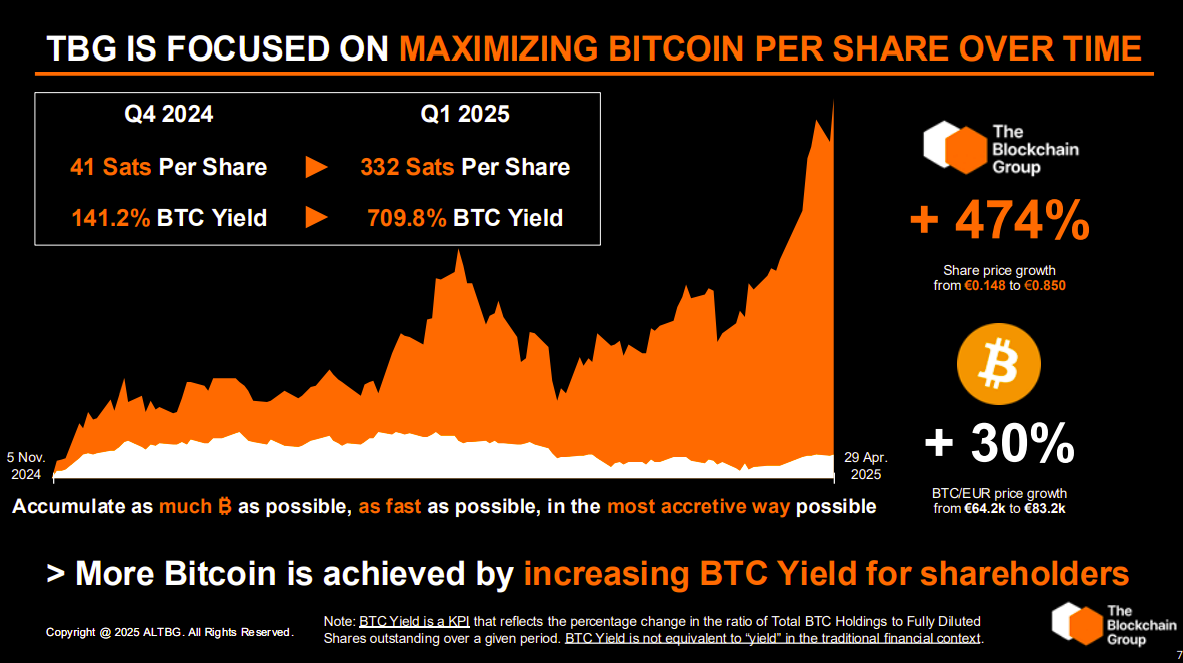

Already, TBG has seen its share price soar by. This move is supported by crypto-native investors like Fulgur Ventures, UTXO Management, and TOBAM. And by a respected name:.

Bitcoin: a geopolitical conviction assumed

Why this strategic pivot towards bitcoin? The answer lies in: scarcity, security, inflation, independence.

CEO Alexandre Laizet sums it up as follows:

There is no alternative. Bitcoin is today the only credible strategic reserve against the depreciation of fiat currencies.

In his report, he continues:

There is no plan B. There are only 21 million bitcoins, and we want to capture 1% of them.

This discourse resonates at a time when, when currencies weaken, and when distrust of the euro rises. TBG no longer wants to depend on fiat-denominated assets. It wants a global, incorruptible asset, audited by code, not banks.

Thehas already reduced the issuance to 3.125 BTC per block. By 2033, there will be little left to mine. Buying now is betting on the contraction of supply and the FOMO effect. For Laizet, it is also a way to detach from a “financial system based on unkept promises“.

BTCUSD chart by TradingViewEurope finally joins the bitcoin race

TBG’s initiative caught part of the ecosystem off guard. Until now,. Too regulated, not daring enough. Now, it is a European company claiming to become “the first corporate holder of bitcoin in Europe“.

And it works. “Bitcoin treasury companies are the fastest-growing companies in Europe“, states TBG in its report. Their internal indicator,in the first quarter of 2025. This ratio is their North Star: the higher it climbs, the more shareholders benefit.

But it is not just a financial bet. It is an industrial stance. A ten-year vision. A break with the strategic softness of many European companies.

Some analysts wondered: why Europe does not react to the wave of bitcoin reserves? Now, it has a champion. The Blockchain Group sends a strong message: Europe can also dream big, accumulate bitcoin methodically, and why not, lead the race.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.