French Savings Accounts Get Slashed—Again—As Traditional Finance Bleeds Yield

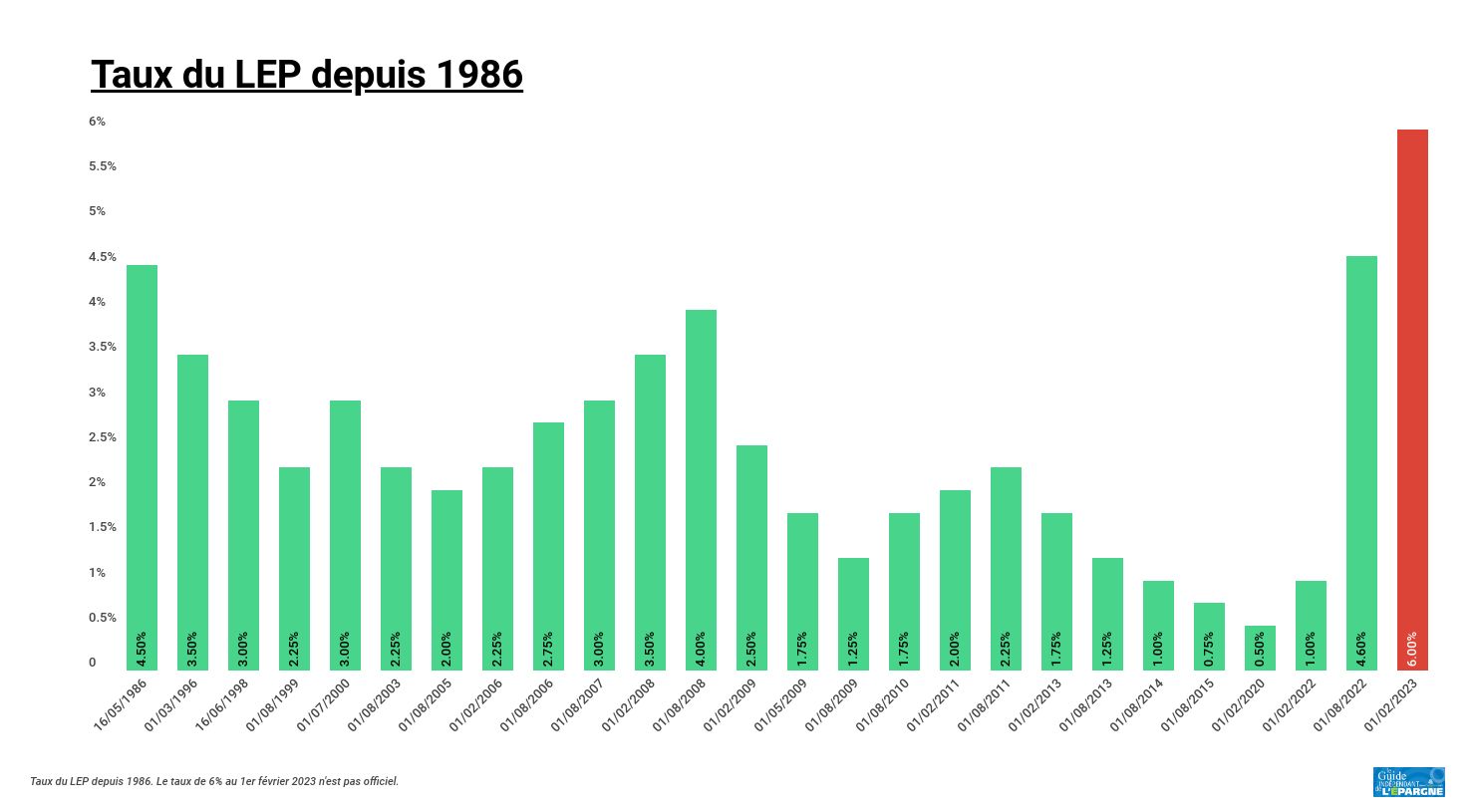

August brings another gut punch to savers: Livret A, LEP, LDDS, and CEL rates are all getting trimmed. The old-guard banking system continues its race to the bottom.

Here’s the damage: Government-backed savings vehicles—the supposed ’safe havens’—are now delivering returns that would make a crypto skeptic blush. Meanwhile, inflation eats away at whatever’s left.

Bankers shrug, regulators fiddle, and your purchasing power quietly evaporates. But hey—at least it’s ’secure,’ right?

In brief

- The Livret A will drop to 1.7% from August 2025.

- The LEP could remain stable at 3%, according to the Bank of France.

- Young people are turning to new products, such as the PEAC.

- A rumor speaks of a freeze on accounts exceeding 23,500 euros.

Livret A, the great disappointment of French savers

Just open a bank statement to feel the slap: after dropping from 3% to 2.4% in February,and affect your savings. No suspense here: the mechanics of the official formula, as cold as an Excel sheet, applies. As a result, savers are about to say goodbye tofor a fully loaded account.

And the hemorrhage is quite visible. In March,, unprecedented since 2016. Meanwhile, euro funds of life insurance and new climate savings plans are taking over. Even theis doing better, with. A signal? More like an alarm.

On X, @tony_fbr_invest sums up the situation:

The Livret A rate should drop from 2.4% to 1.7% in 08/2025. The LEP rate might stay at 3.5%. To be followed.

The LEP, last bastion for modest households?

In this slump, theappears as a shield. Reserved for modest households,. A near-heroic performance in a landscape of declining yields. Certainly, if the formula were applied mechanically,. But the governor of the Bank of France has already used his joker in February, arguing that it was necessary to “maintain a significant gap with the Livret A“.

dominate: a rate held at 3% (for a gap of 1.3 points) or a plan B at 2.5%. It will all depend on the political will to support the most vulnerable. With, the LEP remains the heartfelt (and rational) choice for those who are not rolling in money but want to grow some savings without fearing the stock market or bitcoin.

is here: budgetary coherence or protection of purchasing power? The Bank of France has until July to decide.

A sacrificed generation? Young and small savers seek an outlet

which is an alternative to Bitcoin to finance the French nuclear park: it is opened at birth, where grandma’s gifts are deposited. But for those under 21, the wind is turning., intended to finance green projects. A marketing gimmick or a real alternative? For now, the product remains confidential.

It’s the French people’s favorite investment, but it is not a good investment!

Mounir Laggoune – CEO of FinaryMeanwhile, small savers — those who do not read ECB reports but watch every euro — see their purchasing power erode., a fiscal alms.

And a persistent rumor is stirring online:. Information relayed by @Mia79663222, an activist on X, which chills more than one holder.

A drop to 1.7% for the Livret A, disillusioned youth, modest households clinging to their LEP: French savings are going through a moment of truth. While stock markets wobble, gold and bitcoin soar. And if the real refuge, ultimately, was no longer to be found in the Caisse des Dépôts accounts, but elsewhere? Is it time to turn to DeFi for better investing?

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.