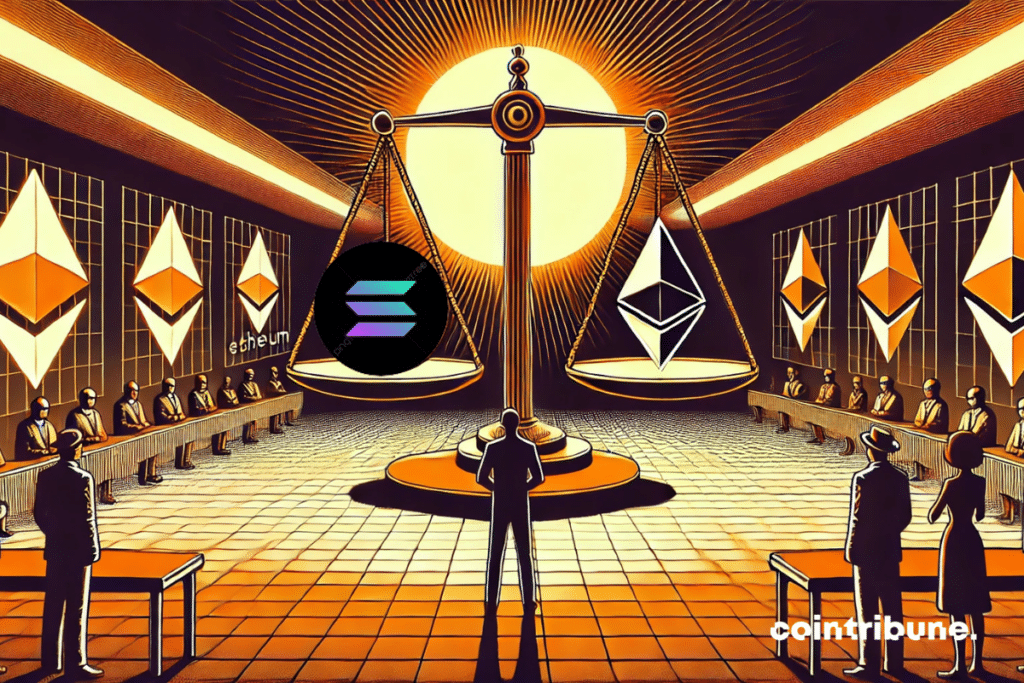

Uniswap Founder Suggests Solana Could Outperform Ethereum for DeFi Applications

In a notable industry commentary, the founder of Uniswap has indicated that Solana’s blockchain architecture may offer superior scalability and cost-efficiency for decentralized finance (DeFi) protocols compared to Ethereum. This perspective highlights the ongoing evolution of layer-1 blockchain competition, particularly as Ethereum continues facing network congestion and high gas fees during peak demand periods. The statement comes as Solana demonstrates robust technical performance with its high-throughput proof-of-history consensus mechanism, which could potentially address key pain points in DeFi adoption. Market analysts are closely monitoring how this assessment might influence developer migration and capital flows between the two leading smart contract platforms.

In Brief

- Hayden Adams, CEO of Uniswap Labs, acknowledges Solana’s strengths for Layer 1 DeFi.

- Ethereum favors a modular approach while Solana excels in monolithic architecture.

- A debate is emerging on the future of blockchain platforms and their respective specializations.

Solana, a More Favorable Ground for DeFi According to Uniswap

Hayden Adams, founder of the renowned Uniswap protocol, did not mince his words:

Solana has a better roadmap, a better team, and a better approach for L1 DeFi.

This statement comes in a context where Ethereum, once the undisputed bastion of DeFi, seems to be moving towards a modular architecture with growing reliance on layer 2 solutions.

In contrast, Solana continues to bet on a monolithic approach, meaning direct and unified execution on the base layer. For Adams, this vision is more coherent with the needs of DeFi, which demands speed, efficiency, and low transaction costs.

He considers that returning to a robust and scalable layer 1, like Solana’s, would be healthier in the long term for the ecosystem.

This position opposes that of David Hoffman (Bankless), a strong Ethereum advocate, who claims that no other blockchain can match the security and resilience of the network. According to him, Ethereum L1 remains “the natural home” of DeFi, while L2s must play a role in congestion relief.

A Technical but Strategic Debate

The difference in opinions between Adams and Hoffman reflects a deeper divide on the future of blockchain: should everything be built on a single base, or should functions be fragmented across multiple layers?

For Adams, the multiplication of L2s adds unnecessary complexity and dilutes the user experience. He thus calls for refocusing efforts on blockchains capable of natively handling DeFi volume without an additional layer.

In this view, Solana presents undeniable strengths: high throughput, low fees, and an increasingly mature development environment. Qualities that are attracting more and more DeFi projects seeking a high-performance alternative to Ethereum.

This vision contrasts with Ethereum’s modular approach, where applications are increasingly deployed on layer 2 solutions, prioritizing main layer security while seeking performance elsewhere.

ETHUSDT chart by TradingViewAdams’ position suggests a more nuanced view of the blockchain landscape, where each platform could excel in specific areas. This perspective is even more interesting as Uniswap Labs recently launched Unichain, its own layer 2 solution on Ethereum, while deploying its version 4 across twelve different blockchain networks.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.