U.S. Treasury Heightens Scrutiny as Crypto Market Activity Surges: Are We Nearing a Tipping Point?

Amid escalating trading volumes and heightened institutional interest in digital assets, the U.S. Treasury Department is reportedly increasing its monitoring of cryptocurrency markets. Regulatory bodies are evaluating whether current frameworks can accommodate rapid innovation while mitigating systemic risks. This comes as Bitcoin approaches key resistance levels and altcoins show unusual volatility, prompting concerns about retail investor protection. Market analysts suggest the Treasury may be preparing guidance on stablecoin oversight and DeFi compliance, with potential implications for exchange licensing requirements. The situation mirrors 2021’s regulatory pivot following Bitcoin’s last major bull run, though today’s market structure reflects more mature derivatives products and institutional participation.

In brief

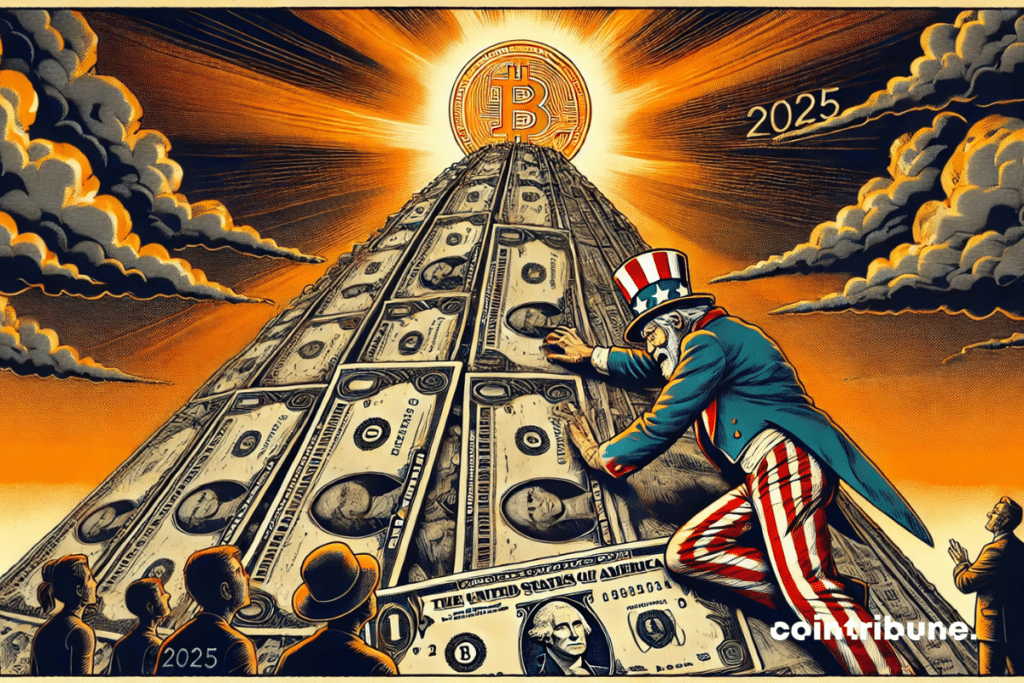

- The record issuance of Treasury bonds in 2025 could destabilize the markets

- Crypto assets could appeal amid prolonged inflation risks

A colossal debt weighing on the markets and benefiting crypto

The US Treasury plans to flood the financial market with. This represents 109% of the projected GDP for 2025 and 144% of the money supply (M2). Such an overload could push yields upward. But that’s not all! It would also harm risk assets, including cryptocurrencies.

Paradoxically, this pressure could nevertheless boost. This notably refers to BTC, often seen as a store of value independent of central banks.

If rates explode, the FED will indeed have to adjust its monetary policy. It will choose:

- either a sudden pivot;

- or a liquidity injection.

In either case, the crypto market could come out ahead.

Debt monetization: a scenario that could propel crypto

Faced with the scale of financing needs, some crypto analysts fear. The concept is simple: turn on the printing press to avoid a budget crisis. This scenario would fuel fears of prolonged inflation. Which would further weaken the dollar.

In such a context, crypto-assets appear asfor investors wishing to hedge against monetary depreciation. The bitcoin, in particular, could be seen as a protection against the loss of purchasing power of fiat currencies.

The scale of bond issuances will indeed force the FED to. In this sense, crypto could once again benefit from the macroeconomic disorder.

2025 thus promises to be a decisive year for American debt… and for crypto. Between inflation, monetary uncertainty, and huge financing needs, crypto-assets could become a rational choice to diversify one’s portfolio.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.