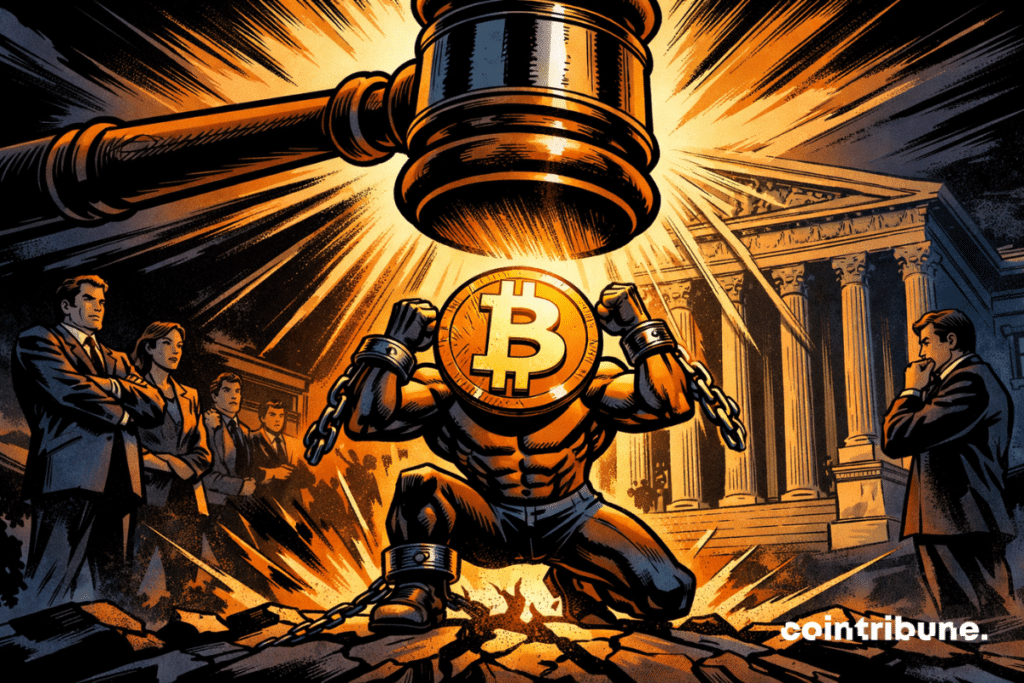

Bitcoin Under Pressure: Supreme Court Ruling Could Shake Crypto Markets

The gavel drops—and Bitcoin braces for impact. A pending Supreme Court decision threatens to rewrite the regulatory playbook for digital assets, sending tremors through trading desks worldwide.

The Legal Fault Line

Forget minor regulatory tweaks. This case cuts to the core of how cryptocurrencies are classified—commodity, security, or something entirely new. A broad ruling could hand unprecedented power to federal agencies, while a narrow one might leave a patchwork of state laws intact. Either way, the uncertainty alone is enough to freeze institutional capital mid-flow.

Market Mechanics on Edge

Watch the derivatives markets. Options traders are already pricing in volatility spikes, with put options seeing unusual demand ahead of the ruling. Liquidity providers are pulling back from wide spreads, anticipating flash moves. It’s the classic finance dance—everyone positioning for a storm they can’t yet define.

The Ripple Effect

Bitcoin’s reaction will set the tone, but the real drama unfolds in altcoins. Tokens with any whiff of centralization or security-like features face existential scrutiny. Projects built on pure decentralization narratives might catch a bid—if the court draws that line clearly. Otherwise, it’s a blanket sell-off until clarity emerges.

The Institutional Pause

Wall Street’s crypto desks have one finger on the ‘execute’ button and another on the ‘abort’ switch. ETF flows could reverse overnight. Corporate treasury allocations? On hold. The ruling either green-lights mainstream adoption or sends it back to the drawing board—with lawyers charging by the hour, naturally.

Long Game vs. Short Chaos

Short-term, prepare for knee-jerk volatility. Long-term, clarity breeds innovation. The most cynical take? The ruling will create a new cottage industry of compliance consultants and legal loopholes—because nothing makes money like uncertainty, except maybe exploiting the rules once they’re written.

The verdict isn’t just about law; it’s about legitimacy. And in crypto, perception often moves faster than price.

Read us on Google News

Read us on Google News

In brief

- Bitcoin remains immobile, trapped in a neutral zone between $88,000 and $92,000.

- Crypto traders are cautious, waiting for a clear price breakout.

- The US Supreme Court becomes a key catalyst for future volatility.

Neutral zone and hesitation: when Bitcoin goes in circles

The bitcoin price clings around $90,000, showing no clear direction in an environment where traders remain passive. This behavior reflects a collective expectation of external catalysts rather than internal technical signals. In the crypto landscape, it looks like a scene where everyone waits for someone to make the first move.

On X, @DaanCryptoTrades summarized this situation frankly:

BTC remains in range, as has been the case for about two months. I have absolutely no interest in trying to trade the next 5% MOVE on it.

This tweet highlights a lack of active engagement in the market, which is rare for an asset as important as BTC. Support and resistance levels around $88,000 and $92,000 act as strong psychological barriers. The crypto-sphere watches but does not engage massively. Even if some players hope for a bullish breakout, lack of conviction results in a prolonged sideways movement.

This scenario highlights a reality: sometimes, in a crypto market, the absence of clear information is better than a false signal. And as long as bitcoin does not release a major catalyst, this technical stalemate is likely to persist.

The US Supreme Court: the verdict that could change everything

At the heart of this hesitation, a judicial drama is unfolding. The United States Supreme Court could soon issue a decisive verdict on the tariffs imposed by Donald Trump. This topic, which seems far from the concerns of the crypto-sphere, is about to become a global volatility catalyst.

According to data shared on the social network X by The Kobeissi Letter, the likelihood that these tariffs will be judged illegal is about 74%, according to prediction markets like Polymarket. Meanwhile, @CoinBureau highlighted that this verdict could reshape trade policy and cause waves in global markets, including crypto.

When a legal decision from one country affects a global asset like Bitcoin this way, it shows how connected cryptos are to traditional economic dynamics. Investors await this verdict as a strong signal likely to provide clear macroeconomic guidance.

Meanwhile, volatility contracts. Buy and sell orders neutralize each other, and bitcoin finds itself trapped in a range with no dominant direction. Until the Supreme Court speaks, the crypto-sphere will remain in this state of psychological suspension, looking for answers in exogenous movements rather than intrinsic technical signals.

Bitcoin, hostage to politics: when macro dictates crypto

Behind its rebellious asset appearance, bitcoin remains trapped in a very earthly setting: US politics. Every statistic, every Fed statement, acts on it like a gust of wind on a flickering flame. The TRUMP tariff case is the perfect example: a judicial decision in Washington can be enough to shake the crypto planet.

Recent US figures offer no bullish drive. In December, the country created 50,000 jobs, far from the 66,000 expected. Unemployment fell back to 4.4%, while the Fed suspends rate cuts. As The Kobeissi Letter writes: “The Fed is preparing to suspend interest rate cuts”.

Result: flows to risky assets contract, depriving BTC of fresh air.

Key indicators to know now

- BTC price around $90,465, highlighting fragile stability;

- Range zone between $88,000 and $92,000 as a key barrier;

- Imminent US Supreme Court decision as an external catalyst;

- Relative decline in institutional capital flows, slowing bullish momentum;

- Rotation towards traditional assets observed among some investors

Bitcoin remains stuck because capital flows toward the asset are drying up, reducing investor appetite even when geopolitical events create noise. This liquidity shortage slows bullish momentum and keeps BTC in a lateral consolidation phase, waiting for stronger catalysts or a clearer return of confidence.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.