XRP and Solana ETFs: The 2025 Crypto Market Game-Changer You Can’t Ignore

Forget everything you thought you knew about crypto investing—the ETF landscape just got a major upgrade.

The New Contenders Enter the Ring

Wall Street's favorite crypto wrapper—the ETF—is expanding beyond its Bitcoin and Ethereum origins. Regulatory clarity, long the industry's white whale, finally arrived for assets like XRP and Solana. That opened floodgates institutional money had been waiting for.

Why This Isn't Just Another Product Launch

This shift does more than add tickers to a screen. It fundamentally rewires market structure. XRP's settlement utility and Solana's blistering throughput now sit packaged in familiar, regulated vehicles. That means pension funds, endowments, and your conservative uncle's brokerage account can gain exposure without touching a private key. Liquidity follows legitimacy.

The Ripple Effect Across Finance

Watch for correlated movements. As these ETFs soak up demand, they pull liquidity and attention from the underlying spot markets. Traditional finance's embrace often comes with a side of irony—they'll happily trade a derivative of a decentralized asset, so long as a trusted, centralized custodian holds the actual coins. The old guard profits by selling shovels, even if they never believed in the gold rush.

What Comes Next?

The dominoes are tipping. Approval for these major altcoins sets a precedent, a template other projects will scramble to follow. The race for the next crypto ETF listing is already on, fueled by lawyer armies and lobbying budgets that would make a defense contractor blush. The market's narrative is pivoting from speculative frenzy to infrastructural maturity. Love it or hate it, the game has changed.

Read us on Google News

Read us on Google News

In brief

- XRP and Solana ETFs attract more than 1 billion dollars in net inflows in 2025, while Bitcoin and Ethereum suffer 4.6 billion dollars in outflows.

- Regulatory clarity for XRP, scalability and the DeFi ecosystem for Solana, make them favored targets for institutions.

- Analysts target $2.50–$4.00 for XRP and $250–$350 for Solana in 2026, driven by institutional adoption, ETFs, and derivatives such as CME futures.

Crypto ETF: XRP and Solana, the new darlings of institutions

XRP-related ETFs have crossed the symbolic threshold of 1.12 billion dollars in assets under management, with daily net inflows since their launch in November 2025. Five major issuers, including Grayscale, Bitwise, and Franklin Templeton, dominate this market. XRP benefits from regulatory clarity after its victory against the SEC, as well as increasing utility in cross-border payments. Reduced or even zero crypto fees for the first billions attract traditional investors.

Meanwhile, solana recorded more than 420 million dollars in net inflows in November, despite a 53% price drop since January. Players like Fidelity and CME bet on its scalability and DeFi ecosystem, which shows a total value locked (TVL) of 9.19 billion dollars. These institutional flows confirm a trend: investors seek crypto assets with concrete use cases.

Historic ETF rotation: why are Bitcoin and Ethereum losing ground?

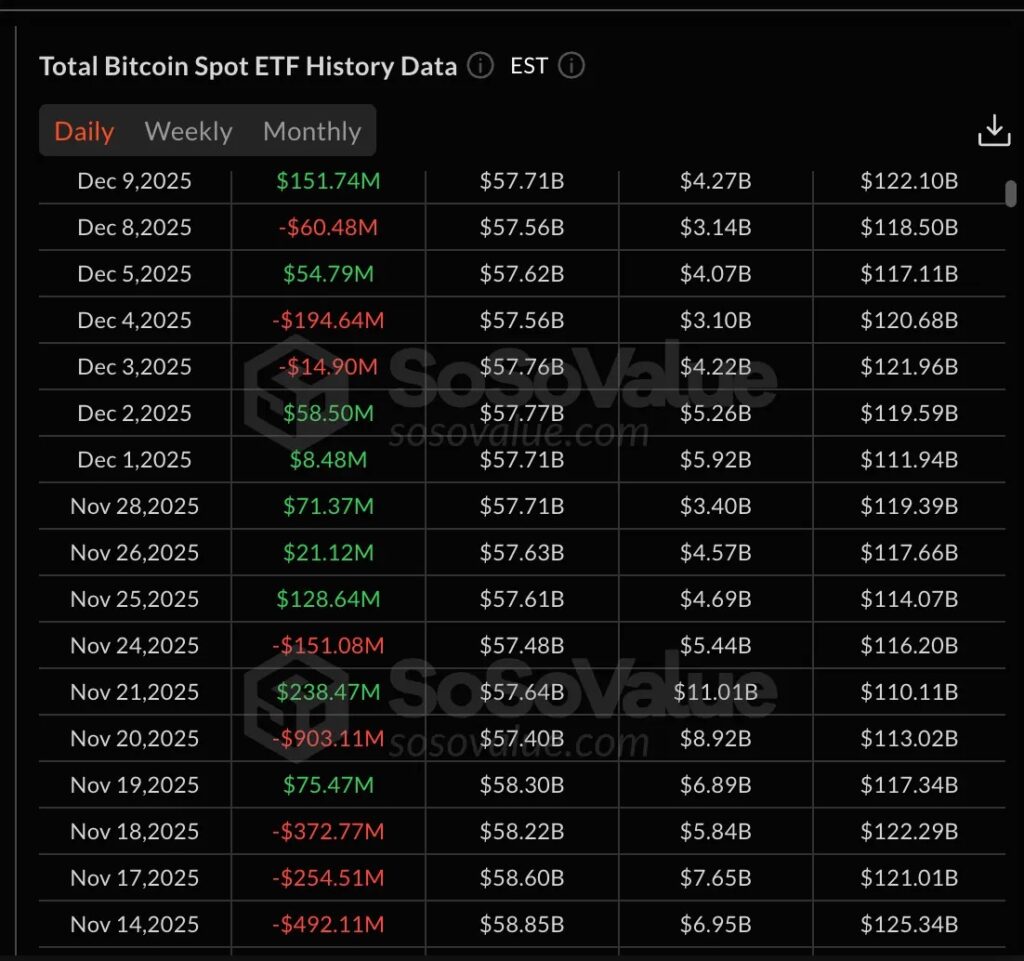

Bitcoin and Ethereum ETFs have suffered nearly 4.6 billion dollars in outflows since November 2025, while XRP and Solana have had no net outflow days. This divergence is explained by fatigue toward crypto “blue chips”, seen as too speculative or correlated with traditional markets. Institutions are turning to assets offering real utility: payments for XRP, DeFi for Solana.

Regulatory clarity around XRP, now considered a non-security asset, and Solana’s technological innovation reassure investors. ETF FLOW charts show a clear capital rotation, marking a turning point in crypto portfolio allocation. This trend could intensify if derivatives like CME futures gain popularity.

Moreover, staking products, such as those from Grayscale, could attract an additional 500 million dollars by March 2026. However, competition from Ethereum L2 solutions and regulatory risks remain major challenges. In case of crisis, a correction down to 1.50 dollars for XRP and 150 dollars for Solana is not excluded.

XRP and Solana ETFs mark a turning point in crypto adoption, where utility and regulation prevail over speculation. The first quarter of 2026 will be decisive to confirm this trend. And you, do you bet on these assets or wait for a correction before investing?

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.