Xinjiang Bitcoin Mining Crackdown Claims Fall Short of Hashrate Data

Reports of a sweeping Bitcoin mining crackdown in Xinjiang just don't add up—at least not when you check the numbers.

The Hashrate Tells a Different Story

While headlines scream about shutdowns and regulatory pressure, the global Bitcoin hashrate refuses to play along. It's holding steady, even ticking upward in some metrics. That's the network's ultimate lie detector—you can't fake computational work.

Reading Between the Regulatory Lines

Localized enforcement actions? Sure, they happen. But a coordinated, region-wide takedown capable of denting the global network? The data suggests otherwise. Miners are a resilient bunch, often relocating operations faster than regulators can draft the next memo.

The Bigger Picture for Bitcoin

This episode highlights Bitcoin's antifragility. Attempts to stifle it in one jurisdiction often strengthen it elsewhere, redistributing hashrate and further decentralizing the network. It's a feature, not a bug.

So, before you sell the rumor, maybe check if the network itself is buying it. Spoiler: it usually isn't. Another day, another regulatory headline that moves markets more than it moves the actual math—almost as if some traders prefer drama to data.

Read us on Google News

Read us on Google News

In brief

- Bitcoin hashrate fell briefly after Xinjiang reports, but data shows losses were far smaller and recovery across major pools was quick.

- Net hashrate declined by nearly 20 EH/s, well below early claims of 100 EH/s tied to a major China mining shutdown.

- North American pools, led by Foundry USA, saw the sharpest drops, pointing to U.S. power curtailments as a major factor.

- Despite China’s 2021 ban, mining activity linked to Xinjiang persists due to cheap energy and unused data center capacity.

Bitcoin Hashrate Dip Far Smaller Than Early Xinjiang Claims, Data Shows

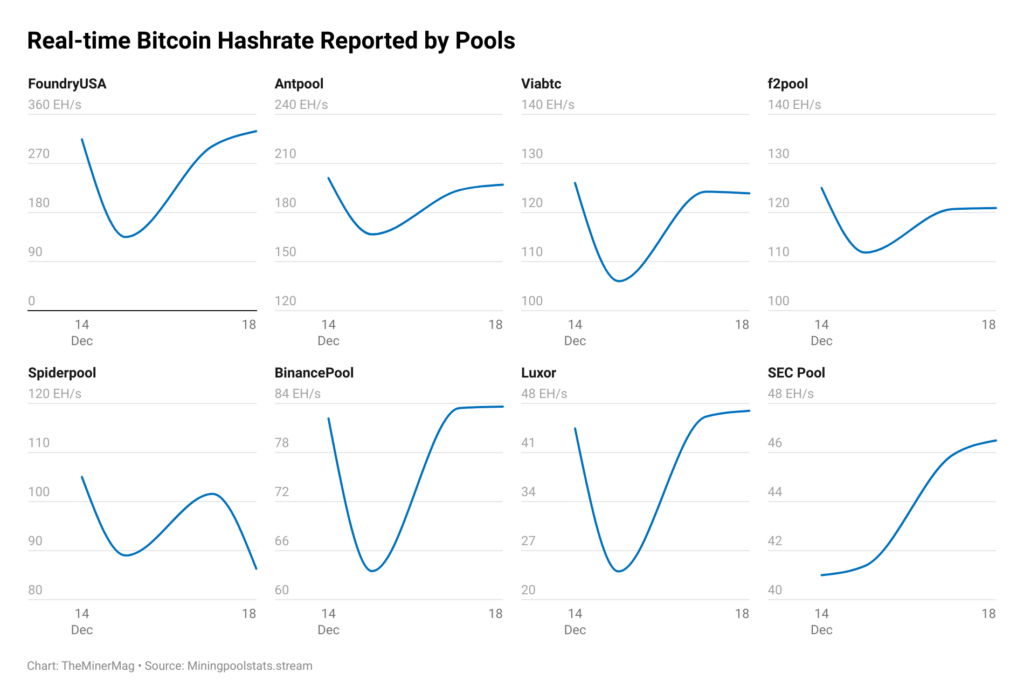

Data from TheMinerMag shows that while Bitcoin’s hashrate did dip, early claims overstated both the scale and the cause. Initial reactions centered on Xinjiang, while later evidence pointed to a mix of factors, including temporary power limits in the United States.

In its latest Miner Weekly report, TheMinerMag noted that Bitcoin’s total hashrate fell shortly after reports of shutdowns in Xinjiang surfaced. The drop fueled fears of a major regional disruption. Recovery followed quickly, with most large mining pools returning close to previous levels within days.

Rather than the widely cited 100 exahashes per second (EH/s) loss, the data points to a net decline of around 20 EH/s. This pattern indicates a short-lived interruption rather than a sustained, region-specific shutdown. And for Bitcoin, the difference matters. Prolonged declines in hashrate can slow block production and affect mining difficulty, while brief dips typically have a limited effect.

Mining Data Shows Fast Recovery After Brief Global Hashrate Dip

Pool-level data adds another LAYER of context to the Xinjiang-focused narrative. North American pools recorded the steepest losses during the same period. Foundry USA alone reported an estimated 180 EH/s drop, pointing to power curtailments outside China as a key factor.

Chinese-origin pools did register combined declines of about 100 EH/s. Even so, analysts caution against attributing all of that to Xinjiang. Activity shifted unevenly across pools, making a single-cause explanation unlikely.

Key takeaways from the hashrate data include:

- A short-term hashrate dip followed by a fast recovery.

- A net loss closer to 20 EH/s, not 100 EH/s.

- The largest pool-level declines occurred in North America.

- Chinese pools recorded mixed and uneven reductions.

- No evidence of a sustained, nationwide shutdown.

Questions about China’s role resurfaced after Jianping Kong, a former Canaan executive, said some Xinjiang operations had stopped. crypto commentator Kevin Zhang estimated that roughly 2 gigawatts of mining capacity went offline.

Early social media posts suggested that as many as 500,000 machines were affected, but later analysis pointed to narrower compliance or operational issues rather than broad enforcement.

Bitcoin mining activity linked to China has gradually returned since the 2021 nationwide ban. Data from CryptoQuant suggest China may now account for 15% to 20% of global mining activity, making it the world’s third-largest bitcoin miner.

Xinjiang remains attractive due to low-cost energy and large data center investments. Some local facilities reportedly lease unused capacity to miners to offset demand swings from other computing services. Together, these factors help explain why mining activity in the region persists despite periodic disruptions and renewed scrutiny.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.