Trump’s Historic Fed Shift: Is Bitcoin Primed for Takeoff?

Trump just dropped a bomb on monetary policy. The proposed Fed overhaul isn't just a tweak—it's a potential regime change for the dollar itself.

The New Blueprint

Details are still emerging, but the core idea is seismic: shifting the Federal Reserve's focus away from its dual mandate. The move targets the very foundations of modern central banking. It redefines the rules of the game for inflation, employment, and ultimately, the value of fiat currency.

Bitcoin's Moment

This isn't happening in a vacuum. The crypto market has been coiled like a spring, waiting for a catalyst. A fundamental shift in U.S. monetary authority could be the trigger. Bitcoin, designed as a hedge against centralized financial failure, suddenly has its thesis tested in real-time. The network doesn't need permission to process transactions—it just needs a reason for people to use it.

Wall Street's Ironic Dilemma

Traditional finance is scrambling. The same institutions that spent years dismissing crypto now face a potential devaluation of their core asset: trust in the existing system. It's a beautiful, cynical twist—the ultimate 'hedge' might be the thing they mocked. Meanwhile, Bitcoin's ledger keeps ticking, utterly indifferent to the political theater.

The countdown starts now. Will Bitcoin's decentralized architecture become the new safe haven, or is this just another chapter in the volatile saga of modern money? The market is about to cast its vote.

Read us on Google News

Read us on Google News

In brief

- President Trump announces a new Fed leader favorable to a significant cut in interest rates.

- Despite current volatility, crypto markets remain stable, speculating on the impact of a more accommodative Fed, historic for boosting bitcoin demand.

- A looser monetary policy and a more favorable regulatory environment could propel bitcoin, often correlated with rate cuts.

Trump promises a new very accommodative Fed chair

Donald Trump recently stated that the next Fed chair will significantly reduce interest rates. This statement comes as Trump holds multiple interviews to appoint Jerome Powell’s successor, whose term ends in May 2026. Among the candidates, Christopher Waller, Fed governor and cryptocurrency supporter, and Kevin Hassett, director of the National Economic Council, stand out.

In a speech, TRUMP emphasized that the new chair will be someone who believes in “much lower” rates. A promise aimed at restarting the economy and easing financial market tensions before the 2026 midterm elections. This appointment is crucial, as it could redefine U.S. monetary policy for the years to come.

Trump’s remarks immediately sparked reactions. The markets await official confirmation, but speculation is rife. One thing is certain: this appointment could mark a turning point for the economy and cryptocurrencies.

Volatility and uncertainty: where to position while awaiting Trump’s official announcement?

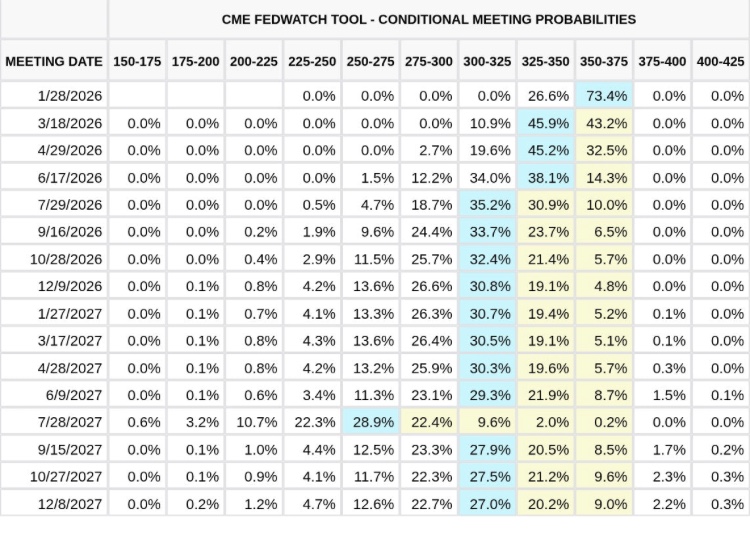

Bitcoin and cryptos remain stable, but volatility persists. Investors are waiting for the official appointment of the new Fed chair, creating an atmosphere of uncertainty. CME Group’s FedWatch Tool indicates a 73.4% probability that the Fed will not cut rates next month, but speculation on an accommodative shift after the appointment fuels debates.

Crypto traders and analysts adopt a cautious approach. Some see this period as a buying opportunity, while others prefer to wait to avoid risks. Macro indicators remain mixed, and a late announcement or unexpected appointment could trigger sharp market movements.

In this context, investors must remain vigilant. Current volatility reflects anticipation and expectation, but also fears of a market on hold. Where to position yourself? The answer will largely depend on Trump’s final appointment and the new Fed leadership’s first actions.

Bitcoin, the big winner of a more flexible Fed?

If the new Fed chair significantly cuts rates according to Trump, bitcoin could be the big beneficiary. Historically, BTC performs well during monetary easing cycles, often seen as a hedge against inflation and a store of value. Experts like Tom Lee from BitMine believe a change in Fed leadership could support a broader crypto market recovery in 2026.

Moreover, a Fed more open to cryptocurrencies would favor institutional adoption of BTC, strengthening its position in financial markets. However, risks persist. But if the low-rate promises materialize, bitcoin could well enter a new growth phase. Investors must still be cautious, as markets remain sensitive to announcements and monetary policy changes.

Trump’s announcement about the Fed’s future direction could mark a turning point for bitcoin. Between promises of low rates and uncertainties, markets are eagerly waiting. If speculations come true, BTC could be the big winner. But in such a volatile environment, one question remains: how should investors prepare for this new era?

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.