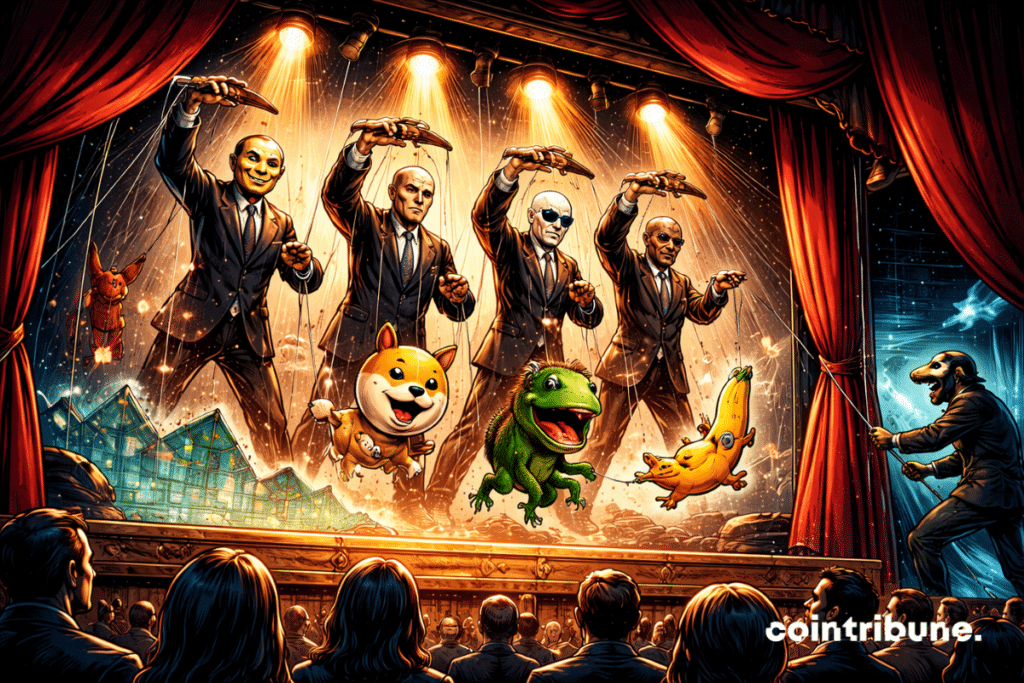

CoinGecko Exposes The Spectacular Crash Of Meme Tokens - What’s Next For Speculative Crypto?

Meme token mania hits a brutal reality check. The charts don't lie—what soared on hype and viral tweets is now in freefall, leaving a trail of vaporized portfolios.

The Anatomy of a Bubble Burst

Forget fundamentals; this was a pure sentiment play. Prices detached from any utility, rocketing on social media frenzy before gravity—and common sense—reasserted itself. The dramatic plunge showcases the extreme volatility lurking in the crypto market's more speculative corners.

A Lesson in Market Cycles

Every bull run breeds its own irrational exuberance. This cycle's meme craze followed the classic script: parabolic rise, influencer hype, and the inevitable, painful correction. It's a stark reminder that what goes up on memes often comes down twice as hard.

Survival of the Fittest (or Most Serious)

While joke coins tumble, the downturn separates the toys from the tools. Capital is rotating—away from pure speculation and toward projects with actual roadmaps, developers, and use cases. The market's self-cleansing mechanism is harsh but effective.

The smart money watches from the sidelines, placing bets on infrastructure and real-world adoption, not the next shiba-something. After all, in finance, if you don't know who the greater fool is in the trade, you're probably it.

Read us on Google News

Read us on Google News

In brief

- In 2024, memecoins become political speculation tools, driven by electoral euphoria and social networks.

- The market reached a historic peak of 150.6 billion dollars, boosted by tokens linked to Donald Trump or Javier Milei.

- Early 2025, the market collapsed sharply, with a drop of over 73 % in a few months.

- CoinGecko alerts on extreme volatility of political memecoins, which have become vectors of narrative manipulation.

When the ballot boxes raise tokens : the rise of political memecoins

The memecoin market experienced a spectacular surge according to the report published by CoinGecko in early December, reaching a record capitalization of 150.6 billion dollars in December 2024.

This unprecedented performance was largely supported by the electoral dynamics in the United States, where political tokens played a central role in speculative euphoria. The report highlights that “the enthusiasm triggered by the re-election of President Donald TRUMP coincided with the sector’s peak”, marking a turning point in how these assets are perceived and used.

Several factors fueled this surge :

- The emergence of political narratives in the crypto world, with the creation of tokens inspired by public figures like Donald Trump or Javier Milei, who quickly dominated social media discussions ;

- The proliferation of launchpads, particularly on the Solana blockchain, which enabled the rapid and massive deployment of new memecoins with political aims ;

- Exceptional virality, fueled by social algorithms and community campaigns, which allowed these tokens to capture the attention of the general public and speculators ;

- A favorable market environment, in which political storytelling turned into a growth lever, making memecoins high-potential speculative instruments.

CoinGecko notes that this configuration gave rise to a new generation of tokens, shaped no longer only by humor or web culture, but by powerful political narratives capable of driving the market into a growth dynamic that is as rapid as it is fragile. This trend, although temporarily profitable, carried the seeds of an abrupt reversal.

From euphoria to disenchantment : a programmed collapse

The euphoria of political memecoins did not withstand the test of time. From the beginning of this year, the market experienced a sharp reversal.

CoinGecko identifies a pivotal moment: the launch of the TRUMP token, a token officially linked to the figure of the American president. Initially propelled to a peak of 73 dollars, the token then collapsed to around 5 dollars.

This sharp drop created a climate of distrust among investors. Another emblematic case is the LIBRA token, associated with Argentine president Javier Milei. Barely launched, it was hit by a major scandal when creators withdrew more than 107 million dollars in liquidity. An operation deemed suspicious enough to trigger several investigations.

Last November, the total capitalization of memecoins fell to 38 billion dollars, a decrease of more than 73% compared to the peak of the previous December. This plunge was accompanied by a general decline in the most speculative sectors of crypto, including NFTs, whose sales dropped to 320 million dollars, their lowest level of the year.

CoinGecko observes that memecoins have now become instruments of very high volatility, “reflecting cultural and political sentiments”, but also extremely sensitive to changes in perception.

The brutal correction reminds us of a reality now hard to ignore : memecoins are no longer enough to support the solana ecosystem. Fueled by speculation, the blockchain must now prove its ability to attract solid and sustainable projects, beyond viral trends which alone guarantee neither resilience nor legitimacy in the long term.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.