Bitcoin Flexes Dominance as Altcoins Bleed Out: The Great Rotation of 2025

Bitcoin isn't just holding the line—it's advancing while the rest of the crypto army retreats. A stark divergence is playing out across digital asset markets, reshaping portfolios and trader psychology as the year winds down.

The King Stands Tall

While speculative fever often lifts all boats, true stress tests reveal the hierarchy. Capital isn't just fleeing risk; it's executing a strategic pivot toward the original crypto reserve asset. This isn't mere safe-haven flow—it's a vote of confidence in Bitcoin's foundational narrative amid regulatory fog and economic crosswinds.

Altcoin Avalanche

The 'altseason' narrative has hit a wall. Projects lacking clear utility or robust ecosystems are getting crushed, separating technological pioneers from mere meme-fueled gambles. The downturn exposes the fragile liquidity and over-leveraged positions that built up during the previous hype cycle—a classic case of markets doing what they do best: separating conviction from convenience.

The New Calculus

Forget the old playbook. The dynamic reinforces a brutal truth in crypto investing: during periods of contraction, beta gets slaughtered while true alpha—and Bitcoin's increasingly institutional profile—provides ballast. It's a reminder that in finance, as in life, when the tide goes out, you see who's been swimming naked on leverage and promises. The rotation underscores a maturation, painful for some, that prioritizes network security and adoption metrics over Twitter threads and influencer endorsements.

One cynical take? The altcoin crash is just Wall Street's favorite game—dressing up volatility as 'sector rotation'—played out with digital assets. The outcome remains the same: the house always wins, and right now, the house is painted orange.

Read us on Google News

Read us on Google News

In brief

- Bitcoin continues to outperform most altcoins as capital rotates toward BTC in a risk-averse market.

- Altcoins such as Ethereum, AI tokens, and memecoins have suffered significantly deeper losses.

- Persistent capital concentration around Bitcoin could keep altcoins under pressure going forward.

Bitcoin Gains Strength as Capital Rotates Away From Altcoins

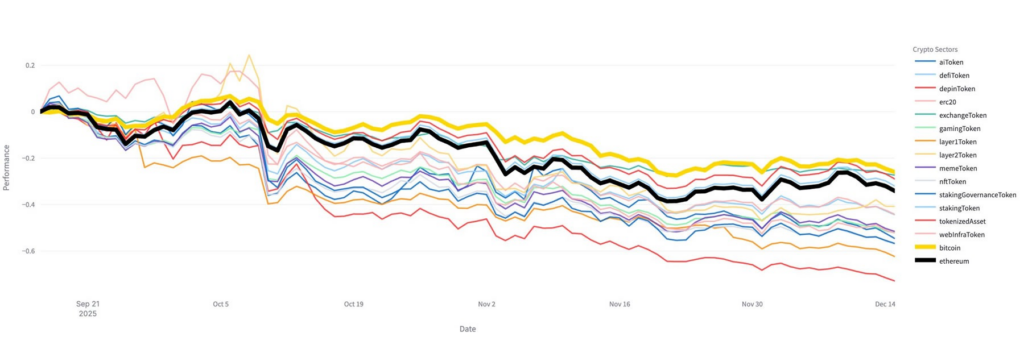

According to Glassnode, Bitcoin has outperformed most altcoins over the past three months. The data shows that average returns across nearly all altcoin segments lagged behind Bitcoin, pointing to a market environment shaped by caution and risk aversion.

This trend suggests that investors are increasingly concentrating capital in bitcoin rather than spreading exposure across higher-risk assets. In uncertain conditions, BTC remains the primary destination for liquidity.

While some analysts have argued that Bitcoin’s dominance weakened in the second half of the year, the broader market has failed to establish a new leader. Attempts at recovery following the deleverage event have lost momentum, leaving the market without a clear anchor.

Altcoins underperform Bitcoin across key sectors

Price data supports Glassnode’s assessment. Bitcoin declined by roughly 26% over the past three months and currently trades near $86,000. This performance is slightly better than the broader crypto market, which saw total market capitalization fall by about 27.5% over the same period.

Ethereum recorded steeper losses. Since mid-September, ETH has dropped around 36% and is now trading below the $3,000 level. Other altcoin categories experienced even heavier drawdowns.

AI-related tokens declined by approximately 48%. The memecoin market suffered one of the sharpest drops, with total market capitalization falling by around 56%. Real-world asset tokens were down about 46%, while DeFi tokens lost roughly 38%.

Bitcoin remains the preferred safe haven in crypto

Nick Ruck, Director at LVRG Research, agreed with Glassnode’s findings. He said recent data shows that capital inflows continue to favor bitcoin, reflecting investor preference for BTC’s relative stability. Ruck added that Bitcoin’s dominant position leaves many altcoins struggling to stay relevant.

He also pointed to BTC’s established reputation and growing institutional interest as key drivers behind its continued appeal. In volatile conditions, BTC is increasingly viewed as a safer haven within the crypto market.

Bitcoin continues to stand out as market confidence fades

Despite the recent pullback, Bitcoin remains more resilient than most altcoins. The data shows a clear rotation of capital toward BTC as investors reduce exposure to higher-risk assets. Until broader market confidence improves, Bitcoin is likely to maintain its leading role.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.