Bitcoin Shatters Correlation With US Stock Market - The Great Decoupling Is Here

Bitcoin just cut the cord.

For years, the digital asset danced to the tune of Wall Street's mood swings. When the S&P 500 sneezed, Bitcoin caught a cold. It was the narrative that wouldn't die: crypto as a mere risk-on satellite to traditional finance. No more.

The Correlation Crumples

The 90-day rolling correlation between Bitcoin and major US equity indices has plunged toward zero—and in some metrics, into negative territory. This isn't a blip. It's a structural break. The asset that was once dismissed as a speculative toy for stock traders is now writing its own rules.

What's Driving the Divorce?

Forget the old playbook. Institutional adoption is creating its own demand cycles, independent of Fed whispers or quarterly earnings reports. The proliferation of spot ETFs has opened a direct pipeline for capital that views Bitcoin not as a tech stock proxy, but as a distinct monetary asset—digital gold with a verifiable supply cap. Meanwhile, the traditional market grapples with the usual circus of inflation theatrics and political theater, which Bitcoin increasingly shrugs off.

A New Chapter for Portfolio Strategy

This decoupling is a portfolio manager's dream—or nightmare, if you missed it. True diversification is back on the menu. An asset that moves independently can hedge systemic risk, not amplify it. It forces a fundamental rethink: is Bitcoin a risk asset, or is it becoming the risk-off asset for a digital age? The charts are starting to shout the answer.

The great decoupling is underway. Bitcoin isn't just breaking correlation; it's bypassing an entire era of financial dogma. Wall Street can keep playing its short-term games—Bitcoin is building a separate reality. Sometimes, the best trade is to stop trading the same old story.

Read us on Google News

Read us on Google News

In brief

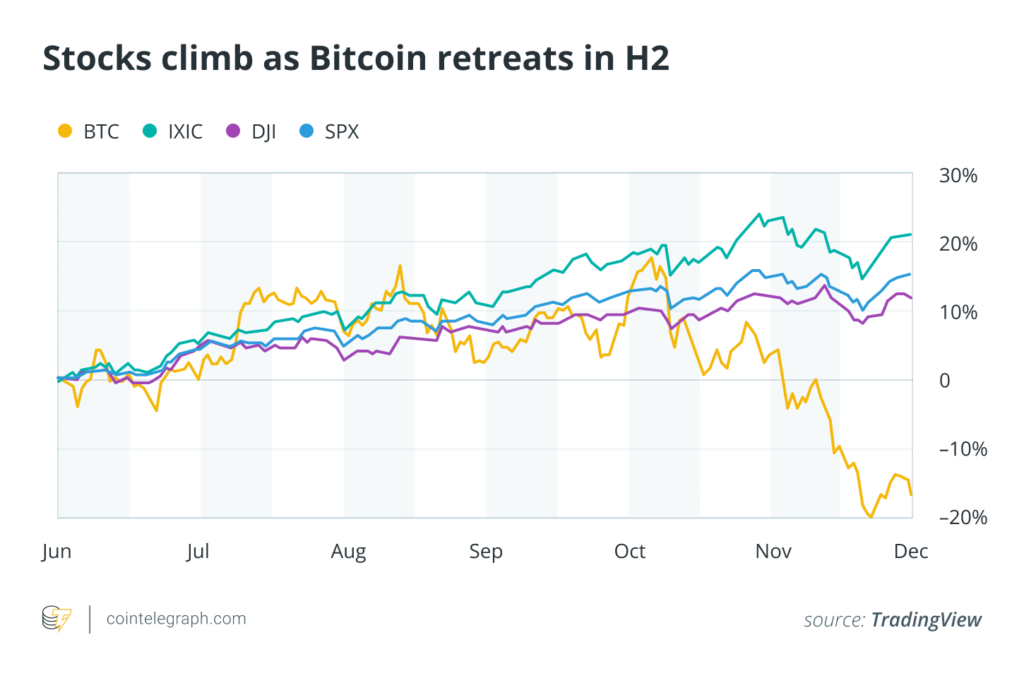

- Bitcoin increasingly decoupled from US stocks in the second half of 2025 as equity markets continued to rise.

- Major US stock indexes posted strong gains, while Bitcoin entered a correction after its October peak.

- Interest rate cuts, political uncertainty and large liquidation events widened the gap between crypto and stocks.

- The divergence highlights Bitcoin’s growing tendency to move independently from traditional markets.

Bitcoin and US Stocks Move in Different Directions

During the second half of 2025, bitcoin and US equities followed very different paths. While stock markets benefited from falling interest rates and strong corporate earnings, Bitcoin struggled to maintain momentum after its October peak.

Over the past six months, Bitcoin dropped nearly 18%. At the same time, the Nasdaq Composite gained 21%, the S&P 500 ROSE 14.35%, and the Dow Jones Industrial Average climbed 12.11%. This growing gap highlights a clear decoupling between Bitcoin and traditional risk assets, according to Cointelegraph.

Bitcoin Gains Support From GENIUS Act in July 2025

July was a strong month for both stocks and crypto. Despite new tariff announcements, investor sentiment remained positive. Markets quickly shifted their focus back to earnings and economic growth. On July 9, Nvidia became the first company to reach a $4 trillion valuation. US stock indexes hit new record highs on the same day. Bitcoin also performed well, closing the month up 8.13%.

Crypto sentiment improved further after President Donald Trump signed the GENIUS Act into law. The legislation provided regulatory clarity, especially for stablecoins. Corporate Bitcoin adoption continued, with more companies adding BTC to their balance sheets. Interest in ethereum and Solana also increased during this period.

Rate Cut Expectations Drive Volatility Across Crypto in August

In August, markets focused on expectations of interest rate cuts by the Federal Reserve. A weaker US dollar and rising trade tensions helped push Bitcoin to a new all-time high of around $124,000 on August 14.

Later in the month, attention shifted to the Jackson Hole symposium. Fed Chair Jerome Powell signaled that rate cuts were still possible. This helped push Ether to a new all-time high.

Bitcoin, however, failed to hold its gains. After a short rally, the price moved lower again. By the end of August, Bitcoin closed down 6.49%. Stocks, meanwhile, remained strong.

Bitcoin Beats “Red September” Again

September is usually a weak month for Bitcoin. In 2025, the trend broke once more. Bitcoin posted its third consecutive positive September, ending the month up 5.16%.

The MOVE followed the Fed’s first rate cut of the year. The central bank lowered rates by 25 basis points, citing signs of a cooling labor market. Stocks continued their rally as investors priced in further easing.

Bitcoin faced internal pressure at the same time. A major debate emerged over a proposed network upgrade that WOULD allow more data on the blockchain. The disagreement split the community and added uncertainty to the market.

Market Liquidations and Trade Tensions Hit Bitcoin in October

Bitcoin reached another all-time high on October 6. The month quickly turned negative. A massive liquidation event wiped out roughly $19 billion in Leveraged positions.

Several factors played a role. These included a price glitch on Binance and heavy use of futures trading. The main trigger was a social media post by President Trump, who threatened 100% tariffs on Chinese imports.

Both stocks and crypto sold off initially. Stocks recovered soon after. Bitcoin did not. The asset ended October down 3.69%, breaking a five-year streak of positive Octobers. A second Fed rate cut later in the month failed to reverse the trend.

Bitcoin’s Worst Month of 2025

November is historically Bitcoin’s strongest month. In 2025, it became the worst. Bitcoin fell 17.67% and dropped below $100,000 by mid-month.

The divergence from equities was clear. Stock markets traded sideways as the US government shutdown ended. Concerns about an AI-driven bubble remained, but strong earnings from Nvidia helped stabilize stocks. Bitcoin continued to weaken despite calmer conditions in traditional markets.

Bitcoin and US Stocks Show Clear Divergence in 2025

Bitcoin is slightly up so far in December. Major stock indexes are also posting modest gains. Historically, December has been a solid month for Bitcoin. However, Optimism is much lower this year. Several analysts have reduced their price targets. Standard Chartered cut its Bitcoin year-end forecast from $200,000 to $100,000. The bank also delayed its long-term $500,000 target from 2028 to 2030.

Overall, the widening gap between Bitcoin and US stocks highlights a clear divergence in market behavior throughout 2025. Even with growinginstitutional involvement, Bitcoin has increasingly moved on its own and reacted differently than stocks to monetary policy shifts, political uncertainty and broader macroeconomic developments.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.