Vitalik Buterin Unveils Game-Changing Solution to Ethereum’s Fee Volatility Crisis

Ethereum's co-founder just dropped a bombshell proposal aimed at taming the network's notoriously unpredictable transaction costs. This isn't just another tweak—it's a fundamental rethink of how fees work on the world's leading smart contract platform.

The Core Problem: Fee Rollercoaster

Users and developers know the pain all too well. One minute, a simple swap costs a few cents; the next, it's a $50 highway robbery thanks to a trending NFT mint or a DeFi frenzy. This volatility isn't just annoying—it stifles innovation, pushes out everyday users, and makes budgeting for projects a nightmare. It's the kind of uncertainty that makes traditional finance guys snicker into their double lattes.

Buterin's Blueprint: Stability Through Design

The proposed solution cuts through the complexity. While exact mechanics are under wraps, the core idea bypasses the current auction-style chaos. Think predictable, manageable costs, not wild speculation on block space. It targets the root cause, not the symptoms.

Why This Matters for Ethereum's Future

Scaling solutions like rollups address throughput, but fee predictability is a separate, critical battle. For Ethereum to become the global settlement layer it aspires to be, it needs reliability. Businesses won't build on quicksand. This move isn't about lowering fees to zero—it's about making them stable and comprehensible, turning a gamble into a calculated cost.

The Verdict: A Necessary Evolution

Buterin's latest brainchild tackles one of Ethereum's most persistent user experience failures head-on. Implementing this won't be easy and will face rigorous community debate. But it signals a mature shift from pure scalability obsession to holistic network quality. The goal? An Ethereum where the cost of doing business doesn't require a crystal ball—or a hedge fund's risk tolerance.

Read us on Google News

Read us on Google News

En bref

Ethereum explores a solution to fix the Gas price in advance

Last Saturday, Vitalik Buterin launched on X a technical and strategic proposal. The Ethereum co-founder advocates the development of a “trustless on-chain gas futures market.”

Concretely, this system WOULD allow users to buy gas today for future consumption at a fixed price, directly on the blockchain.

This initiative addresses a recurring concern in the ecosystem. Despite progress in Ethereum’s roadmap to reduce long-term costs, short-term volatility remains problematic. Buterin states that actors need certainty to build and operate with peace of mind.

The principle is inspired by traditional futures markets. On these markets, producers and consumers set today the price of future transactions to protect themselves from fluctuations.

In Ethereum’s case, a DeFi project could buy gas forward to hedge against a fee surge during a massive user influx. This mechanism would provide a clear signal on market expectations and direct financial coverage.

Buterin emphasizes that such a market would allow users to “receive a clear signal of expectations regarding future gas rates” and even “hedge against future price fluctuations by effectively prepaying a specific amount of gas within a precise time frame.”

ETHUSDT chart by TradingViewA vital predictability for institutional adoption

This proposal comes at a pivotal moment. Ethereum seeks to consolidate its role as a global financial infrastructure, especially amid growing institutional adoption.

An institutional trader, an app with millions of users, or a fund tokenizing real assets cannot afford to see their costs suddenly multiplied.

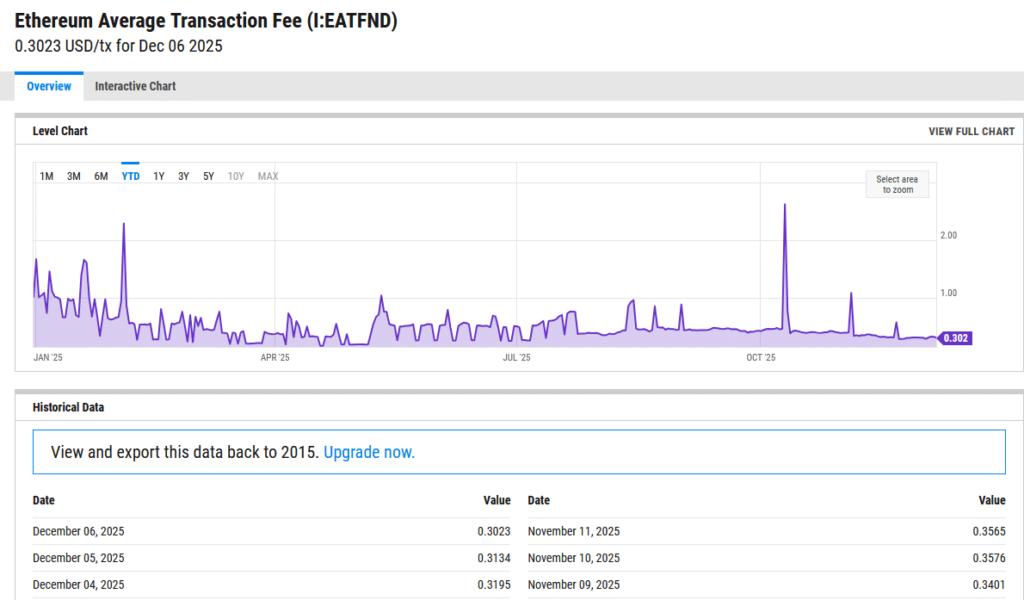

Current data illustrates this need. The average gas price for a simple transaction is very low, about $0.01 according to Etherscan. But this apparent stability hides a more complex reality.

Sophisticated transactions cost between $0.05 and $0.27. More importantly, Ycharts data reveals that average fees in 2025 have experienced abrupt oscillations, ranging from $1 at the beginning of the year to $0.30 currently, with a peak at $2.60 and a low at $0.18.

This instability hampers economic planning. A reliable futures market would transform this random variable into a manageable parameter. Application builders, traders, and institutions could finally plan their operations with financial stability.

This is especially crucial for high-volume actors who need to precisely forecast their operating costs.

Establishing such a market would constitute a key indicator allowing the ecosystem to “speculate, plan or grow,” as Buterin explains.

Companies and institutions considering Ethereum as a strategic infrastructure could do so with medium-term visibility. This is more than a technical optimization: it is a necessary condition for scaling up.

In short, Buterin’s vision goes beyond simple cost management. He lays the groundwork for a mature Ethereum where native financial instrument sophistication meets the requirements of the traditional economic world. The battle for mass adoption will also be won on the battlefield of predictability.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.