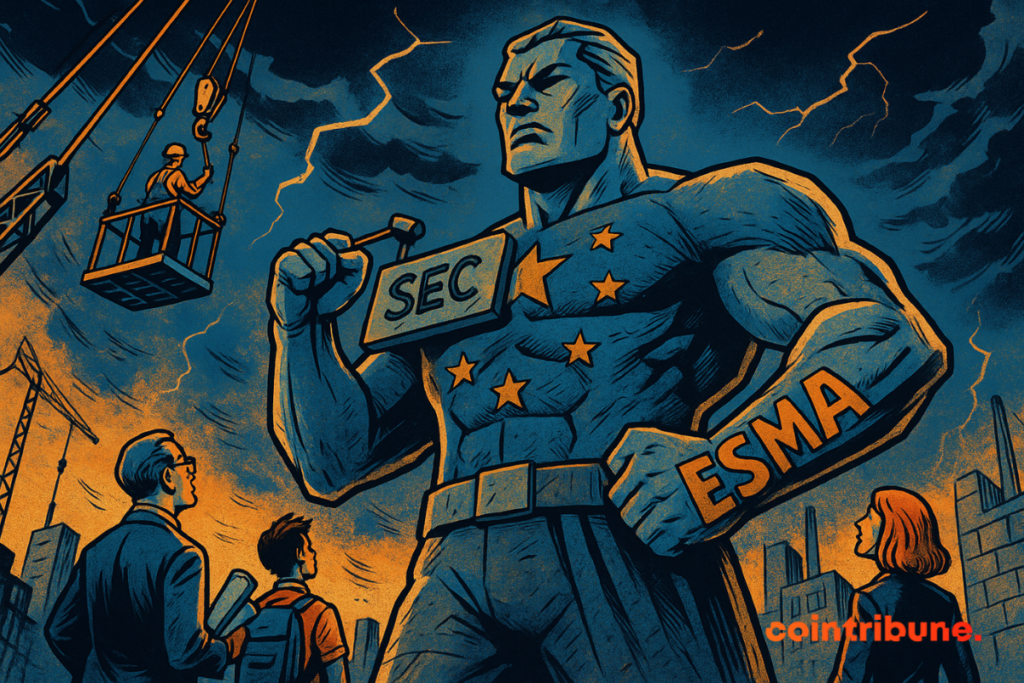

Europe’s Crypto Power Play: How the EU Is Building Its Own SEC—And Why It Matters

Forget waiting for global consensus. Europe is carving its own path in crypto regulation—and the world is watching.

While the U.S. Securities and Exchange Commission (SEC) grapples with enforcement-by-lawsuit, the European Union is constructing a comprehensive regulatory framework from the ground up. The goal? To become the world's de facto standard-setter for digital assets.

The Blueprint: MiCA and Beyond

The Markets in Crypto-Assets (MiCA) regulation isn't just a rulebook—it's a strategic gambit. By establishing clear licensing for issuers and service providers, the EU aims to lure blockchain businesses with the promise of a 'passport' to operate across 27 member states. It's regulatory clarity as a competitive advantage.

Enforcement with Teeth

Unlike the SEC's reactive approach, Europe's system empowers national authorities like Germany's BaFin and France's AMF with proactive supervisory tools. Think real-time transaction monitoring, capital requirements for stablecoin issuers, and consumer protection rules that actually protect consumers—not just the lawyers writing them.

The message to crypto firms is clear: play by our rules, and you get access to a market of 450 million people. Break them, and face penalties that could reach 5% of global turnover. Suddenly, those compliance costs don't look so optional.

The Global Ripple Effect

This isn't just about Europe. When a market this large sets standards, others follow—or risk getting left behind. We're already seeing Asian and Latin American regulators studying MiCA's architecture. The EU isn't just building its own SEC; it's attempting to write the rulebook for everyone else.

Will it work? Early signs suggest yes. Major exchanges are already restructuring to comply, treating MiCA approval as a badge of legitimacy. Because in finance, nothing says 'serious' like a 400-page regulatory framework—except maybe the threat of being locked out of a half-trillion-dollar economy.

The final irony? Europe's 'bureaucratic' approach might just deliver what Wall Street's 'innovative' financiers have failed to create: a stable, scalable crypto ecosystem where mainstream money actually feels safe. Sometimes the revolution comes with paperwork.

Read us on Google News

Read us on Google News

In brief

- Europe wants to centralize crypto regulation under the aegis of an ESMA with extended powers.

- Tech startups fear authorization delays slowing innovation and growth of small players.

- The reform aims to harmonize European finance to compete with the more integrated American markets.

- Some member states contest, fearing an inefficient, heavily bureaucratic centralized model.

A “European SEC” to Strengthen EU Finance

On December 4, 2025, the European Commission presented an ambitious reform: unifying the supervision of financial markets and cryptos within a single European gateway, embodied by the ESMA. The goal: to strengthen the EU’s competitiveness against the United States and their $62 trillion stock exchange. For comparison, the EU’s caps at $11 trillion.

Maria Luís Albuquerque, Commissioner for Finance, summarizes Brussels’s vision as follows:

For too long, Europe has tolerated a level of fragmentation that hampers our economy. Today, we are deliberately choosing to change course. By building a true single financial market, we will offer citizens better opportunities to grow their savings, while unlocking stronger funding for Europe’s priorities. Market integration is not a technical exercise — it is a political imperative for Europe’s prosperity and global relevance.

With this new model, ESMA will be able to directly supervise crypto platforms, digital asset managers, and major financial infrastructures. The current European passport system, which allowed a startup to establish in one country to operate across the EU, could disappear. A major break for the balance between regulation and innovation.

Crypto Startups: The Specter of a Regulatory Slowdown

For crypto startups, it is a cold shower. Many fear a boomerang effect. While MiCA is just beginning to roll out, a new administrative LAYER could slow down procedures and chill crypto investors. Faustine Fleuret, from Morpho, warns:

I am even more concerned that the proposal assigns ESMA both authorization and supervision of CASPs, and not just supervision.

Similar sentiment from Elisenda Fabrega, from Brickken:

Without adequate resources, this mandate could become unmanageable, leading to delays or overly cautious assessments that could disproportionately impact small businesses or innovative companies.

Some believe reopening discussions on MiCA, even before its full implementation, WOULD add unnecessary legal uncertainty. Regulators claim to want harmonization, not complexity. But the line between the two seems very thin.

Behind the Promise of Integration, Very Real Divisions

While major European powers — France, Germany, Italy — support the idea of centralized supervision, other countries like Luxembourg or Malta are hesitant. Minister Gilles Roth said his country favors supervisor convergence rather than a centralized model considered costly and ineffective.

Among institutions, some also fear loss of sovereignty. Even within supportive states, tensions arise about modalities: should ESMA be given sanction power? Who will finance its increased means? At what pace will these changes apply?

Exchanges on X also show concerns. Several users highlight the risk of turning the EU into an “audit machine,” disconnected from the field. Others, on the contrary, applaud the desire to put an end to 27 divergent national regulations.

5 key facts about the EU crypto reform:

- The US stock market is worth $62 trillion, compared to $11 trillion for the EU;

- ESMA would become the sole supervisor for crypto actors;

- The current European passport model would be abolished;

- Crypto startups fear bureaucratic suffocation;

- Progressive implementation starting in 2026, with no precise date.

As long as the ECB presents the digital euro as the engine of a “stronger” European economy, cryptos will have no respite. Regulation will advance at the pace of this monetary ambition. Behind the promise of a more integrated system, an entire industry will have to learn to survive in a Europe that wants to both encourage digital finance… and control it.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.