Bitcoin ETF Exodus: Why Are Institutional Investors Pulling Out in Droves?

Institutional floodgates open—then slam shut. The Bitcoin ETF experiment faces its first major stress test as heavyweight investors execute a coordinated retreat. Forget the retail frenzy; this is the smart money voting with its feet.

The Great Unwind

Portfolios are being rebalanced, not in a trickle but a torrent. The narrative flipped overnight from 'adoption milestone' to 'liquidity event.' These aren't panic sells—they're calculated exits by players who treat markets like chessboards. They got the regulatory green light, took their seats at the table, and are now quietly pushing back from it.

Follow the Fees

The real story isn't in the price charts; it's in the expense ratios. When you're moving billions, basis points become mountains. Some funds are discovering that wrapping Bitcoin in a traditional wrapper adds layers of cost that chew through hypothetical gains—a classic case of financial innovation creating more fees than value.

Regulatory Hangover

Compliance departments are waking up with headaches. The operational reality of holding Bitcoin—even the paper version—is colliding with legacy risk frameworks. Every withdrawal tells a story of internal committees deciding the regulatory scrutiny outweighs the allocation.

What Comes Next

This isn't the end of institutional crypto—it's the end of the easy phase. The next wave won't be about access vehicles, but actual utility. The exits reveal a simple truth: creating a tradable ticket doesn't create a reason to hold it. The market just conducted a billion-dollar survey, and the results should worry anyone banking on passive inflows.

Sometimes the most bullish signal in finance is watching the 'smart money' be spectacularly wrong at the exact wrong time. Other times, it's just smart.

Read us on Google News

Read us on Google News

In Brief

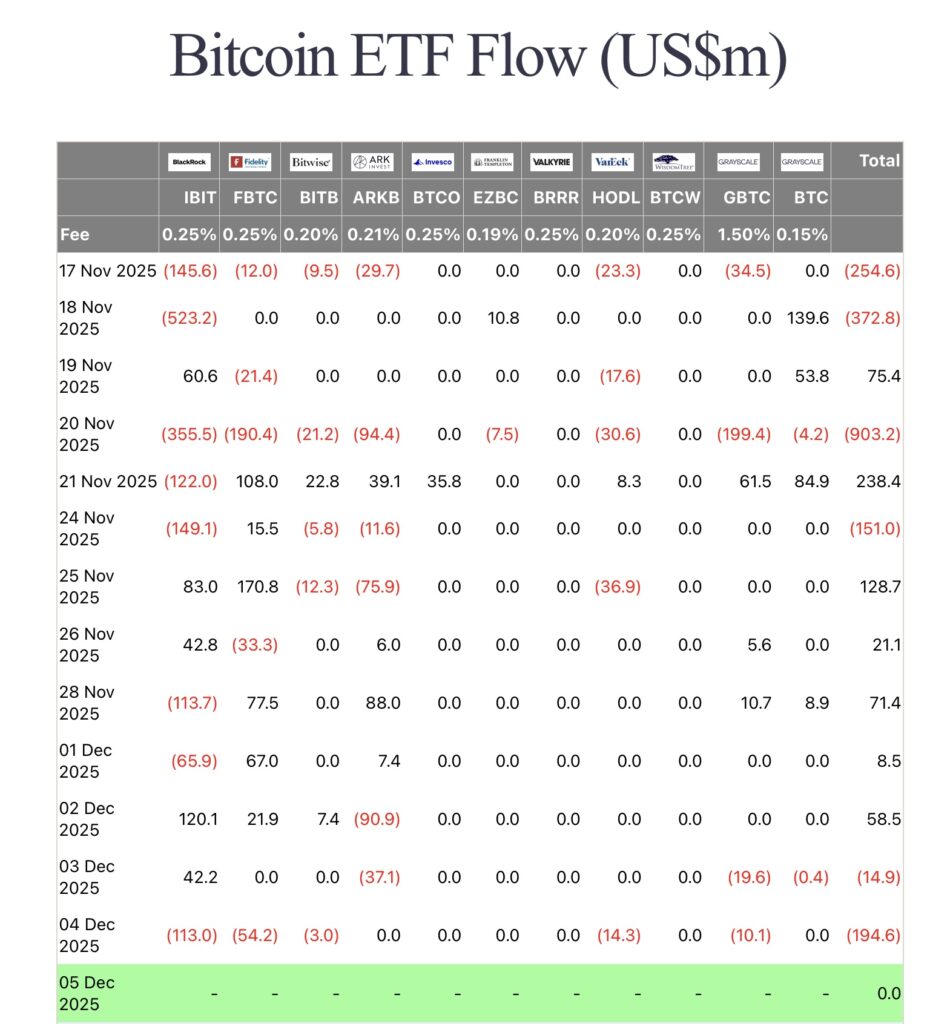

- Bitcoin ETFs recorded $194 million in withdrawals on December 4, 2025, an unprecedented level in two weeks.

- Massive outflows from Bitcoin ETFs are due to institutional investors closing ’basis trades.’

- Relative stability of Bitcoin, but macroeconomic risks remain for the end of 2025.

Bitcoin ETF: Massive $194 Million Outflow — What Is Happening?

On December 4, 2025, bitcoin ETFs recorded net outflows of $194.6 million, according to Farside Investors. BlackRock’s IBIT fund alone accounted for $113 million in outflows, followed by Fidelity’s FBTC with $54.2 million. These figures contrast with five consecutive days of inflows before this hemorrhage.

The causes are multiple. First, institutional investors closed ’basis trades’, a strategy that consists of buying Bitcoin ETFs while selling futures contracts to lock in low-risk profits. Second, macroeconomic fears, notably anticipation of a rate hike by the Bank of Japan on December 19, weigh on the markets. These combined factors explain this massive outflow, the highest in two weeks.

Why Are Institutional Investors Abandoning BTC?

Some analysts believe these massive $194 million outflows of Bitcoin ETFs reflect a repositioning out of Leveraged positions, often used by institutional investors. In addition to risks linked to the ’yen carry trade’, a practice where investors borrow yen to invest in higher-yielding assets like BTC. A rise in Japanese rates could make this strategy less attractive.

Others believe the current selling pressure comes from institutions closing their ’basis trades’! This, along with progressive market consolidation in 2026, after this retracement phase. Arthur Hayes already pointed to these strategies as responsible for the massive Bitcoin ETF outflows in recent months.

Bitcoin: A Black December in Sight?

Despite the record outflows, the BTC price remained relatively stable, with a limited drop of 1.7% over 24 hours and 0.5% over seven days. However, the monthly trend remains negative, with a 10.5% drop in November. Does this apparent stability mask a deeper vulnerability?

The outlook for December is mixed. On one hand, macroeconomic risks, such as rate hikes in Japan, could increase pressure on Bitcoin. On the other hand, the closing of ’basis trades’ could mark the end of a selling cycle, opening the way for stabilization. For investors, caution is key: monitoring ETF flows and central bank announcements will be crucial to anticipate market movements.

The massive outflows from Bitcoin ETFs raise questions about market resilience. While analysts agree on institutional disengagement, the outlook for December remains uncertain. One thing is clear: investors will need to stay alert to macroeconomic signals and capital flows. Should this be seen as a buying opportunity or a sign to exercise increased caution?

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.