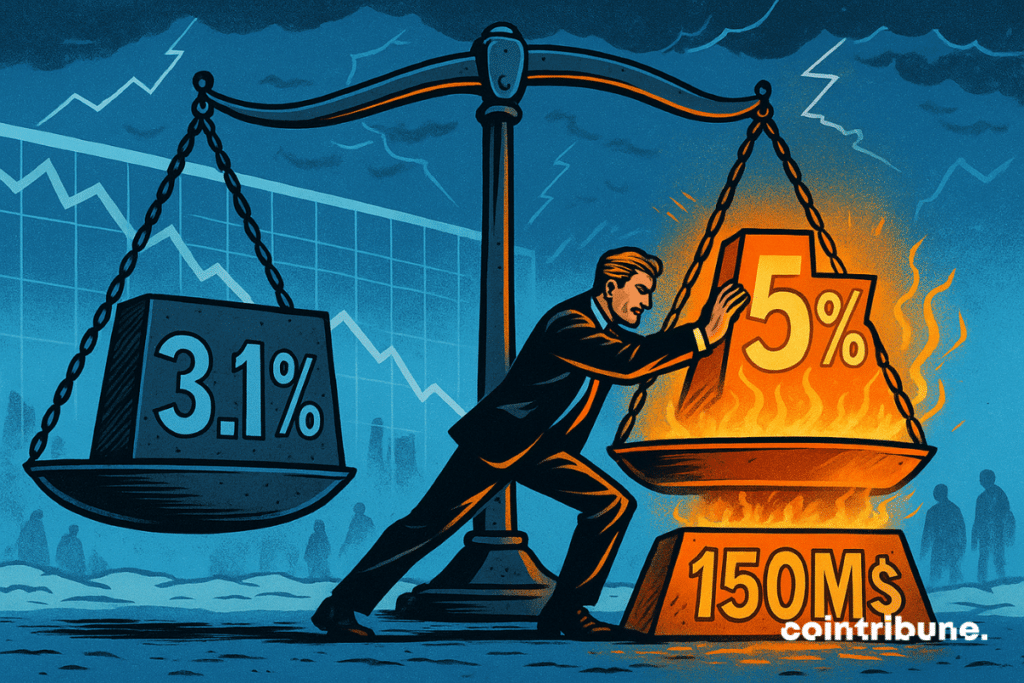

BitMine Bets Big: $150M Ethereum Investment Targets 5% Network Control

One crypto miner just made a move that could reshape the entire Ethereum landscape.

BitMine, a major player in the digital asset space, is pouring a staggering $150 million into Ether. This isn't just another portfolio addition—it's a strategic power grab with a clear, audacious goal: to control a full 5% of all Ethereum in circulation.

The Scale of the Ambition

Let's put that number in perspective. Controlling 5% of a major blockchain's native asset is unprecedented for a single corporate entity. It's a bet that goes beyond mere speculation; it's a play for significant influence over network governance, staking rewards, and the future development trajectory of the entire ecosystem.

Why This Matters Now

The timing is provocative. While traditional finance hedges and waits for regulatory clarity, crypto-native firms are moving to consolidate power. This massive capital deployment signals a belief that Ethereum's infrastructure is not just an investment but a critical piece of digital real estate worth dominating.

It's a stark contrast to the cautious, spreadsheet-driven moves of legacy funds—a reminder that in crypto, aggressive accumulation often beats timid analysis.

A New Era of Corporate Holders

This move blurs the line between miner, investor, and network stakeholder. It raises immediate questions about centralization, market liquidity, and the shifting balance of power away from retail holders toward institutional behemoths.

Will other mining giants follow suit, turning hash power into direct economic influence? The race for blockchain sovereignty might just have found its new battleground.

One thing's clear: when a miner decides to hoard the very asset its machines help secure, it's not just a trade—it's a declaration. And for the rest of the market, it's a wake-up call that the biggest players aren't just mining blocks anymore; they're building empires. After all, what's a little market manipulation among financiers?

Read us on Google News

Read us on Google News

In brief

- BitMine bought $150 million worth of ether via Kraken and BitGo this week.

- The company now holds more than 3% of the total Ethereum supply available on the market.

- The plan relies on the Fusaka update and a favorable macro environment.

- BMNR stock jumps 15%, driven by the rise of ether and massive purchases.

Ethereum: the hunt for 5% is on

BitMine hits hard after a $70M purchase. In just one week, 96,798 ETH have come to swell the company’s coffers. A massive purchase made via Kraken and BitGo, according to Arkham’s data. In total, BitMine now holds over 3% of the total ether supply. The goal is clear: reach 5%.

But where many see a simple bet, Tom Lee talks about infrastructure. “We have increased our weekly ETH purchases by 39%“, he specifies. For him, ethereum is where Bitcoin was in 2017: surrounded by doubts… but ready to explode.

While other crypto treasuries are scaling back — an 81% drop in purchases since August — BitMine stands apart. And it’s not just a PR move. With Chi Tsang leading the company and three new independent directors, governance is strengthening for a long-term ambition.

The winning trio: Fusaka, Fed, FOMO

The decision by BitMine is not just ideological. It fits a well-crafted timing. First, there is the Fusaka update, recently deployed. This crucial technical change for Ethereum improves its ability to process more transactions with more security.

Next, there is the changing wind at the Federal Reserve. Several top officials — Waller, Daly, Williams — hint at an imminent rate cut, planned for December 10. This kind of macro context always boosts risky assets, including Ethereum.

The crypto market has found its bearings… We are now more than seven weeks from the liquidation shock of October 10.

Tom LeeA statement that justifies BitMine’s renewed appetite: its weekly ETH purchases have jumped 39%.

Cherry on the cake: Ethereum-related ETFs absorbed $140 million in one day, according to DeFiLlama, while Bitcoin’s ETFs saw $15 million fly away. The game of musical chairs begins.

BMNR, this Ethereum stock proxy that intrigues Wall Street

On the stock market side, the impact was immediate. BMNR, BitMine’s stock, soared 15% in December. Why? Because it acts as a lever for Ethereum. The correlation between BMNR and ETH ROSE to 0.50. When Ethereum goes up, BMNR follows, even amplifies.

Technical signals reinforce this idea. The CMF (Chaikin Money Flow), an indicator of big players’ flows, is rising despite stagnant prices. The OBV (On-Balance Volume) is also climbing. Everything suggests discreet accumulation by large investors.

An inverted head-and-shoulders pattern is forming, with a bullish potential towards $52.70, i.e., +55% from the current $33.59. But beware: in case of failure, $24.31 remains the breaking level.

Key figures not to forget

- $3,203: the price of Ethereum at editorial time;

- 5%: BitMine’s target share of total ETH supply;

- $140 million: inflows into Ethereum ETFs in one day;

- +15%: BMNR stock growth in December;

- 81%: drop in ETH purchases by other treasuries since August.

Among some analysts, skepticism remains. For them, despite the energy deployed by BitMine, companies’ interest in Ethereum seems to be eroding. In fact, ETH is free-falling in institutional portfolios, and nothing guarantees that a single player, however aggressive, will manage to change the game.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.