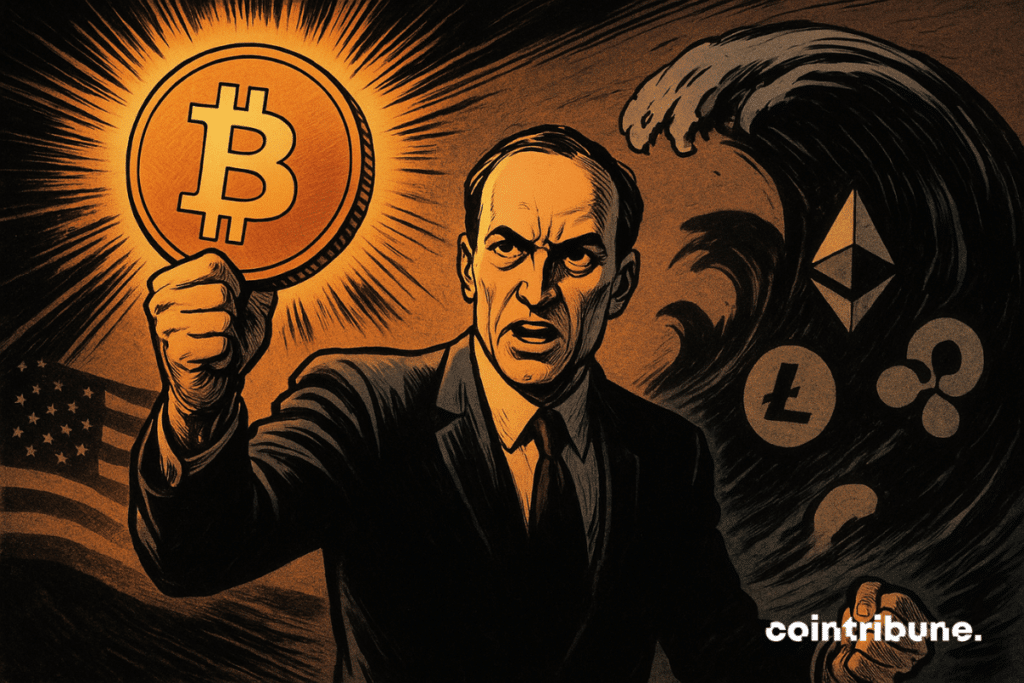

Gensler Draws the Line: Bitcoin Stands Alone While Crypto Tokens Face Regulatory Heat

SEC Chair Gary Gensler just threw a regulatory grenade into the crypto arena—and Bitcoin walked away unscathed.

The Great Divide

In a move that clarifies the murky regulatory landscape, Gensner reasserted Bitcoin's unique, non-security status. The message was clear: the original cryptocurrency operates in a different league. Meanwhile, the spotlight turns—harshly—onto the thousands of other digital tokens now squarely in the SEC's crosshairs.

Scrutiny Season is Open

For everything else? The party's over. The SEC's stance signals an aggressive new phase of examination for altcoins, DeFi tokens, and stablecoins. The agency's framework suggests most are unregistered securities, setting the stage for a wave of enforcement actions that could reshape the entire sector. It's the kind of scrutiny that makes traditional finance's compliance departments look like a weekend hobby—though with about the same level of genuine public benefit.

A Bullish Signal in Disguise?

Paradoxically, this regulatory crackdown could cement Bitcoin's dominance. By drawing a bright line, the SEC effectively anoints Bitcoin as the established, compliant digital asset. It separates the proven protocol from the speculative projects, potentially driving institutional capital toward the one asset with regulatory clarity. The ultimate result? Bitcoin isn't just surviving the regulatory winter—it's being handed the keys to the kingdom.

Read us on Google News

Read us on Google News

In brief

- Gensler says Bitcoin stands apart and most tokens rely on speculation without solid backing or clear economic support.

- Stablecoins tied to the US dollar viewed as the only assets with consistent backing, raising doubts about other tokens.

- Enforcement under Gensler included major actions targeting exchanges accused of running unregistered operations.

- He rejects partisan framing, saying crypto oversight centers on fair markets and equal access for everyday investors.

Ex-SEC Leader Highlights Ongoing Risks in Non-Bitcoin Tokens

Gensler explained that bitcoin functions more like a commodity, while most other tokens still lack solid fundamentals or clear returns. He added that global excitement around crypto has often moved faster than careful analysis. And as such, this leaves many buyers exposed when markets turn volatile.

The former SEC chief urged investors to consider what underpins the value of non-Bitcoin tokens. According to him, only a narrow group of stablecoins tied to the US dollar can claim clear backing.

All the thousands of other tokens, not the stablecoins that are backed by US dollars, but all the thousands of other tokens, you have to ask yourself, what are the fundamentals? What’s underlying it… The investing public just needs to be aware of those risks.

Gary GenslerEverything else, Gensler said, raises questions about economic structure, disclosures, and durability.

The ex-SEC chair’s concerns primarily center around the following issues:

- Most tokens lack cash flows or rights linked to real economic activity.

- Market prices often depend heavily on speculation.

- Issuers rarely provide information comparable to public companies.

- Many trading platforms operate outside long-standing rules.

- Retail investors carry most of the downside when markets swing.

Gensler’s views are shaped by his time leading the SEC from 2021 to early 2025, a period marked by an assertive approach to crypto oversight. Cases against major trading platforms became hallmarks of his tenure. Coinbase faced allegations of operating as an unregistered exchange, broker, and clearing agency.

Kraken paid a $30 million penalty and shut its US staking service. Although industry groups argued that the actions created confusion, Gensler maintained they reflected basic expectations applied across capital markets.

Gensler Highlights Investor Protection as Crypto ETFs Gain Ground

Questions about political angles surfaced during the interview, including references to crypto interest within the TRUMP family. Gensler dismissed the notion that digital assets fall along partisan lines. He said the debate centers on fairness, adding that everyday investors expect the same protections as major institutions when buying stocks, bonds, or any asset offered to the public.

Attention later turned to exchange-traded funds. Gensler said financial systems tend to move toward central points of access over time. In his view, that shift makes the growing role of ETFs in digital assets unsurprising. During his leadership, US markets saw the approval of Bitcoin futures ETFs, bringing parts of crypto trading closer to traditional finance.

His remarks ended with a familiar message placing Bitcoin in its own category, supported by its structure and long trading history. He added that most other tokens still function as speculative instruments with uncertain footing. Even after leaving office, Gensler’s comments continue to draw attention across the crypto industry as market participants gauge how regulators view the crypto market.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.