AI Now Weaponized: Large-Scale Smart Contract Exploits Unleashed

Blockchain's 'unhackable' myth shatters as artificial intelligence goes on the offensive.

Subheading: Code-Cracking at Scale

Machine learning models are bypassing audit protections faster than Solidity devs can say 'rug pull.'

Subheading: The New Attack Surface

DeFi protocols face existential threats as AI probes for vulnerabilities across thousands of contracts simultaneously—no human hacker could match this scale.

Closing thought: Maybe those '10,000% APY' farms should've spent less on marketing and more on security... but what do we know? We just report the fires.

Read us on Google News

Read us on Google News

In brief

- AIs have generated $4.6 million in exploits on recent smart contracts.

- They now identify new vulnerabilities in contracts previously thought to have no known weaknesses.

- The average contract analysis cost has fallen to just $1.22.

- These AIs progress so fast they double their efficiency approximately every 1.3 months.

AI: the new invisible hackers targeting blockchains

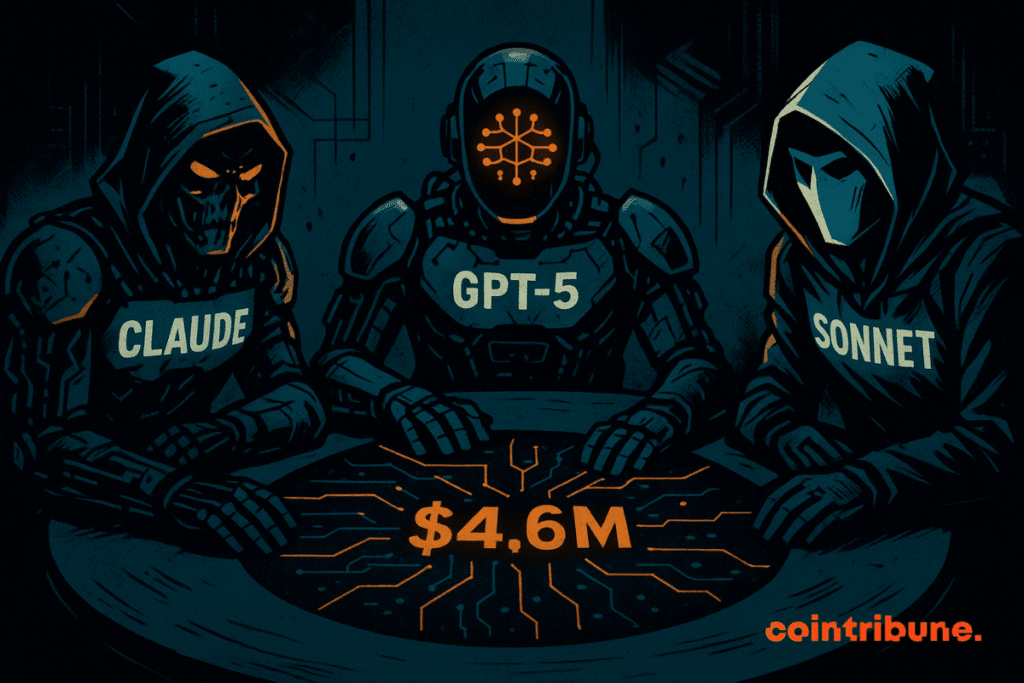

Artificial intelligences never sleep, never get tired, and never forget. According to a study by Anthropic and MATS, models like Claude Opus 4.5, Claude Sonnet 4.5, and GPT-5 have succeeded in identifying vulnerabilities in recent smart contracts without any human help. The result? Scripts capable of exploiting contracts for a simulated total of $4.6 million.

These AIs have not only analyzed old known codes. They also scanned 2,849 recent contracts reputed to be secure. Yet, they discovered two “zero-day” vulnerabilities never seen before. This confirms that AIs can now produce unprecedented attacks without prior training data. At a low cost: $1.22 on average to analyze a contract.

Here is a striking quote taken directly from the Anthropic report:

More than half of the blockchain hacks carried out in 2025 — supposedly by experienced human attackers — could have been executed autonomously by current AI agents. The discovery, by our demonstration agent, of two new zero-day vulnerabilities shows that these test results are not only about retrospective analysis: autonomous and profitable exploitation is already possible today.

Security experts know: it’s no longer a question of if AIs will hack contracts. They already have, and they learn quickly. The crypto industry may well enter an era where each contract is tested by AIs even before the developer can hit “deploy”.

The crypto market under threat of an automated war

We knew about trading bots, but now come the hacking bots. And their efficiency is thought-provoking. Testing ten AI models on 405 contracts already hacked between 2020 and 2025, Anthropic simulated $550.1 million worth of stolen funds. That’s colossal. This figure is not pulled out of thin air: it reflects the real ability of AIs to understand, exploit, and maximize vulnerabilities, well beyond simple “bug bounty”.

For example, GPT-5 generated an exploit yielding $1.12 million, but Claude Opus 4.5 extracted $3.5 million for the same bug by multiplying attack vectors. That’s the difference between a good hacker and a master algorithmic thief.

In another revealing quote, Anthropic writes:

Over the past year, revenues from simulated hacked funds have approximately doubled every 1.3 months. The shaded area represents a 90% confidence interval, calculated by bootstrap over all model-revenue pairs.

It’s no longer just a matter of Bitcoin, Ethereum, or BNB. All DeFi ecosystems are exposed: ERC-20 contracts, swap platforms, DAOs… Even projects on the Base blockchain have been integrated into the SCONE-Bench test base. The higher the locked value in a protocol, the more it attracts these new digital predators.

Artificial intelligence: increasingly profitable exploits, ever lower costs

The striking thing about this evolution is the speed. AIs are progressing, and their efficiency follows an exponential curve, not a linear one. Smart contract developers, no matter how skilled, can no longer keep up alone.

Example: a simple function forgotten without the view modifier allowed an AI to generate fake money, then exchange it for real assets. Another vulnerability allowed redirecting trading fees on a token creation contract. Result? AIs discover bugs even WHITE hats did not anticipate.

And tomorrow? With even more powerful models, scanning thousands of contracts will become trivial, cheap, and brutally accurate. At this pace, the crypto industry could find itself cornered: between code transparency and the opacity of algorithmic intentions, the game is rigged.

What to remember:

- In 2025, AIs identified 19 vulnerabilities post their training date;

- Claude Opus 4.5 generated a $3.5M exploit, compared to $1.12M for GPT-5;

- The average cost to scan a contract dropped to $1.22;

- Exploitation capacities doubled every 1.3 months last year;

- $550.1M of simulated stolen funds on 405 existing contracts (2020-2025).

Knowing that AIs not only hack but also deeply transform markets and jobs, the mix becomes explosive. Barely three years after the appearance of ChatGPT, companies are changing their face and landmarks are collapsing. If nothing is anticipated, we could experience a double economic and digital shockwave in record time.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.