Bitcoin Whale Exodus Sparks Market Panic: Is This The Ultimate Buying Opportunity?

Whale wallets are dumping Bitcoin at alarming rates—sending shockwaves through crypto markets and triggering widespread fear.

The Great Unloading

Massive Bitcoin deposits hitting exchanges signal institutional players are taking profits. Market sentiment tanks as leveraged positions get liquidated in cascading sell-offs.

Fear Versus Greed

While retail investors panic-sell, seasoned crypto veterans recognize these blood-in-the-streets moments typically precede major rallies. The same whales causing today's downturn will likely be the ones buying back at lower prices.

Wall Street's predictable pattern—create fear, accumulate cheap assets, then profit from the recovery. Smart money knows volatility is the price of admission for 10x returns.

Read us on Google News

Read us on Google News

In brief

- Whale transfers of 9,000 BTC signal heavy selling pressure as Bitcoin hits a seven-month low near $80,600.

- Stablecoin reserves on Binance hit a record $51B, reflecting defensive positioning across major exchanges.

- Analysts warn leverage may force Bitcoin into a $70K–$80K sweep before any attempt at recovery.

- Sentiment stays weak with extreme fear as BTC volume rotation shows major supply redistribution in the market.

Whales Drive 45% of BTC Inflows as Stablecoin Reserves Hit Record Levels

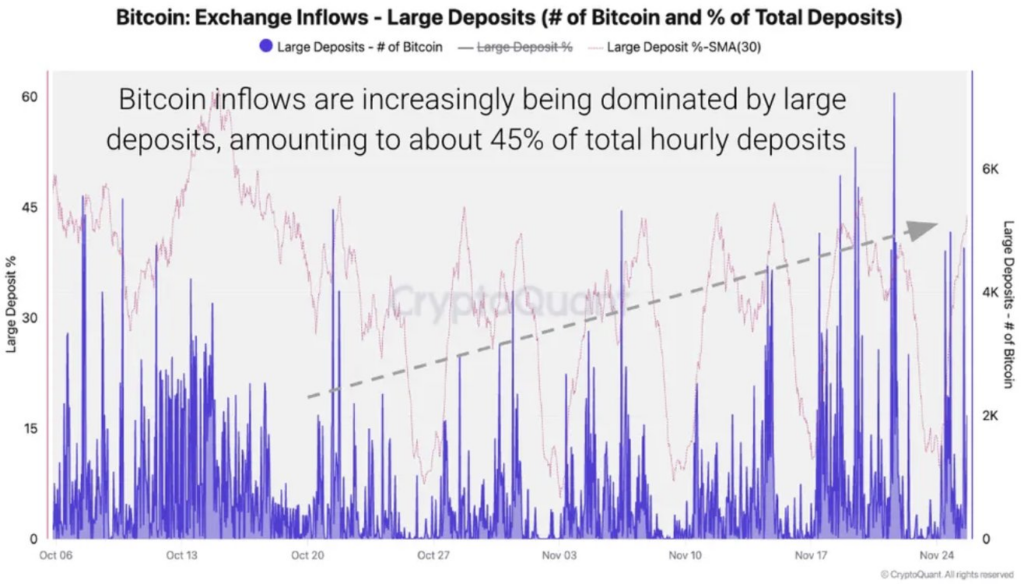

Whale activity jumped sharply on Nov. 21, when CryptoQuant tracked about 9,000 BTC moving to exchanges in a single day. Around the same time, bitcoin slipped to $80,600 on Coinbase—its lowest level in seven months—hinting at growing strain among investors with large positions. Exchange inflows often signal an intention to sell, making the latest spike something traders are watching closely.

Roughly 45% of all BTC sent to exchanges came from transfers of 100 BTC or more, according to CryptoQuant. This concentration suggests whales are still trimming positions as the broader correction plays out. The average BTC deposit ROSE to 1.23 BTC in November, the highest in a year, pointing to a rise in larger transactions.

Stablecoin activity added another wrinkle to the market setup. Binance’s stablecoin reserves climbed to a record $51 billion this week, a sign that traders are parking funds in dollar-linked assets while waiting for clearer direction. BTC and Ether inflows across major exchanges reached $40 billion, with Binance and Coinbase responsible for most of the movement.

Rising stablecoin reserves often accompany periods of caution. Capital moves out of volatile assets and into neutral positions, where it can sit until conditions improve or new opportunities appear.

Commentators Warn Bitcoin Could Dip to $70K–$80K as Leverage Risks Persist

Analysts are split on where Bitcoin may settle from here. Earlier in the week, James Check pointed to remaining leverage in derivatives markets, arguing that a brief MOVE into the $70,000–$80,000 range is still possible if excess risk needs to be flushed out. BitMine chairman Tom Lee also tempered his earlier optimism, saying a return to Bitcoin’s all-time high by year-end is now only “maybe” within reach.

Ether and other major altcoins are showing similar behavior to the OG crypto. Ether deposits on exchanges have increased, though not as dramatically as Bitcoin. Broader altcoin inflows picked up through the month as selling intensified, pushing many assets back toward levels last seen during bear-market phases.

Blockchain intelligence platform 10x Research explained that Bitcoin remains in a tactical oversold phase. Experts at the firm pointed to $92,000 and $101,000 as the next significant resistance zones for market participants to watch.

Bitcoin Recovery Falters as Extreme Fear Persists and Supply Rotation Intensifies

Bitcoin briefly climbed back to $91,000 on Thursday and remained slightly above that level at the time of writing. Even so, sentiment remains weak, with the Fear & Greed Index at 22.

Key forces influencing sentiment include:

- Rising exchange inflows show increased selling interest.

- High stablecoin reserves indicate defensive positioning.

- Reduced market liquidity during sharp price swings.

- Persistent leverage that magnifies volatility.

- Weak risk appetite across global markets.

Bitcoin has fallen 36% since October 2025 and is holding short-term support NEAR $80,500. More than 8% of the asset’s circulating supply changed hands within a week during the decline, an unusually large shift.

Analysts say this pattern shows meaningful redistribution among long-term holders, short-term traders, and buyers stepping in on the dip. Researchers at K33 noted that the depth of the pullback may offer a relative opportunity for investors who are willing to look past near-term volatility.

Long-range forecasts for 2026 vary widely, from $90,000 to $200,000, and depend heavily on ETF flows, institutional demand, and broader adoption trends.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.