Bitcoin Liquidation Storm Brews as Market Turbulence Intensifies

Bitcoin's wild ride just got wilder—liquidation risks are mounting as volatility shakes the foundations of crypto markets.

The Perfect Storm

Market turbulence isn't just rattling nerves—it's creating a cascade of liquidation triggers that could wipe out leveraged positions faster than you can say 'bull market.' When volatility spikes, margin calls follow, and right now the indicators are flashing red across trading platforms.

Domino Effect in Motion

Each forced liquidation triggers more selling pressure, creating a feedback loop that amplifies price swings. It's the market's version of musical chairs—when the music stops, someone's always left standing without a seat. Traditional finance veterans might smirk, but they've seen this movie before in their own backyard during margin meltdowns.

Survival Tactics

Traders are scrambling to adjust positions, reduce leverage, and build cash buffers. The smart money's not betting against volatility—they're preparing to ride it out. Because in crypto, the only thing more predictable than volatility is Wall Street's selective memory about their own history of liquidations.

Read us on Google News

Read us on Google News

In brief

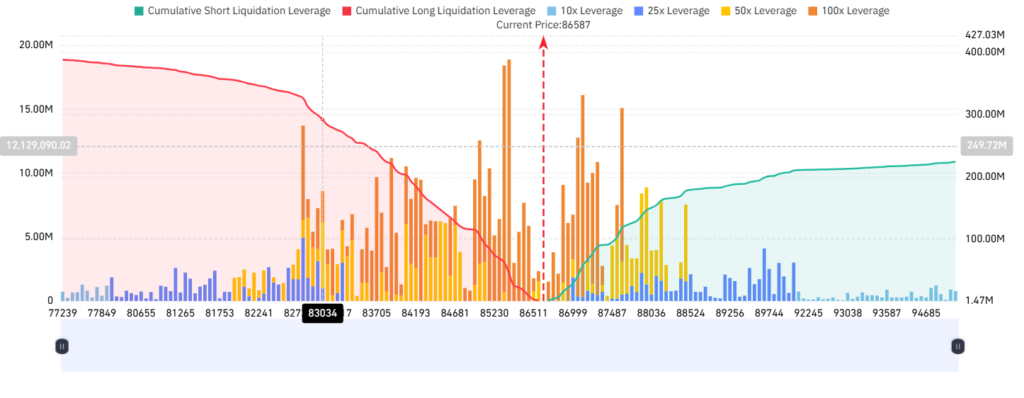

- Nearly $2B in long positions risk liquidation if Bitcoin slips to $80K, adding pressure to already fragile market conditions.

- Extreme fear grips traders as the sentiment index drops below 5, often signaling capitulation before possible technical rebounds.

- Arthur Hayes warns tightening liquidity and credit stress could push Bitcoin lower before setting up a longer-term price recovery.

- Analysts note liquidity readings may improve into December, creating a setup for a decisive move as volatility continues to rise.

Market Fear Deepens : Bitcoin Drops to $82K Before Recovering Above $84K

Bitcoin traded near $84,550 at the time of writing after a mild rebound from Friday’s dip to $82,000. That move followed a turbulent week during which Bitcoin fell from a record high near $126,199. Heavy ETF outflows, weakening risk appetite, and waves of forced selling drove the sudden reversal, liquidating thousands of long positions and accelerating the slide.

Market action in recent weeks shows how quickly confidence can erode when volatility rises. Forced liquidations across major exchanges have created feedback loops, adding pressure to an already fragile setup.

Sentiment entered extreme fear territory as the 10x Research index fell below 5. Readings this low have often aligned with capitulation phases, in which selling exhausts itself before technical rebounds take shape. Analysts note that similar levels in past cycles preceded meaningful recoveries.

Key elements of this sentiment gauge include :

- Volatility signals across multiple time frames ;

- Price momentum and trend strength ;

- Bitcoin’s share of the overall crypto market value ;

- Shifts in social and trading activity ;

- Broader market positioning indicators.

Investors Weigh Rebound Potential Against Sharper Downside Toward $80K

Arthur Hayes, co-founder of BitMEX, warned earlier that tightening liquidity conditions and emerging credit stress could drag bitcoin toward the mid-$80,000s in the short term. He projected that falling equities and rising bond yields might force policymakers to respond with emergency measures—conditions he believes could support a future rally toward $200,000–$250,000.

Hayes also noted that ETF basis trades and corporate treasury inflows, both major demand drivers during Bitcoin’s climb, have nearly stopped, leaving markets exposed to a deeper liquidity squeeze.

In contrast, analyst Miad Kasravi noted that the National Financial Conditions Index signals improving liquidity, suggesting the potential for a decisive MOVE in early to mid-December.

Investors now face a mixed environment as fear-driven selling may create buying opportunities, yet macro uncertainties and rapid price swings continue to pose significant risks. Bitcoin needs to regain and hold $85,000 to confirm a durable rebound, while a drop toward $80,000 could trigger another wave of forced liquidations and extend the downturn.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.