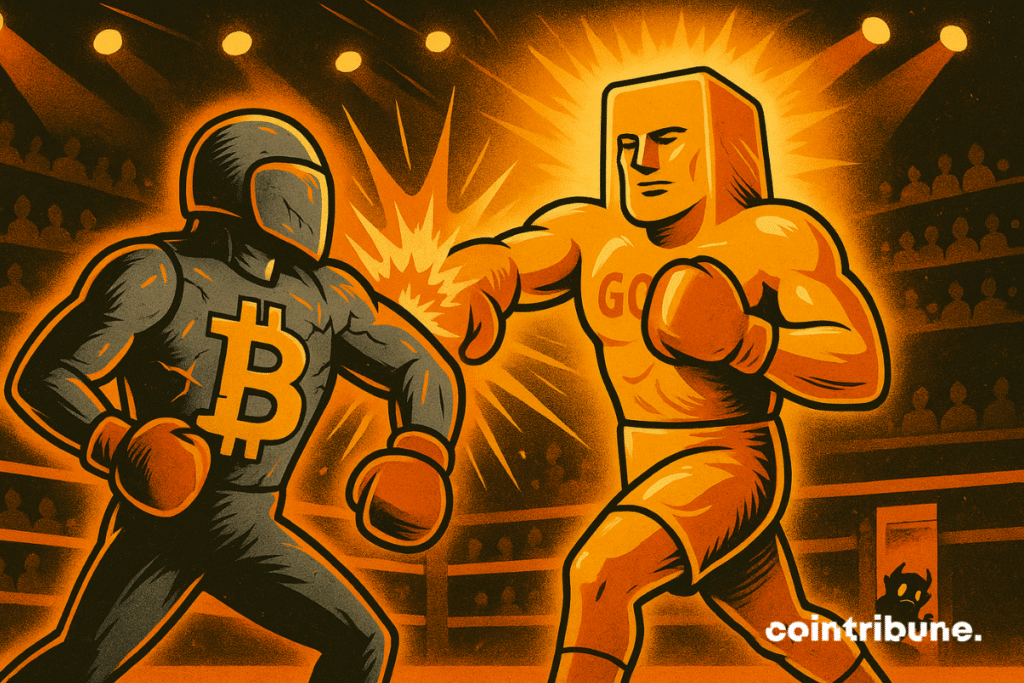

Bitcoin Sentiment Plummets as Gold Surges: A Safe Haven Flip in 2025?

Markets shift as Bitcoin bleeds and gold gleams—what's behind the sudden role reversal?

Gold's rally leaves crypto in the dust

While gold ETFs see record inflows, Bitcoin's fear-and-greed index hits yearly lows. Traders flock to the 'barbarous relic' just as Wall Street starts pretending they always believed in tangible assets.

The crypto crowd's nightmare scenario

Miners capitulate, leverage gets liquidated, and that NFT portfolio now buys you half a gold coin. Meanwhile, central bankers suddenly remember they hate volatility—unless it's in their fiat printing machines.

Finance's eternal pendulum swing

Two weeks ago you were a 'digital gold' maximalist. Today you're explaining why physical gold was always part of your diversified strategy—right after liquidating those Bitcoin positions at a 40% loss.

Read us on Google News

Read us on Google News

In brief

- The crypto market is going through a turbulent phase marked by an extreme fear sentiment not seen since March.

- The Crypto Fear & Greed Index falls to 15/100, signaling massive disengagement of retail investors.

- Experts like BitQuant and Santiment mention a possible capitulation point and imminent reversal.

- Social activity around Bitcoin is sharply declining, confirming a climate of widespread distrust.

Extreme fear sets in : a market on the brink of capitulation

While many analysts wonder if the end of the shutdown will really boost the crypto market, the Crypto Fear & Greed Index, a benchmark for measuring crypto investor sentiment, fell to 15 out of 100 last Wednesday, a threshold synonymous with “extreme fear.”

This is its lowest level since March. This level, unprecedented for months, reflects a deeply marked general pessimism across the market. Trader BitQuant highlighted on X : “below 20? I’ve never seen this indicator drop so low. Retail investors must have already left the market.” This statement reveals the growing withdrawal of small investors, often considered an indicator of collective loss of confidence.

Below 20? I’ve never seen this indicator that low. Retail must have already left the market. https://t.co/H052J102mA

— BitQuant (@BitQua) November 13, 2025Other signals confirm this dynamic of market withdrawal and exhaustion :

- Social engagement levels are sharply dropping: according to Santiment, the usually balanced ratio between optimistic (“bullish”) and pessimistic (“bearish”) comments on social media around bitcoin is now significantly lower than average ;

- Retail investor disengagement is widespread, contrasting with bitcoin’s current capitalization estimated at 2 trillion dollars ;

- Santiment mentions a potential reversal, explaining that “when the crowd turns negative on assets, especially those with high capitalization, it signals we are approaching the capitulation point” ;

- Historically, this type of situation often precedes a phase where institutional players or whales recover assets sold in panic, which can then initiate a new bullish dynamic.

😠 Traders' moods are fading toward crypto, which is welcomed news for the patient.

🟥 Bitcoin $BTC: Even bullish/bearish ratio of social media comments (significantly lower than usual)

🟨 ethereum $ETH: Just over 50% more bullish vs. bearish comments (less than usual)

🟦 XRP… pic.twitter.com/ZY9RXUxKDK

This accumulation of weak but converging signals illustrates a pivotal moment: between a market that could hit a technical low and an ecosystem where trust seems durably impaired.

Bitcoin underperforms against gold : a reversed dynamic

While fear dominates trading in the crypto universe, the contrast with the precious metals market is striking. With the end of the shutdown, an event widely anticipated by markets, it is Gold and silver that have captured investor attention.

The yellow metal surpassed $4,200 an ounce, driven by speculation around a new $2,000 stimulus check promised by the TRUMP administration. The Kobeissi Letter summarizes this sentiment : “if $2,000 checks become reality, momentum will accelerate very quickly. Gold and silver always know first.”

Silver prices are quietly up +11% over the last 5 days, even as the government shutdown is about to end.

If the $2,000 stimulus checks actually happen, momentum is going to accelerate quickly.

Gold and silver always know first. pic.twitter.com/BGgfbJjZIs

In this configuration, the BTC/XAU ratio (bitcoin’s value in gold) threatens to reach its lowest levels in over a year. In other words, despite its colossal capitalization, Bitcoin is losing ground to gold, often considered a safe-haven asset. It is also worth noting that the traditional Fear & Greed index, which measures sentiment in equity markets, remains more moderate at 35/100, illustrating the uniqueness of the trust crisis within the crypto market.

This relative decoupling of bitcoin from traditional assets raises questions about its ability to play the role of a safe-haven in an uncertain macroeconomic context. While gold benefits from renewed interest for its perceived stability, bitcoin seems currently unable to fulfill this function in institutional portfolios. The current divergence could fuel a partial reallocation of institutional capital or even extend the period of crypto underperformance against tangible assets.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.