Ethereum Exodus: Validator Exit Queue Hits Record High with 2.45M ETH Waiting to Bail

Ethereum's validator exit queue just became the blockchain's worst traffic jam—2.45 million ETH (worth roughly $9.8 billion at current prices) is now stuck in the digital equivalent of airport security lines. And no, there isn't a TSA PreCheck for validators looking to cash out.

Why the rush for the exits? The Merge's honeymoon phase is over, and validators are realizing staking rewards don’t pay for Lambos—just enough to cover coffee runs while watching ETH price charts. Some are cutting losses; others are rotating into hotter chains (or at least those with higher APYs and fewer existential debates about MEV).

The irony? This backlog proves Ethereum’s decentralization works—just slowly enough to make impatient whales regret their life choices. Meanwhile, TradFi bankers are taking notes: 'See? Even crypto’s 'unstoppable code' has a customer service hold time.'

Read us on Google News

Read us on Google News

In brief

- Validator entry and exit queues grow as demand rises, stretching wait times and signaling confidence in Ethereum security.

- Native staking appeals to users who want direct control, despite slower liquidity and larger operational commitments.

- Institutions strengthen momentum as stablecoin settlement and DeFi activity reinforce Ethereum’s core economic role.

- Controlled exit mechanics protect network stability and ensure predictable validator withdrawals during heavy demand.

Growing Validator Backlog Signals Strong Long-Term Confidence

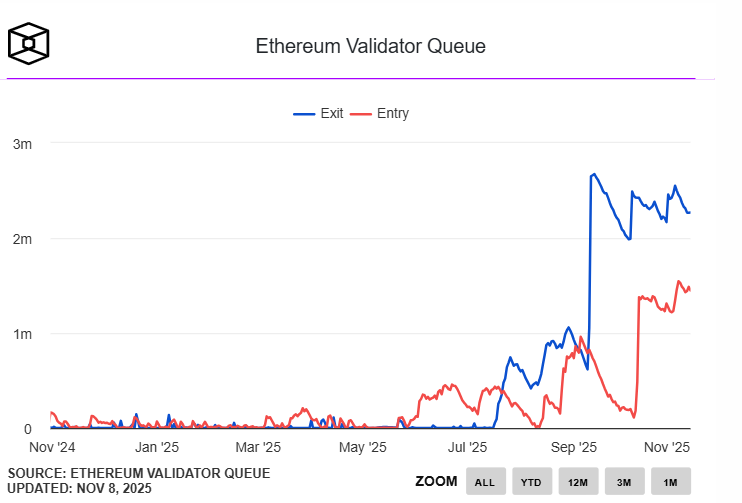

Validator queues serve as a built-in rate limit, helping to maintain network stability. ethereum adds and removes validators at a steady pace during each epoch, which occurs every 6.4 minutes. Large, sudden shifts in validator activity could strain the security model, so the protocol processes requests in a controlled order. As demand grows in both directions, entry and exit wait times now extend across several days.

Native staking continues to attract users who value direct control over their assets. Liquid staking tokens such as stETH and rETH offer greater flexibility but rely on smart contracts and external operators. Many long-term participants prefer to hold their own keys and manage their infrastructure, despite the higher effort and slower liquidity.

Several trade-offs explain why some participants stick with native staking:

- Direct control over validator hardware and operations.

- No exposure to external operators or protocol token mechanics.

- Reduced reliance on third-party smart contracts.

- Requirement to commit 32 ETH per validator.

- Acceptance of longer withdrawal timelines and potential risk of slashing.

Growing interest from institutions adds another layer of momentum. Stablecoin settlement, DeFi lending flows, and on-chain activity continue to place Ethereum at the center of crypto’s economic foundation. Aave and other major protocols continue to process large volumes on the mainnet, reinforcing Ethereum’s role as a trusted settlement layer.

Buterin Affirms Controlled Exit Model as Ethereum Staking Momentum Builds

Rising entry queues suggest growing confidence in Ethereum’s long-term position. Many participants appear comfortable locking capital for extended periods in exchange for validator rewards and direct involvement in network security.

As more entities adopt this approach, staking activity reflects confidence that Ethereum will remain the leading smart-contract platform, despite liquidity and operational constraints.

Meanwhile, Vitalik Buterin stressed that staked ETH cannot be withdrawn instantly, noting that the waiting period serves as a FORM of protection. He explained that this process helps prevent sudden mass exits that could weaken network security and maintain consensus stability. The exit queue processes departures one block at a time, turning what could feel like a rush for the door into a controlled and predictable flow.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.