Stablecoins: Financial Lifeline for Citizens or Economic Time Bomb?

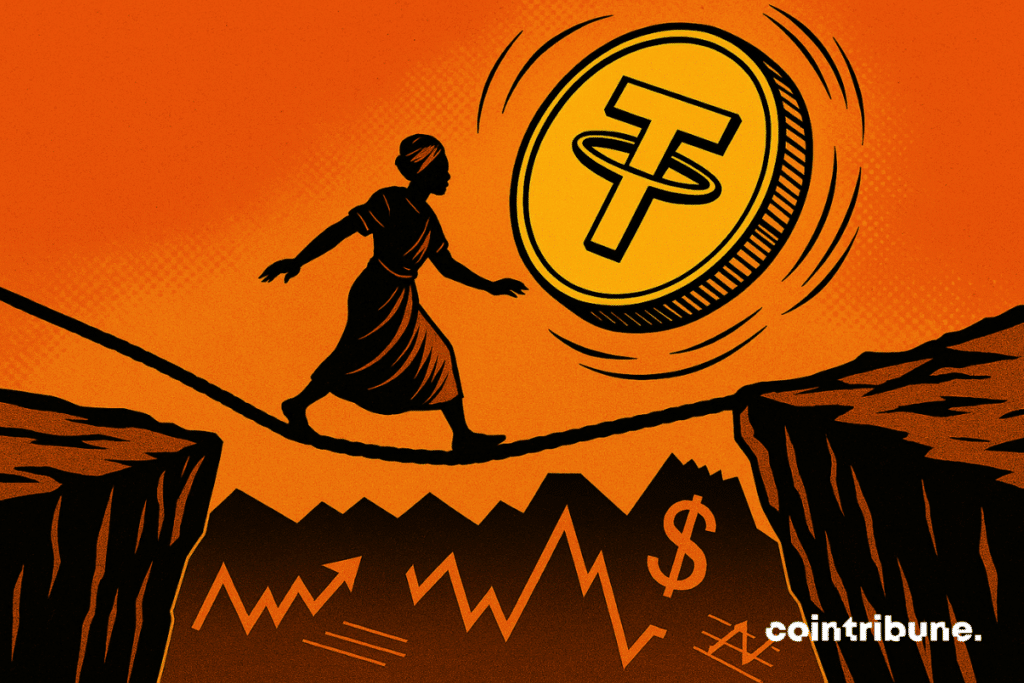

Stablecoins are rewriting the rules of finance—offering everyday users an escape from hyperinflation while quietly threatening to destabilize entire nations.

The double-edged sword of dollar-pegged crypto

Citizens in crumbling economies flock to USDT and USDC as local currencies implode. But when capital flees en masse to blockchain-based dollars, governments lose control overnight. Argentina’s peso collapse saw stablecoin adoption spike 400%—and that was just the beta test.

Central bankers hate this one trick

Why bother with capital controls when anyone can download a wallet? Stablecoins cut through financial red tape like a hot knife through fiat. The IMF’s latest warning shot calls them ‘systemic risks’—which in banker-speak means ‘we didn’t think of it first.’

The coming stablecoin sovereignty crisis

Nations that can’t stabilize their currencies face a brutal choice: embrace the dollarization they tried to avoid or ban the very tools saving their citizens. Meanwhile, Tether’s lawyers are buying bigger yachts.

One thing’s certain: when the next economy collapses, the exit ramp won’t be at your local bank—it’ll be in your MetaMask.

Read us on Google News

Read us on Google News

In Brief

- Stablecoins are experiencing massive adoption in emerging economies hit by hyperinflation and devaluation.

- These dollar-backed cryptos are used as a refuge to protect citizens’ savings against local currency collapses.

- Their success is based on four strengths: stability, mobile accessibility, borderless usage, and resistance to state restrictions.

- According to Standard Chartered, up to $1 trillion could leave local banks to be converted into stablecoins by 2028.

A Tool of Financial Inclusion or a Time Bomb ?

In many emerging economies, stablecoins have established themselves as a tool for preserving purchasing power in the face of local currency collapse.

From Latin America to Africa, currency conversion into U.S. dollars is a daily practice, and stablecoins have “turbocharged this process” by providing a fast, accessible, and widely adopted digital alternative.

In a country like Zimbabwe, 85 % of transactions are now denominated in U.S. dollars, illustrating this informal dollarization. This movement, now amplified by blockchain technologies, is spreading to other areas afflicted by chronic monetary instability, such as Argentina, Turkey, or Nigeria.

Behind this enthusiasm for these cryptos, the main drive is to preserve capital where financial institutions no longer inspire confidence. The Standard Chartered study highlights that for millions living in crisis economies, “capital preservation matters more than capital returns”.

In other words, the priority is not to generate returns but to escape the brutal depreciation of their national currency. Stablecoins meet this need thanks to several key characteristics :

- The stability of the dollar : by being backed by the USD, these cryptos offer a credible anchor to a strong currency ;

- Digital accessibility : they are available via a simple mobile app, without the need for a bank account ;

- Borderless usage : they facilitate savings, payments, and international transfers ;

- Resilience against local restrictions : they bypass currency controls and account freezes often imposed by authoritarian or crisis regimes.

In short, stablecoins have become much more than a trading tool. These cryptos embody a FORM of private monetary insurance for populations exposed to systemic failures. However, this dynamic, while legitimate on an individual scale, is not without consequences for the economies concerned.

A Systemic Risk for Vulnerable Economies

Behind this massive adoption, Standard Chartered sounds the alarm. According to the on-chain data from its report published in October, up to $1 trillion in deposits could leave emerging markets’ banks to migrate to stablecoins by 2028.

“This wealth transfer could pose a profound risk to the foundations of many national credit systems,” warns the British bank, heavily present in Asia, Africa, and the Middle East. Indeed, each conversion from local currency to stablecoin dries up liquidity in the domestic banking system, along with commercial banks’ capacity to lend to businesses and households.

This mechanism also undermines the effectiveness of monetary policy. Central banks, deprived of visibility on these outgoing flows, lose control over the money supply and over their traditional instruments such as interest rates. A chronic monetary instability emerges, exacerbated by the possibility of 24/7 capital flight through crypto platforms not subject to currency controls.

Beyond local erosion, stablecoin reserves are mostly invested in U.S. Treasury bonds. Thus, the digital savings of emerging countries help finance the U.S. debt, currently estimated at $38 trillion. This form of “digital dollarization” could ultimately increase emerging economies’ dependence on the North American financial system, while weakening their own monetary sovereignty.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.