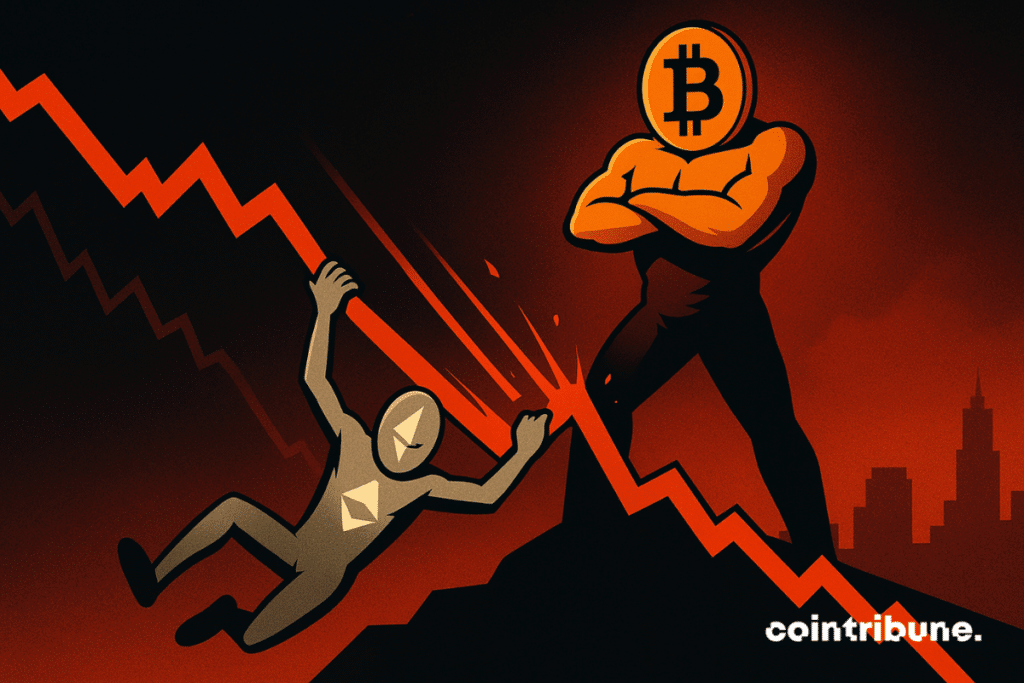

10x Research Sounds Alarm: Ethereum Faces Critical Bearish Setup

Ethereum's technical foundation shows alarming cracks as 10x Research identifies a potentially devastating bearish configuration forming.

The Warning Signs

Market analysts are seeing patterns that could signal significant downward pressure on ETH—just what institutional investors love to see before another 'strategic repositioning' that conveniently lines their pockets while retail gets liquidated.

Technical Breakdown

Multiple indicators are flashing red simultaneously, suggesting this isn't just typical market noise but a coordinated technical deterioration that could trigger cascading sell-offs across the crypto ecosystem.

The Domino Effect

When Ethereum sneezes, the entire altcoin market catches cold—and right now, the charts are pointing toward something more like pneumonia for the digital asset space.

Yet another opportunity for the 'smart money' to prove they're playing a different game entirely while pretending it's all about 'market fundamentals.'

Read us on Google News

Read us on Google News

In brief

- The Ethereum ecosystem shows signs of fatigue, notably in the treasury of ETH-oriented companies.

- Bitcoin benefits from a clear institutional narrative, which accentuates the imbalance with Ethereum.

- Technical indicators point towards a bearish trend, with a risk of breaking the $3,000 support.

- A prolonged stagnation or a more pronounced correction of ETH is now conceivable, according to 10x Research’s analysis.

An institutional mechanism at a standstill

In its latest report, the firm 10x Research reveals a worrying shift in the ethereum ecosystem. While bitcoin continues to absorb most of the institutional flows, Ethereum falls behind, weakened by a treasury mechanism that no longer works.

“While Bitcoin continues to attract institutional treasury capital, ETH-oriented companies are starting to run out of ammunition”, claims the firm in a sharp analysis. This loss of momentum calls into question a model that, until now, had largely helped support the ETH price.

Several factual elements illustrate this break :

- The PIPE model losing momentum : companies like BitMine allowed institutional investors to buy ETH at par (cost price), then resell it with a premium on the retail market, feeding a bullish loop on the price. This mechanism is faltering ;

- Lack of transparency on flows : 10x Research highlights the opacity surrounding capital movements in the Ethereum ecosystem, increasing uncertainty for institutional players ;

- Concentration of holdings : according to the data mentioned, 15 companies hold 4.7 million ETH, with BitMine alone holding 3.3 million ETH. This concentration raises the question of potential vulnerability if a disengagement occurs ;

- The imbalance compared to bitcoin : by comparison, BTC benefits from a clear narrative, reinforced by its function as a store of value, which mechanically attracts more institutional capital.

All these factors converge to the same observation: the institutional dynamic that previously supported Ethereum is now running out of steam, which could pave the way for strategic readjustments in the market.

Bearish technical signals that worsen the context

Beyond these weakened institutional dynamics, 10x Research identifies several technical indicators suggesting a marked correction in the asset’s price.

“The weekly stochastic clearly flashes in overbought territory”, warns the report. Analysts also note that a false bullish breakout has formed, similar to the false breakdown observed last March, which could indicate a resumption of the bearish trend if the $3,000 support were to break. In this scenario, a return to $2,700 WOULD be conceivable in the short term.

This technical reading comes in a climate of overall market fragility, notably after the crash of October 10, which led to the liquidation of $19 billion worth of crypto positions, a historical record. Since then, demand for ETH spot ETFs in the United States has significantly cooled, an indicator of dwindling institutional appetite for Ethereum.

This combination of technical signals and macroeconomic pressure fuels the thesis of a prolonged decline, or at least a worrying stagnation, at a time when bitcoin appears to be consolidating its dominant position.

If institutions begin to permanently turn away from Ethereum, it is the very perception of ETH as a foundational Web3 asset that could be questioned. However, Tom Lee, president of BitMine, continues to anticipate a price of $10,000 for ETH by the end of this year.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.